LEARN MASS INDEX IN 3 MINUTES – BLOCKCHAIN 101

The Mass Index is a unique and powerful technical indicator designed to predict potential trend reversals. Unlike traditional indicators that focus on price momentum or direction, the Mass Index is all about price volatility. It helps traders identify when a market is “stretched” and due for a reversal, even without specifying the direction. In this article, we’ll explore its components, calculation, and how to effectively use it in your trading strategy.

What is the Mass Index?

The Mass Index, developed by Donald Dorsey, is a trend-reversal indicator. Its key innovation lies in its focus on the range between high and low prices over a set period, which helps traders detect when the market is ripe for a reversal.

Unlike oscillators like the RSI or momentum indicators like the MACD, the Mass Index doesn’t tell you if the price will go up or down. Instead, it highlights when a reversal is likely, giving traders a heads-up to prepare for a potential market shift.

How is the Mass Index Calculated?

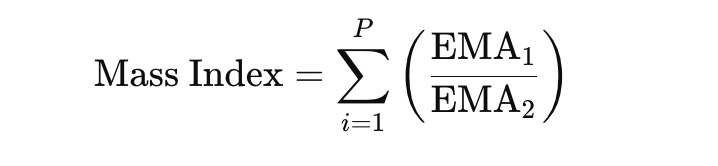

The calculation of the Mass Index involves three steps:

- Determine the Single EMA (Exponential Moving Average):

The EMA is applied to the difference between the daily high and low prices.EMA1=EMA(High – Low,N)

- Calculate the EMA of the EMA:

The second step applies another EMA to the first EMA calculated.EMA2=EMA(EMA1,N)

- Compute the Mass Index:

Finally, the Mass Index is calculated by dividing the first EMA by the second EMA and summing the results over a specified period.

Where:

- NN: Lookback period for EMA (typically 9).

- PP: Period for summing the ratio (typically 25).

Interpreting the Mass Index

The Mass Index typically uses two levels to indicate potential reversals:

- 27.0 (Key Threshold): When the Mass Index rises above this level, it signals that volatility is increasing, and a trend reversal might be imminent.

- 26.5 (Confirmation Level): If the Mass Index then falls back below this level, it confirms the likelihood of a reversal.

This behavior is often referred to as the “bulge” pattern, where the indicator spikes and then returns to lower levels, signaling that the trend may change soon.

How to Use the Mass Index in Trading

1. Identifying Trend Reversals

The Mass Index is best used as a supplementary tool in conjunction with other indicators. Here’s how:

- Watch for the indicator to cross above 27.0.

- Wait for it to fall back below 26.5 for confirmation.

- Pair this signal with other tools like trendlines or candlestick patterns to confirm the direction of the reversal.

2. Combining with Other Indicators

Since the Mass Index doesn’t indicate the direction of the reversal, it’s often paired with:

- Moving Averages: To determine the prevailing trend.

- RSI or MACD: To add momentum analysis to your strategy.

3. Example Strategy:

- Step 1: Identify a key resistance or support level on the chart.

- Step 2: Observe if the Mass Index crosses 27.0, signaling heightened volatility.

- Step 3: Wait for confirmation when the Mass Index falls below 26.5.

- Step 4: Use other indicators to determine whether to buy or sell.

Advantages of the Mass Index

- Unique Perspective on Volatility:

The focus on the price range rather than direction makes it versatile in identifying potential trend reversals. - Simplicity:

While the calculation is intricate, using the indicator is straightforward thanks to preset thresholds (27.0 and 26.5). - Compatibility:

It works well across asset classes, from stocks to cryptocurrencies, and complements other technical tools seamlessly.

Limitations of the Mass Index

- No Directional Signal:

The Mass Index only indicates potential reversals, not whether the price will go up or down. - False Signals in Low Volatility Markets:

In ranging or low-volatility markets, the Mass Index may produce misleading signals. - Requires Confirmation:

To be effective, it must be used alongside other indicators or strategies to confirm the trend direction.

Practical Application in Crypto Trading

The Mass Index is particularly valuable in the volatile cryptocurrency market, where sudden price swings are common.

Example: Using the Mass Index with Bitcoin (BTC)

- Scenario: BTC has been in a steady uptrend for weeks.

- Mass Index Reading: The indicator crosses 27.0, suggesting heightened volatility.

- Confirmation: It drops below 26.5, signaling a potential reversal.

- Action: Combine this signal with a bearish divergence in the RSI or a death cross in moving averages to confirm a shorting opportunity.

Conclusion

The Mass Index is a powerful tool for traders looking to identify trend reversals based on price volatility. While it doesn’t provide directional signals, its ability to predict when a market is about to shift makes it a valuable addition to any trading strategy.

By understanding how to interpret and use the Mass Index effectively, you can gain an edge in volatile markets like cryptocurrencies. Pair it with complementary indicators, validate signals with technical analysis, and always consider the broader market context.

Want to learn more about technical indicators? Stay tuned for our next article, where we dive into the Donchian Channels and how they can refine your trading strategy!

Responses