LEARN VOLATILITY O-H-L-C INDEX IN 3 MINUTES – BLOCKCHAIN 101

The Volatility O-H-L-C (Open-High-Low-Close) indicator is a technical analysis tool used by traders to measure the volatility of an asset within a specific timeframe. By comparing the opening, high, low, and closing prices of an asset, this indicator helps traders assess market behavior and predict potential price movements. Volatility indicators are particularly valuable in determining the strength of price movements and identifying market trends, making them essential for both short-term and long-term traders.

In this article, we’ll explore how the Volatility O-H-L-C indicator works, its benefits, and how traders can use it to enhance their trading strategies.

How the Volatility O-H-L-C Indicator Works

The Volatility O-H-L-C indicator calculates the range between the highest and lowest prices of an asset within a certain period, providing insights into the asset’s price fluctuation. The greater the difference between the high and low prices, the higher the volatility. This indicator typically consists of four key data points:

- Open: The price of the asset when the market opens.

- High: The highest price the asset reached during the trading session.

- Low: The lowest price the asset reached during the trading session.

- Close: The price of the asset when the market closes.

By plotting these data points on a chart, traders can visualize the asset’s volatility and make informed trading decisions based on the potential for price movements.

For example, if the high and low prices during a particular period are significantly different, it indicates high volatility, suggesting that the asset is experiencing large price swings. On the other hand, if the prices remain close together, it indicates low volatility, which might suggest that the asset is trading in a tight range with limited price movement.

Benefits of Using the Volatility O-H-L-C Indicator

- Identifying Market Trends: The Volatility O-H-L-C indicator helps traders identify the current market trend. When the volatility is high, it often indicates that the market is in a trending phase, while low volatility suggests a sideways or consolidating market. This information is vital for deciding whether to enter or exit trades.

- Timing Entry and Exit Points: Knowing the volatility of an asset can help traders determine the best time to enter or exit a trade. For instance, entering a trade when volatility is low may offer less risk, but with the potential for future price movement as volatility increases. Conversely, exiting during high volatility could help lock in profits before the market reverses.

- Risk Management: High volatility often indicates increased risk, so the Volatility O-H-L-C indicator can serve as a tool for managing risk. Traders can adjust their positions based on the level of volatility, reducing exposure when the market is unstable and increasing it when volatility is low.

How to Apply the Volatility O-H-L-C Indicator in Trading

- Monitoring for Breakouts: Traders can use the Volatility O-H-L-C indicator to identify potential breakout opportunities. A sudden increase in volatility often signals that a breakout is about to occur, giving traders the chance to position themselves accordingly.

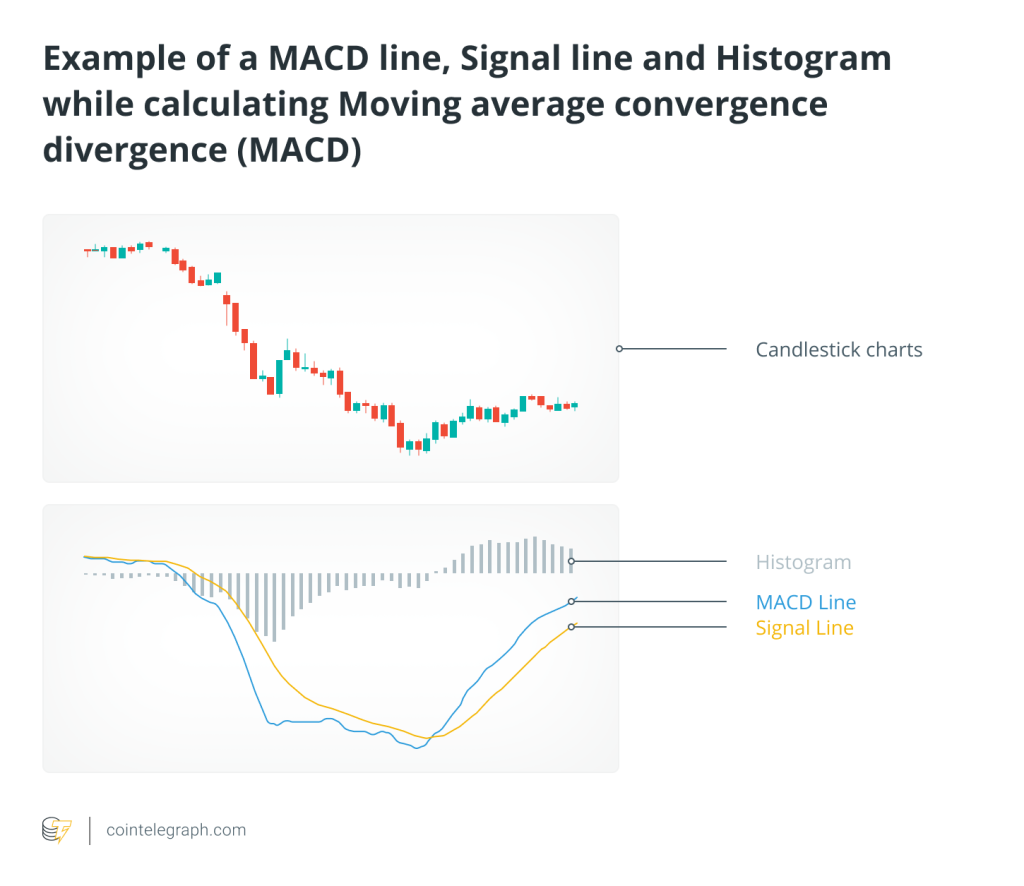

- Combining with Other Indicators: While the Volatility O-H-L-C indicator is a powerful tool on its own, it can also be used in conjunction with other technical indicators such as moving averages, Bollinger Bands, or RSI (Relative Strength Index) to confirm signals and enhance decision-making.

- Adjusting Trading Strategies: Traders may adjust their strategies depending on whether the Volatility O-H-L-C indicator suggests high or low volatility. For instance, in a high-volatility environment, traders might adopt shorter-term strategies like scalping, while in a low-volatility environment, they may choose longer-term strategies such as swing trading.

Conclusion

The Volatility O-H-L-C indicator offers traders a valuable way to assess the volatility of assets and adjust their strategies accordingly. By understanding how market volatility changes over time and learning to read this indicator, traders can better time their entry and exit points, manage risk, and improve overall trading performance. Whether you’re a beginner or an experienced trader, incorporating the Volatility O-H-L-C indicator into your toolkit can provide deeper insights into market behavior and help optimize your trading results.

-INDEX-IN-3-MINUTES@2x-1024x576-4.png)

Responses