LEARN CUMULATIVE VALUE DAYS DESTROYED (CVDD) INDEX IN 3 MINUTES——BLOCKCHAIN 101

Welcome back to our exclusive crypto metrics series. This is our third dedicated lesson on crypto market indicators. If you’d like us to cover a specific metric, feel free to leave your requests in the comments.

Today, we’re focusing on Cumulative Value Days Destroyed (CVDD), a metric pioneered by cryptocurrency analyst Willy Woo. Built upon the concept of Coin Days Destroyed (CDD), CVDD tracks both the age and dollar value of Bitcoin being sold by long-term holders.

In just 3 minutes, we’ll break down CVDD’s core concepts and practical applications.

- Click to register SuperEx

- Click to download the SuperEx APP

- Click to enter SuperEx CMC

- Click to enter SuperEx DAO Academy — Space

The 4 Foundational Principles of CVDD

- Coin Days Destroyed (CDD): When Bitcoin held for N days moves, it “destroys” N coin-days.

- Transaction Value Weighting: CVDD incorporates both coin-days destroyed and the USD value at transaction time, improving capital flow accuracy.

- Time-Weighted Accumulation: CVDD exponentially smooths these values into a trendline.

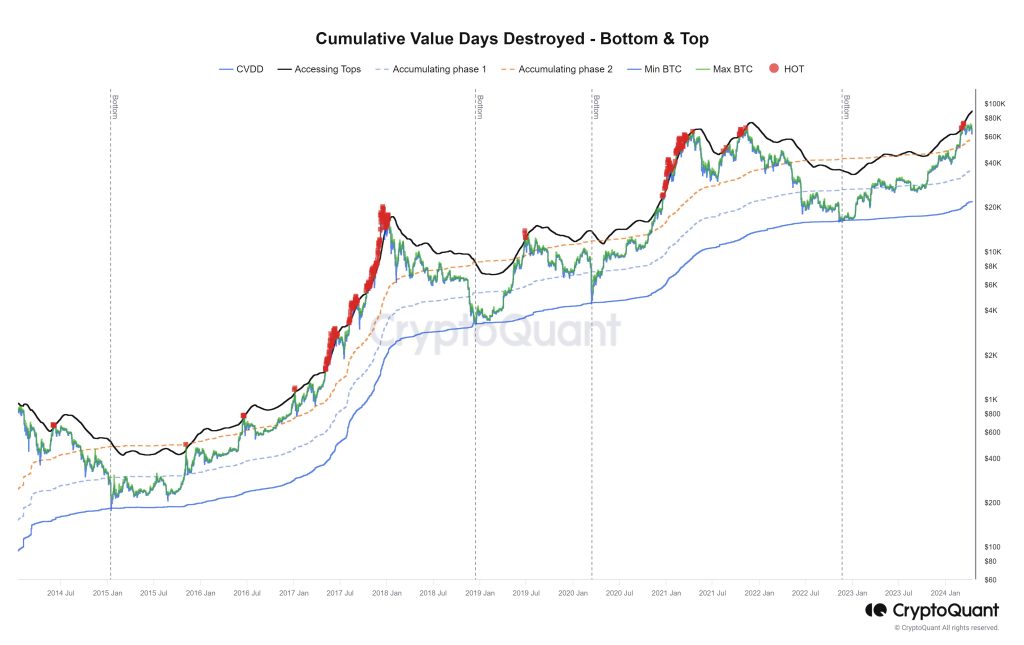

- Statistical Benchmark: CVDD often acts as a market support line, crucial for bottom predictions.

How CVDD Predicts Market Bottoms?

During deep corrections, CVDD frequently serves as a key support zone, signaling potential bottoms. Key signals include:

- Long-Term Holder Capitulation: Rising CVDD suggests large-scale sell-offs—while prices may still drop, the bottom nears.

- Historical Support: Bitcoin prices touching CVDD often indicate oversold conditions, offering prime accumulation opportunities.

- Extreme Bearish Sentiment: When CVDD flatlines at prolonged lows, it reflects maximum fear—a classic bottom indicator.

Calculating CVDD

The formula is straightforward:

- Compute CDD:

CDD=Transaction Amount×Holding Days

- Accumulate & Normalize:

CVDD=∑(CDD×Transaction Price)/Supply

This cumulative approach filters short-term noise, clarifying long-term trends.

Combining CVDD with Other Metrics

While powerful alone, CVDD works best when paired with:

- MVRV Ratio: Values <1 often coincide with bottoms.

- Puell Multiple: Confirms lows via miner revenue trends.

- 200-Week MA: Prices near CVDD frequently align with this moving average.

Conclusion

CVDD in Two Sentences:

- It measures “the dollar-weighted shock when long-term holders sell.” Higher values mean more “OGs” are dumping.

- Think of CVDD as the “HODLer Capitulation Gauge”—spikes signal veteran exits; low values show diamond-handed conviction.

As a pivotal on-chain metric, CVDD offers high-probability bottom signals. While not infallible, combining it with other data helps investors make smarter decisions. For long-term players, CVDD is essential.

Responses