LEARN ADVANCE DECLINE LINE INDEX IN 3 MINUTES – BLOCKCHAIN 101

The world of cryptocurrency trading is fast-paced and ever-evolving, requiring traders to rely on a mix of fundamental knowledge, market understanding, and technical analysis tools. Among these tools, the Advance Decline Line Index (ADLI or ADL) is one of the most underrated yet powerful indicators that can be used to track market trends, understand the breadth of market movements, and assess potential shifts in momentum.

In this article, we will dive deep into what the Advance Decline Line Index is, how it is calculated, how it can be used in crypto trading, and most importantly, how it helps you make more informed decisions in the highly volatile crypto markets. Whether you are a novice or a seasoned trader, mastering the ADL can improve your trading strategy and give you an edge in the market.

What Is the Advance Decline Line Index?

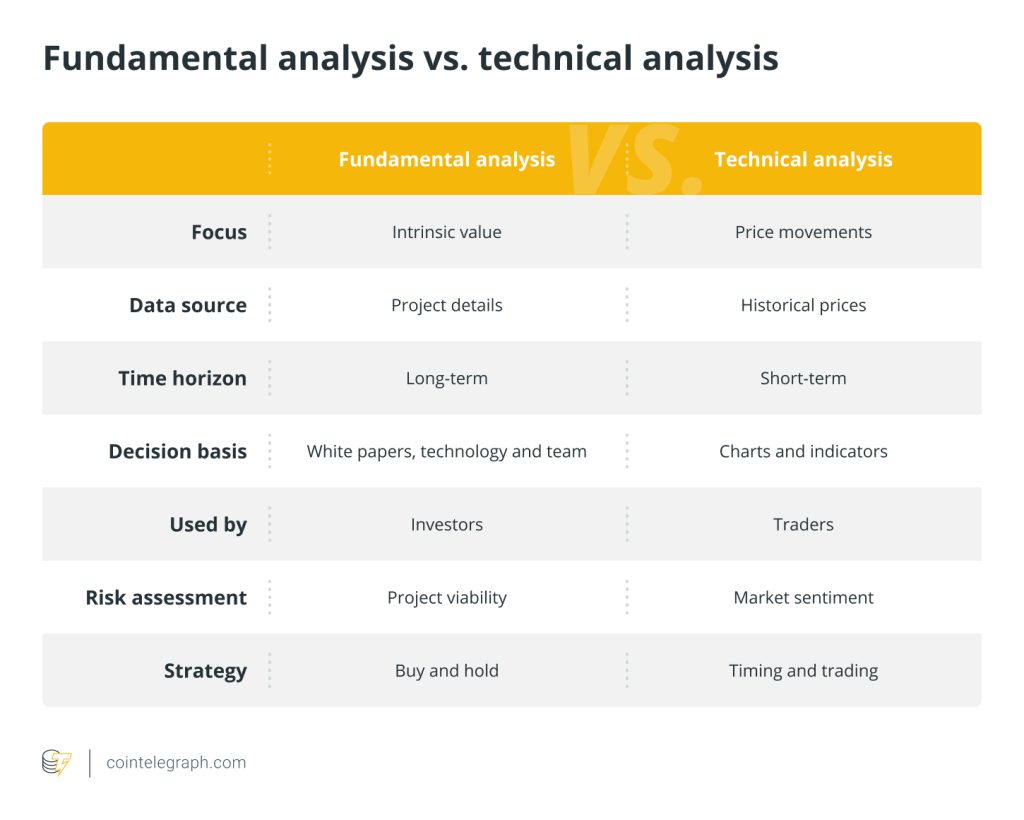

The Advance Decline Line Index is a technical analysis tool used to measure the number of advancing stocks versus the number of declining stocks in a given market index. It is primarily used to assess market breadth, helping traders determine the overall strength or weakness of the market. The ADL is calculated by taking the difference between the number of advancing and declining stocks (or assets) and then plotting it over time.

This indicator is particularly useful in identifying underlying market trends that may not be immediately visible in price charts alone. It highlights the strength or weakness of a trend and gives traders insights into whether a market is healthy or showing signs of exhaustion.

How Is the Advance Decline Line Calculated?

The ADL is calculated by taking the difference between the number of advancing and declining assets (stocks, cryptocurrencies, etc.) for each day and adding it to a cumulative total. Here’s the formula:

ADL = ADL (previous day) + (Advancing Issues – Declining Issues)

- Advancing Issues: The number of assets that have increased in value on that specific day.

- Declining Issues: The number of assets that have decreased in value.

- ADL (previous day): The ADL value from the previous day.

For example, if on a given day there are 300 advancing assets and 200 declining assets, the ADL for that day would be the cumulative total from the previous day plus the difference (300 – 200 = 100). The calculation provides a running total of this difference, which can be plotted as a line on a chart.

Interpreting the Advance Decline Line

The key to using the ADL successfully lies in interpreting the movements of the line itself. There are several patterns and signals that traders look for when analyzing the ADL.

- Uptrend Confirmation: When the ADL is moving upwards, it indicates that more assets are advancing than declining, which is a sign of market strength. This suggests that the overall market is in an uptrend, and traders may want to take long positions or buy assets that are part of the rally.

- Downtrend Confirmation: If the ADL is declining, it shows that more assets are falling in price than rising, signaling weakness in the market. This could indicate a bear market or a correction, and traders may want to adopt a more cautious approach or look for opportunities to short the market.

- Divergence Between Price and ADL: One of the most important signals for traders is a divergence between the price of an asset or market and the ADL. If the price is rising while the ADL is falling, this suggests that the uptrend is not supported by market breadth and could signal an impending reversal. Conversely, if the price is falling while the ADL is rising, it suggests that there is more underlying strength than the price indicates, potentially signaling a buying opportunity.

- Breaking New Highs: When the ADL makes new highs while the price fails to do so, it indicates that the market is becoming more narrowly focused and may be losing momentum. Conversely, if the price is making new highs but the ADL isn’t, this may suggest that the rally is not supported by the market’s breadth, and a reversal could be on the horizon.

- Volume and ADL: The ADL can also be used in conjunction with volume indicators. When the ADL rises with increasing volume, it confirms the strength of the trend. On the other hand, if the ADL rises but volume remains low, the trend may be weak and not sustainable.

How Can the Advance Decline Line Help Crypto Traders?

While the Advance Decline Line Index was originally developed for the stock market, its application is equally valuable in the cryptocurrency markets. Cryptocurrencies, much like stocks, experience periods of uptrends and downtrends, and their prices can often be volatile. The ADL allows traders to measure the internal strength of the market or specific coins and tokens, providing key insights into potential price movements.

Identifying Market Strength and Weakness

Cryptocurrency markets are notoriously volatile, and this can make it challenging for traders to identify whether a price movement is part of a larger trend or just a temporary fluctuation. The ADL helps to clarify this by providing a more objective view of the market’s breadth.

For instance, if Bitcoin is rising but the ADL is showing a decline, this could be a warning signal that the rally is not being supported by the broader market, and a correction might be on the way. On the other hand, if the ADL is rising alongside Bitcoin’s price, this could indicate a healthy trend, suggesting that more coins and tokens are participating in the rally, thus confirming the market’s strength.

Spotting Divergences in Crypto Markets

Divergences between price and the ADL can be a valuable tool for crypto traders. For example, during a bull market, if the ADL fails to confirm price highs, it may signal that the market is becoming overheated and a correction is imminent. Conversely, during a bear market, if prices are falling but the ADL is showing an increase, it could indicate that the selling pressure is weakening, and a reversal might occur.

Using the ADL Alongside Other Indicators

While the ADL is a valuable standalone indicator, its power is significantly enhanced when combined with other technical indicators. For example, combining the ADL with Relative Strength Index (RSI), Moving Averages, or MACD (Moving Average Convergence Divergence) can provide a clearer picture of market momentum.

For example, if the ADL is rising and the RSI is also showing an oversold condition, this could indicate that the market is primed for a reversal to the upside. Similarly, if the ADL is declining alongside a bearish MACD crossover, this could confirm that the market is likely to continue moving downwards.

Using the Advance Decline Line Index in Your Crypto Strategy

To successfully incorporate the Advance Decline Line Index into your cryptocurrency trading strategy, here are a few tips:

- Monitor Market Breadth Regularly: Keep an eye on the ADL to understand how many cryptocurrencies are participating in the market’s movement. This can help you gauge whether a trend is strong or weak.

- Use in Conjunction with Price Action: While the ADL offers valuable insights into market breadth, always complement it with price action analysis to confirm trends and reversal points.

- Look for Divergences: Divergences between the price and the ADL often signal potential trend reversals. Always be cautious when price and ADL are showing opposite signals.

- Set Alerts: Most trading platforms allow you to set price and indicator alerts. Use these to notify you when there are significant changes in the ADL, so you can react quickly to market conditions.

- Apply to Different Timeframes: The ADL can be applied to various timeframes, such as daily, weekly, or even intraday charts. Use shorter timeframes for quick trades and longer timeframes for understanding broader market trends.

Conclusion

The Advance Decline Line Index is a powerful tool for understanding market breadth and trend strength, and it can be a game-changer for cryptocurrency traders. By tracking the number of advancing versus declining assets, the ADL helps traders make more informed decisions, avoid false breakouts, and spot potential reversals before they happen. By adding the ADL to your crypto trading toolkit, you can gain a deeper understanding of market movements, giving you an edge in the highly volatile world of cryptocurrency trading.

With its ability to provide valuable insights into market dynamics, the ADL can be used to enhance your existing strategies and take your trading to the next level. So, take the time to learn and master this tool—it could be the key to unlocking more successful trades and higher profits in the future.

Responses