LEARN MCGINLEY DYNAMIC IN 3 MINUTES – BLOCKCHAIN 101

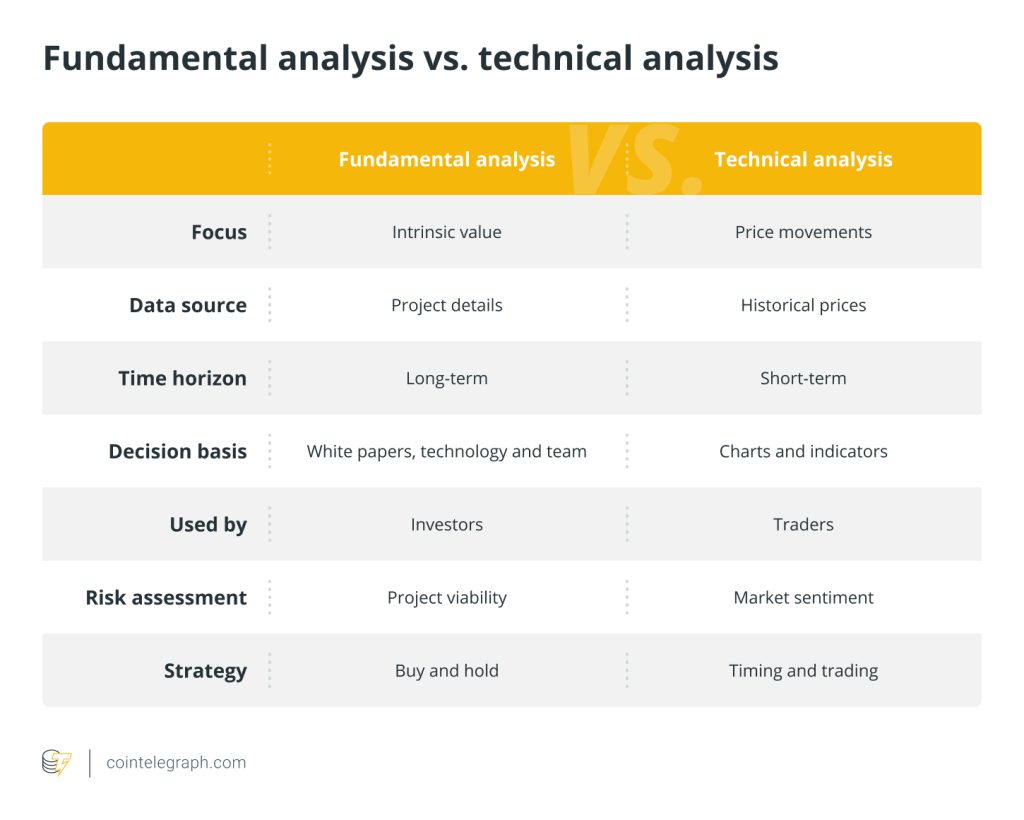

In the world of technical analysis, a variety of indicators emerge continuously, each with its unique perspective and application scenario. However, traditional indicators such as the Simple Moving Average (SMA) and Exponential Moving Average (EMA) often fall short when dealing with market volatility. Therefore, to better capture the true dynamics of the market, the McGinley Dynamic indicator was developed.

What is the McGinley Dynamic Indicator?

The McGinley Dynamic (MD) was developed by technical analyst John R. McGinley in 1997 as a smoothing technical indicator designed to reduce market “noise.” Unlike traditional moving averages, McGinley Dynamic adjusts its calculation period dynamically to adapt to changes in market speed and volatility, thereby providing more accurate trend tracking.

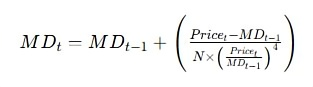

McGinley Dynamic Calculation Formula

The core formula for McGinley Dynamic is as follows:

Where:

- MDtMD_{t}MDt is the McGinley Dynamic value for the current period.

- MDt−1MD_{t-1}MDt−1 is the McGinley Dynamic value for the previous period.

- PricetPrice_{t}Pricet is the current price.

- NNN is the smoothing factor, typically taken as 14.

The key to this formula lies in its dynamically adjusted mechanism, which means that when the market fluctuates significantly, the MD indicator will follow the price more quickly, and when the market is relatively stable, the MD indicator’s response will slow down. This adjustment reduces the lag effect of traditional moving averages, allowing traders to better capture market trends.

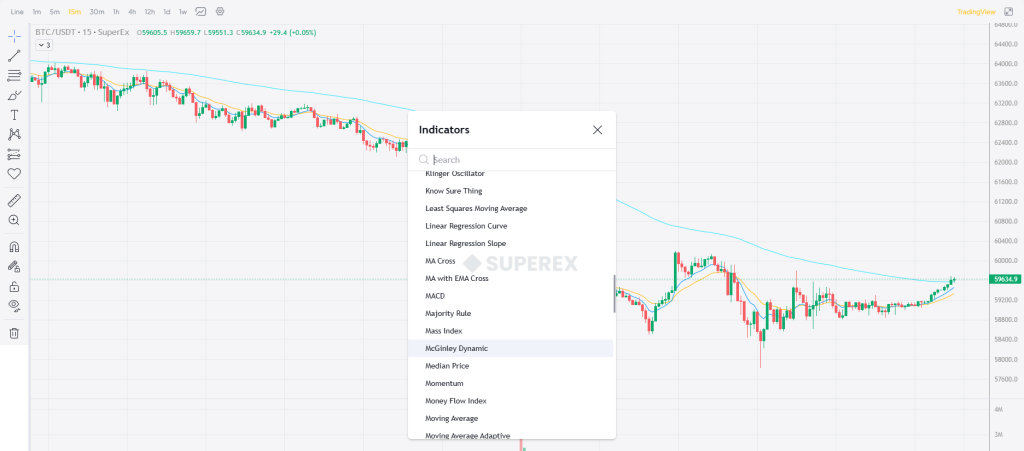

The McGinley Dynamic indicator can be directly accessed in the SuperEx indicator library, making it convenient for users to quickly capture market dynamics, as shown in the following figure:

Advantages of McGinley Dynamic

Reduces lag effect: Since MD automatically adjusts its smoothing period according to market volatility, it avoids the delayed response of simple or exponential moving averages during sharp fluctuations. This keeps it sensitive even during drastic price changes.

Closer to the true market dynamics: MD helps traders make decisions in the early stages of market trends by closely following price changes, without being confused by short-term price fluctuations.

Reduces market noise: The dynamic adjustment feature of McGinley Dynamic allows it to effectively filter out irrelevant noise in the market, enabling traders to focus more on significant trend changes.

Applying the McGinley Dynamic Indicator

- Trend following:McGinley Dynamic is highly suitable for trend-following markets. When the price is above the MD line, it typically indicates an upward market trend; conversely, if the price is below the MD line, it may indicate a downward market trend.

- Support and resistance identification:MD can act as a dynamic support and resistance line. If the price touches the MD line multiple times without breaking through, it may indicate that the line is a strong support or resistance level.

- Trading signals:When the price breaks below the MD line from above, it may be a sell signal; conversely, when the price breaks above the MD line from below, it may be a buy signal.

McGinley Dynamic in Practice

Although McGinley Dynamic offers technical advantages over traditional moving averages, traders should combine it with other technical indicators and market analysis tools to confirm trading signals in actual trading. Since MD is primarily designed to reduce market noise and better capture trends, it works best when paired with momentum indicators such as the RSI (Relative Strength Index) or MACD (Moving Average Convergence Divergence).

For example, in the market, when the MD line and the RSI indicator jointly show an oversold signal, it may be a more reliable buying opportunity. Similarly, when MD is combined with MACD, if both issue the same buy or sell signals, it may enhance the credibility of the trading decision.

Conclusion

The McGinley Dynamic indicator provides traders with a more dynamic and sensitive market analysis tool. Its unique dynamic adjustment mechanism allows it to respond more effectively to market fluctuations and provide traders with more accurate trend judgments. However, like any technical indicator, McGinley Dynamic is not a panacea; it must be combined with other indicators and market analysis methods to improve the success rate of trading strategies. As a trader, understanding and flexibly applying the McGinley Dynamic will add a powerful weapon to your technical analysis toolkit.

Responses