Bitcoin price at $72K is the 'fuse' to reach new ATH: Analyst

Bitcoin price above $72,000 would liquidate $800 million worth of leveraged shorts, making it a significant resistance level for BTC.

If the price of Bitcoin reaches $72,000, it would act as a “fuse,” triggering the breakthrough of the $75,000 psychological barrier.

Bitcoin (BTC) hitting $72,000 would spark a wave of mass liquidations, paving the way to new all-time highs, according to analyst Willy Woo.

Woo wrote in a June 5 X post to his 1.1 million followers:

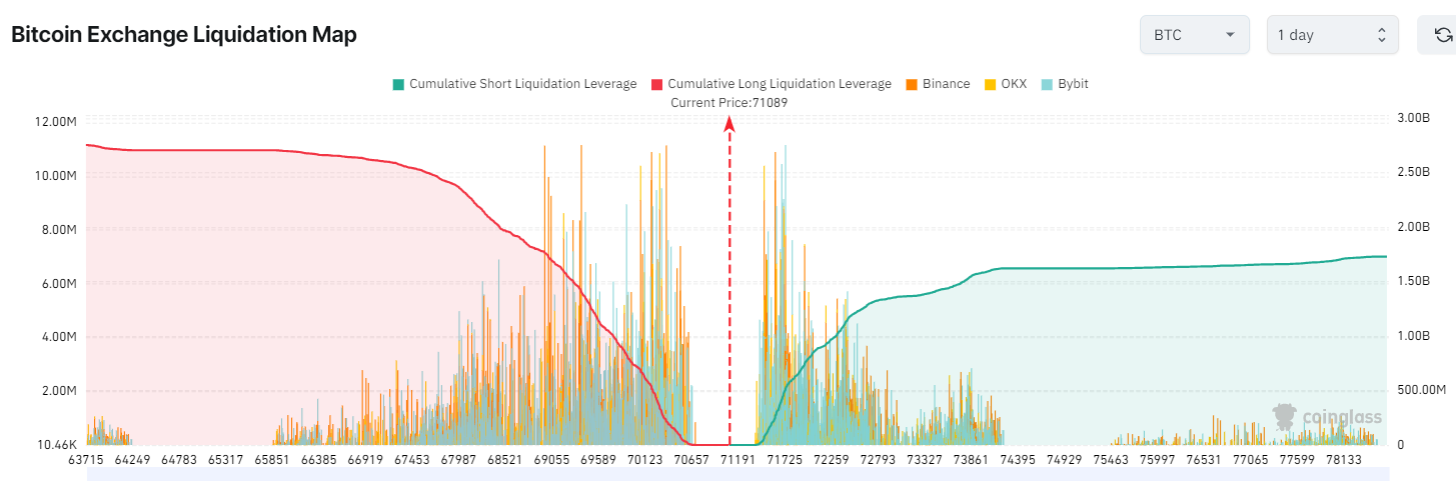

“Tapping $72k is the fuse set to start a liquidation cascade. $1.5b of short positions ready to be liquidated all the way up to $75k and a new all-time high.”

Bitcoin rose 3.15% in the 24 hours leading up to 8:05 am UTC on June 5 to trade at $71,124. The world’s first cryptocurrency is up 4.8% on the weekly chart, according to CoinMarketCap data.

Related: Roaring Kitty’s $300M GME position sparks market manipulation claims

Bitcoin at $72,000 would liquidate $800 million worth of leveraged shorts

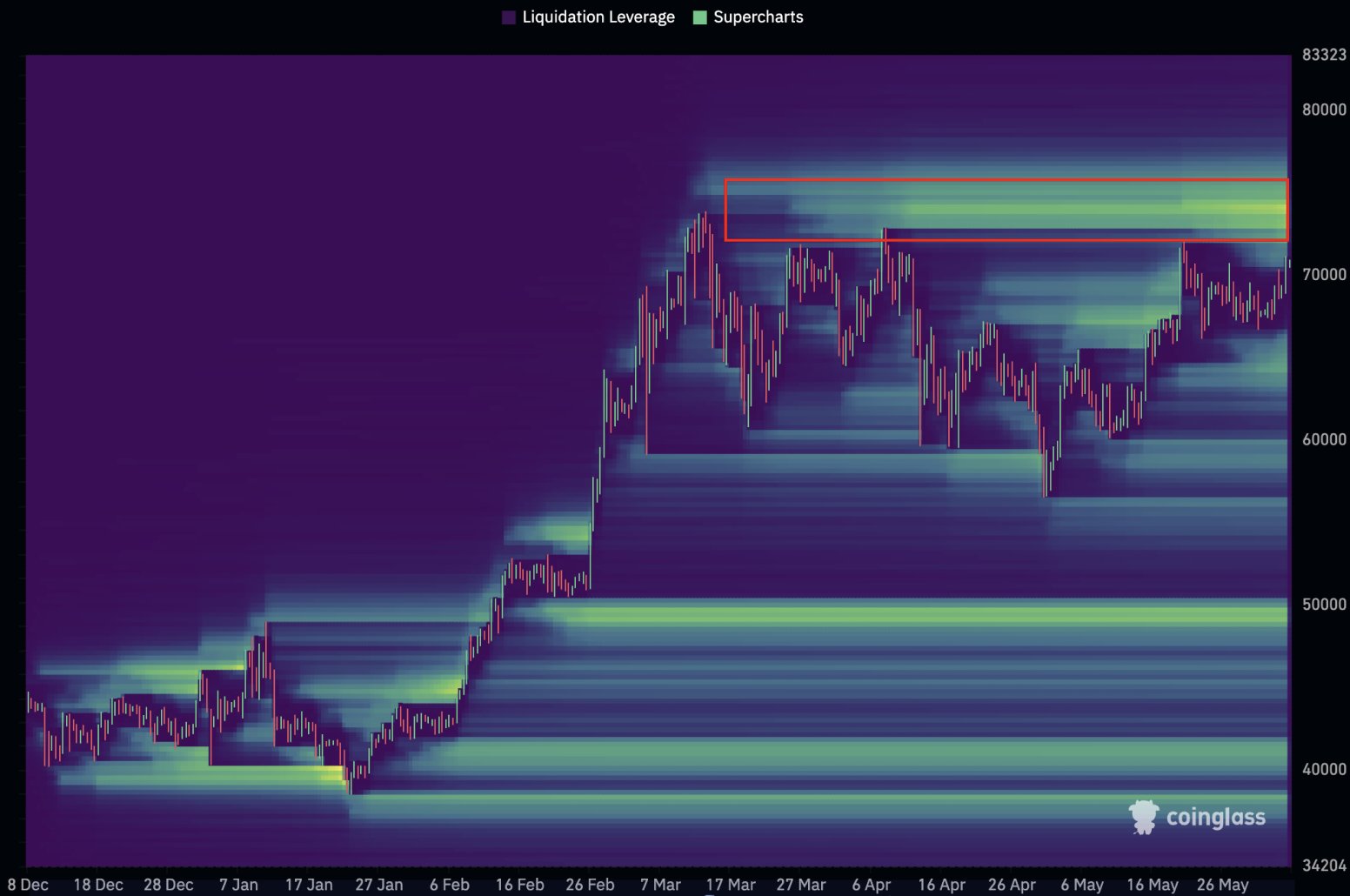

Bitcoin price faces significant resistance at the $71,500 and $72,000 mark.

According to CoinGlass, a potential move above $72,000 would liquidate $800 million worth of cumulative leveraged short positions across all exchanges.

Above the $72,500 mark, Bitcoin would trigger the liquidation of over $1.2 billion worth of leveraged short positions. Currently, Bitcoin is down 3.4% from its previous all-time high of $73,740, which was reached on March 14.

Bitcoin’s post-halving distribution “danger zone” ended on May 6, when Bitcoin firmly rose above the reaccumulation range of $60,000, according to popular crypto analyst Rekt Capital.

Bitcoin’s price has risen over 12.5% since May 6, confirming the end of the post-halving danger zone.

Related: Will Bitcoin benefit from a European Central Bank rate cut?

Bitcoin breaks two-week downtrend

Bitcoin price broke out of a significant two-week downtrend on June 3, wrote Rekt Capital in an X post:

“Bitcoin broke its two-week downtrend today. However, we have seen upside wicks beyond this downtrend before. Which is why a Daily Close later today is needed to confirm this breakout.”

However, Bitcoin still needs to turn the $72,000 resistance into support, before it enters the “parabolic phase” of the bull cycle, according to Rekt Capital.

Responses