LEARN PUELL MULTIPL INDEX IN 3 MINUTES ——BLOCKCHAIN 101

If you’re into Bitcoin and crypto trading, you’ve probably heard that “miners matter.” But how do you actually measure what miners are doing — and why should you care?

That’s where the Puell Multiple comes in.It’s a simple but powerful on-chain indicator that helps you figure out whether Bitcoin is overheated or undervalued, based on miner activity. And the best part? You don’t need to be a blockchain developer or math nerd to understand it.

Let’s break it down in 3 minutes.

What is the Puell Multiple?

The Puell Multiple is an on-chain metric created by analyst David Puell. It’s used to assess whether the daily issuance of Bitcoin (BTC) — that is, how much BTC miners are earning — is too high or too low compared to historical norms.

In other words, it tells us if miners are earning way more (or less) than usual. Why does that matter? Because miner revenue is closely tied to Bitcoin market cycles.

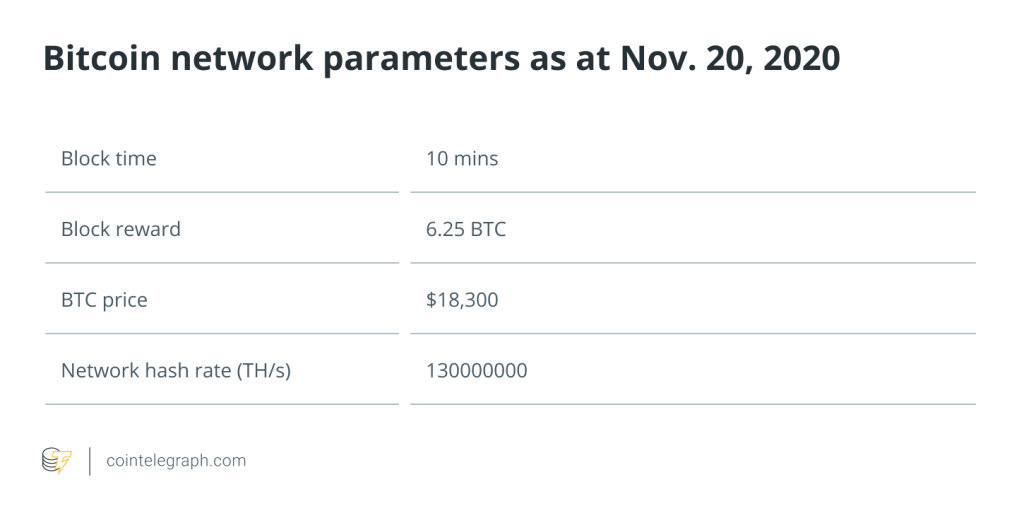

The formula is super simple:

Puell Multiple = Daily BTC Issued (in USD) / 365-day average of Daily BTC Issued (in USD)

So it compares today’s miner revenue to the average over the last year.

- If the multiple is high → miners are raking in a lot more money than usual.

- If it’s low → miners are struggling, earning much less than average.

Why should YOU care what miners earn?

Miners are like the heartbeat of Bitcoin.They secure the network, confirm transactions, and most importantly — they often sell BTC to cover electricity and operational costs. That selling creates downward pressure on the price.

So:

- if miners are making a ton of money and hoarding Bitcoin, that’s bullish.

- If they’re struggling, they may dump their BTC on the market, which can signal local bottoms.

The Puell Multiple lets you see that pressure in real time.

How to Read the Puell Multiple

Let’s look at the key thresholds that traders watch:

Above 4.0 → Possible Market Top

When the Puell Multiple goes above 4, it means miners are making 4x more than usual. Historically, that often happens near bull market peaks — when BTC is overvalued, and euphoria is high.

- 2011 Top: Puell Multiple hit ~10

- 2013 Top: Above 8

- 2017 Top: Around 6.5

- 2021 Top: Hit ~4 again

So when you see Puell above 4, it might be time to think about taking profits.

Below 0.5 → Possible Market Bottom

On the flip side, when the index dips below 0.5, miners are earning way less than average, usually due to a price crash.

That’s when miner capitulation happens — smaller miners shut down, others sell BTC at a loss, and the pain sets in.

Historically, those moments often mark bottoms — because the worst is priced in.

- 2015 Bear Market Bottom: Puell < 0.3

- March 2020 COVID Crash: Puell dropped to ~0.2

- June 2022: Also dipped under 0.5

So when Puell goes that low, smart money starts to accumulate.

Why It Works: Market Psychology + Miner Behavior

The reason Puell Multiple is so effective is because it combines real economic pressure with investor sentiment.

Miners are the only forced sellers in Bitcoin. If they’re under pressure, they sell. When they’re swimming in cash, they can hold or even HODL. That dynamic creates natural feedback loops in the market.

Also, this metric isn’t based on hype, chart patterns, or FOMO — it’s fundamental data from the blockchain. You can’t fake it.

Use Cases: How Traders Actually Use It

Let’s be clear: the Puell Multiple is not a timing tool. It won’t tell you to buy onot a timing tool. It won’t tell you to buy or sell on a specific day.But here’s how real traders and long-term investors use it:

1. Spotting Extremes

Use it to identify macro tops and bottoms. When it’s below 0.5 or above 4, you’re probably in an extreme zone.

2. Layering Entries or Exits

If Puell is in the green zone (<0.5), it might be time to start buying slowly. If it’s in the red (>4), think about trimming exposure.

3. Confirming Market Sentiment

Combine it with other metrics like MVRV, RHODL Ratio, or Realized Cap. If they all say “overheated” or “undervalued,” your signal is stronger.

4. Risk Management for Miners

If you run a mining operation, Puell Multiple helps you anticipate whether you’re heading into a good revenue zone or a danger zone.

Final Thoughts: It’s Not Magic, But It’s a Damn Good Tool

The Puell Multiple isn’t a crystal ball — but it’s one of the simplest and most effective tools for spotting major Bitcoin cycle turning points.If you’re trying to avoid buying tops and panic-selling bottoms, this is a metric worth tracking.And unlike technical indicators, it’s grounded in on-chain reality — directly tied to miner economics and network incentives.

So next time someone says, “I think BTC is overpriced,” just check the Puell Multiple.

- If it’s flashing red — maybe they’re right.

- If it’s flashing green — it might be time to load up.

Responses