LEARN PUELL MULTIPLE INDEX IN 3 MINUTES——BLOCKCHAIN 101

In previous lessons, we have covered various technical indicators that are universally applicable across financial markets, whether in stocks or crypto. However, are there any technical indicators specifically designed for the crypto market? Absolutely, and today, it’s here: Puell Multiple—a technical indicator created to assess whether Bitcoin’s price is at a cyclical top or bottom.

This article will help you master the calculation method, market significance, and practical application of the Puell Multiple indicator in just 3 minutes.

- Click to register SuperEx

- Click to download the SuperEx APP

- Click to enter SuperEx CMC

- Click to enter SuperEx DAO Academy — Space

What is the Puell Multiple Indicator?

The Puell Multiple is an indicator proposed by crypto analyst David Puell, designed to measure the relationship between daily miner revenue and the historical average miner revenue of Bitcoin. It is commonly used in the market to determine whether Bitcoin is at a cyclical top or bottom.

The indicator reflects miners’ profitability, thereby influencing whether they choose to sell Bitcoin. Typically, when the Puell Multiple reaches extremely high or low values, it may signal a trend reversal in the market.

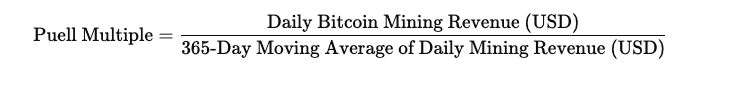

Calculation Formula:

Market Significance of the Puell Multiple

The Puell Multiple primarily assesses miner revenue levels, indirectly reflecting the supply-demand relationship in the market.

- Puell Multiple above 4.0: Indicates that miner revenue far exceeds historical averages, suggesting that miners may be more inclined to sell Bitcoin, potentially leading to an overheated market.

- Puell Multiple below 0.5: Indicates that miner revenue is significantly lower than the historical average, suggesting that the market may be near a bottom, presenting a buying opportunity.

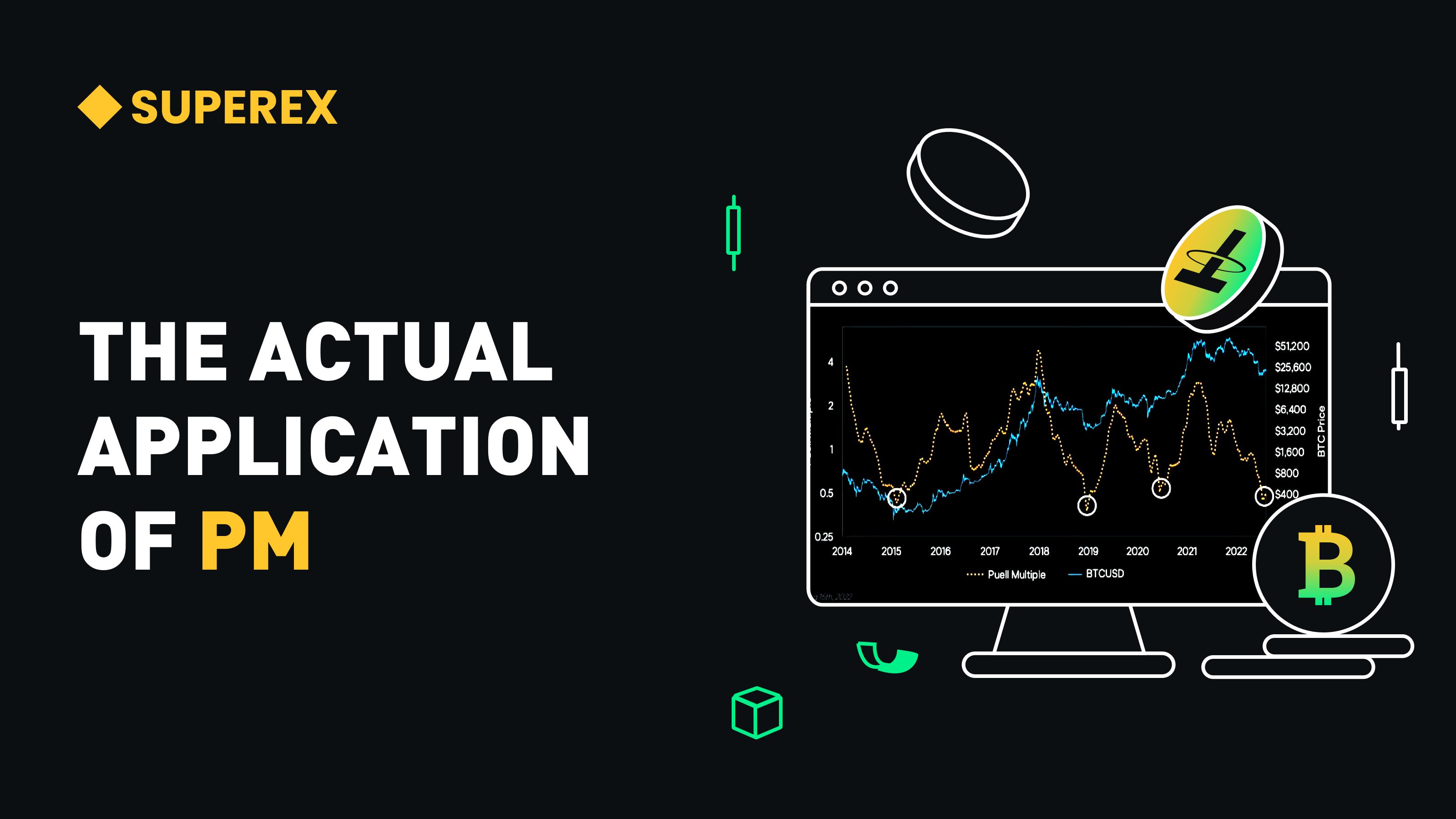

In past Bitcoin bull and bear cycles, extreme values of the Puell Multiple often corresponded to market tops or bottoms.

How to Use Puell Multiple for Investment Decisions?

(1) Identifying Market Tops

When the Puell Multiple exceeds 4.0, it usually indicates exceptionally high miner income, suggesting that miners may concentrate on selling Bitcoin. This scenario typically occurs in the late stages of a bull market, when market sentiment is extremely optimistic, and prices are prone to a pullback.

Examples:

- In the 2013 bull market peak, the Puell Multiple almost reached 10.

- In 2017, just before Bitcoin hit a new all-time high, the Puell Multiple also exceeded 6.

- In April 2021, when Bitcoin surged to $64,000, the Puell Multiple ranged from 3.5 to 4.0.

When the Puell Multiple is excessively high, investors should be wary of market risks and avoid blindly chasing gains during overheated phases.

(2) Identifying Market Bottoms

When the Puell Multiple falls below 0.5, it indicates that miner revenue has drastically dropped compared to historical averages. As a result, some miners may shut down operations due to unprofitability, reducing market supply.

Historical Examples:

- Late 2018: Bitcoin fell to around $3,000 (Puell Multiple at 0.3–0.4).

- 2022 Bear Market: Bitcoin dropped to $15,500, and the Puell Multiple also fell below 0.5.

When the Puell Multiple is extremely low, it might signal a buy-the-dip opportunity, suitable for long-term investors looking to build positions.

Limitations of the Puell Multiple

While the Puell Multiple has demonstrated effectiveness in historical data, it does have some limitations:

- Ignores Demand-Side Factors: The indicator only considers miner revenue, without directly measuring market demand changes.

- Market Structure Evolution: As Bitcoin halving events and the mining ecosystem evolve, miner profitability and market impact may change.

- Short-Term Volatility: Due to daily miner revenue fluctuations, the Puell Multiple may exhibit noise signals in the short term.

Therefore, when using the Puell Multiple, investors should combine it with other on-chain indicators (such as MVRV, RHODL, SOPR) and market trend analysis for comprehensive judgment.

Conclusion

The Puell Multiple is a simple yet effective on-chain indicator that helps investors identify potential tops and bottoms for Bitcoin.

- When the Puell Multiple exceeds 4.0, the market may be overheated, requiring cautious action.

- When the Puell Multiple falls below 0.5, the market may be nearing a bottom, presenting a potential buying opportunity.

Combining the Puell Multiple with other technical indicators and market trend analysis can enhance investment decision accuracy. In the volatile crypto market, the rational use of on-chain analysis tools can help investors make more informed and thoughtful decisions.

We hope this article helps you better understand and apply the Puell Multiple indicator, boosting your investment proficiency!

Responses