LEARN PRICE CHANNEL INDEX IN 3 MINUTES – BLOCKCHAIN 101

The Price Channel Index (PCI) is a powerful yet underutilized tool in technical analysis, providing insights into market trends and helping traders make informed decisions. Despite its value, the PCI often remains overshadowed by more mainstream indicators. This guide breaks down its mechanics, advantages, and application in cryptocurrency trading, ensuring you can master it in just a few minutes.

The PCI operates by identifying a price’s relative position within a predefined price channel. A price channel consists of an upper and lower boundary, usually derived from high and low prices over a specified period. The PCI then quantifies the relationship between the current price and these boundaries, offering insights into whether the asset is overbought, oversold, or trading within its expected range.

Why the Price Channel Index Matters

The unique strength of the PCI lies in its ability to adapt to various market conditions. In a volatile cryptocurrency market, the indicator’s dynamic range can help traders detect early signs of trend reversals or confirm ongoing trends. Unlike rigid indicators that rely on static thresholds, the PCI adjusts to the asset’s price behavior, making it particularly useful for assets with high volatility, such as MEME coins or newly launched tokens in decentralized and centralized exchanges.

Key Components of the PCI

- High and Low Prices: These are the core elements defining the price channel. The high price represents the upper limit, while the low price sets the lower boundary.

- Midpoint: The midpoint of the price channel serves as a benchmark for evaluating whether the price is relatively high or low.

- Current Price: The PCI assesses the current price in relation to the channel, quantifying its position.

The formula for calculating the PCI is straightforward:

PCI={(Upper Band−Lower Band)/(Current Price−Lower Band)}X100

This value ranges from 0 to 100, with values near 0 indicating proximity to the lower boundary and values near 100 suggesting closeness to the upper boundary.

Practical Applications of the PCI in Crypto Trading

- Identifying Overbought and Oversold Levels

The PCI excels at identifying overbought and oversold conditions. When the PCI approaches the upper boundary (e.g., values above 80), the asset might be overbought, signaling a potential reversal or consolidation. Conversely, values near the lower boundary (e.g., below 20) can indicate oversold conditions, suggesting a buying opportunity.

For example, if a MEME token on SuperEx consistently reaches a PCI of 90 and subsequently dips, this pattern could serve as a warning signal for traders to exit or reduce exposure before the trend reverses.

- Trend Confirmation

Traders can use the PCI to confirm trends. If the index consistently remains within the upper range during an uptrend, it indicates strong bullish momentum. Conversely, if the PCI hovers near the lower boundary, it signifies bearish pressure.

This trend confirmation is particularly valuable when trading volatile pairs, such as BTC/USDT or ETH/BSC, where price fluctuations can mislead traders relying solely on candlestick patterns.

- Entry and Exit Signals

The PCI provides clear entry and exit signals by identifying price extremes. A trader might enter a long position when the PCI moves from the oversold region back toward the midpoint. Similarly, a short position can be initiated when the PCI transitions from overbought levels toward the midpoint.

For instance, a trader monitoring TRX on SuperEx could use the PCI to time entries when TRX enters the lower 20% of its price channel, capitalizing on the subsequent upward momentum.

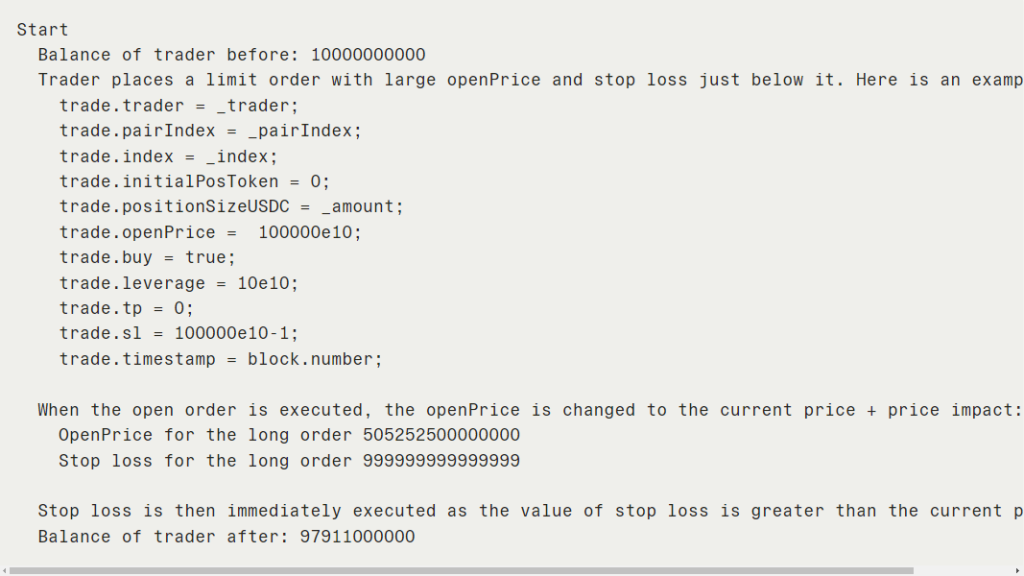

- Risk Management

Incorporating the PCI into a broader strategy enhances risk management. By setting stop-loss levels based on PCI readings, traders can protect themselves from unexpected market movements. For example, exiting a position when the PCI exceeds historical thresholds can safeguard against steep losses in a downtrend.

How to Implement the PCI in Your Trading Strategy

Implementing the PCI requires a systematic approach:

- Choose an Appropriate Timeframe: The PCI’s effectiveness depends on the timeframe used. Shorter timeframes capture intraday movements, while longer timeframes identify broader trends. Adjust the timeframe based on your trading style.

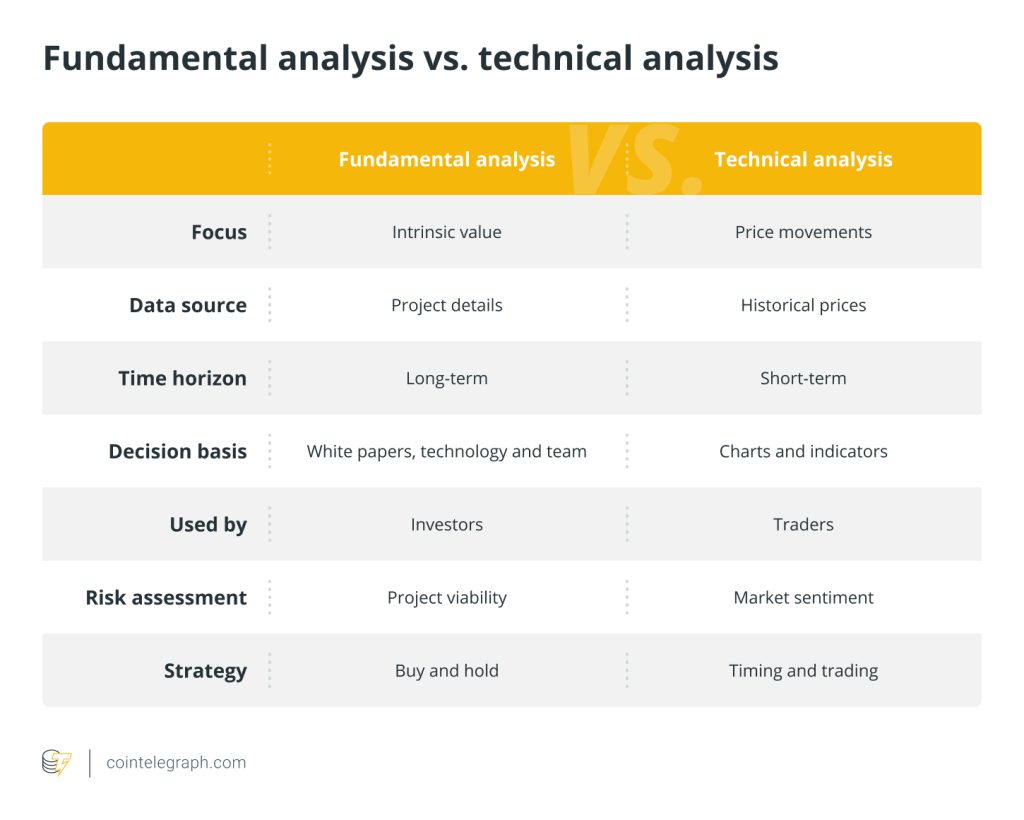

- Combine with Other Indicators: While powerful on its own, the PCI works best when paired with complementary indicators, such as the Relative Strength Index (RSI) or Moving Averages. This combination provides a more comprehensive market view, reducing false signals.

- Regularly Monitor Adjustments: The PCI adapts to changing market conditions. Periodically review the high and low levels of the price channel to ensure the index remains accurate.

Common Mistakes to Avoid

- Ignoring Market Context

The PCI is most effective when used in conjunction with market analysis. Relying solely on the indicator without considering macroeconomic factors, news events, or overall market sentiment can lead to suboptimal decisions. - Overtrading

Frequent trades based solely on PCI signals can result in higher fees and reduced profitability, particularly in volatile markets. Exercise patience and wait for strong confirmation before acting. - Neglecting Stop-Loss Levels

Failing to set stop-loss orders can expose traders to significant losses, especially during unexpected market reversals. Always incorporate risk management into your PCI-based strategy.

Conclusion

The Price Channel Index is a versatile tool that enhances decision-making in cryptocurrency trading. Its adaptability to volatile conditions and ability to identify overbought and oversold levels make it indispensable for traders seeking to optimize their strategies. By mastering the PCI and incorporating it into your trading routine, you can gain a significant edge in navigating the complex world of cryptocurrencies.

Responses