Sustainable finance and digital identity — Interview with Sovereign Wallet

Digital identity and currency advancements introduce new opportunities for secure, decentralized transactions.

As blockchain technology continues to reshape the financial landscape, companies are striving to address the challenges of digital identity, currency and secure transactions. One such project is Sovereign Wallet, an identity-based blockchain technology company.

Founded in 2014, Sovereign Wallet focuses on decentralizing identity and tokens, implementing peer-to-peer transactions and integrating a unified ledger system. The platform’s mainnet MetaMUI — a finance-specific hybrid blockchain platform launched in 2021 — aims to achieve full digitization of social infrastructures, including currency, identity management and certified messaging protocols.

In this interview, Sovereign Wallet CEO and founder Phantom Seokgu Yun discusses the company’s approach to digital currency, privacy-centric identity mechanisms and tokenized securities.

Cointelegraph: Digitizing various aspects of social infrastructure seems ambitious. Could you walk us through your approach to digital currency, digital identity and tokenized securities?

Phantom Seokgu Yun: MetaMUI strongly emphasizes identity-based transactions to ensure legal compliance. Transactions are recorded based on the user’s digital identifier, known as DID. To address privacy concerns, we have embraced a decentralized identity mechanism termed Self-Sovereign Identity (SSID).

A notable advantage of utilizing MetaMUI for implementing tokenized securities is our ability to facilitate identity-based asset transfers, ensuring security, legal compliance and peer-to-peer functionality. This capability enables us to build a highly scalable, massive crowdfunding platform.

CT: With the transition to digital infrastructure, concerns about security and privacy often arise. How does Sovereign Wallet address these concerns and ensure the integrity of its digital systems?

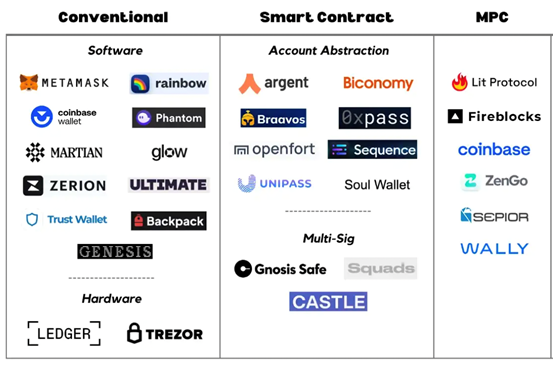

PSY: Despite numerous innovations in consensus protocols and network operations, wallet technologies remain rudimentary. Errors in wallet management can result in the total loss of a user’s assets. Sovereign Wallet aims to offer an advanced wallet that complements and seamlessly integrates with the blockchain network.

The MetaMUI wallet generates a key on the user’s device to sign transactions for asset transfers. We offer a key recovery mechanism if the user loses the device and the key. The user’s privacy is guaranteed since identity verification is decentralized and no private information is stored on the blockchain.

CT: Can you elaborate on how your identity-based blockchain technology facilitates a crowdfunding platform and what advantages it offers over traditional models?

PSY: Most asset trading is conducted by centralized exchange service providers because verifying the seller’s identity in peer-to-peer, direct trading is challenging. MetaMUI resolves this issue with a decentralized identity infrastructure to verify sellers without a centralized authority. MetaMUI’s crowdfunding platform is a peer-to-peer trading platform, significantly reducing the risk of massive asset hacking incidents.

CT: How does your Security Token Offering Platform contribute to creating an economic system without relying on debt, and what impact do you anticipate this having on the financial industry?

PSY: Sovereign Wallet’s subsidiary, United Net Zero Nation (UNZN), will launch a Security Token Offering (STO) platform in Switzerland later this year. This STO platform facilitates large-scale crowdfunding, funding many climate projects requiring substantial investment. Climate-aware individuals can micro-invest in essential climate projects, reducing the need for bank loans and decreasing reliance on a debt-based economy.

CT: Can you explain the motivation behind your collaboration with Indigenous nations in Australia for a cross-border payment network and how it aligns with the goals of Sovereign Wallet?

PSY: One of Sovereign Wallet’s major goals is to replace slow and costly cross-border payments with internet-based digital currency. However, initiating this innovation in developed countries is challenging due to the many stakeholders involved. Therefore, we began this initiative with the Yidindji, a leading Indigenous nation in Australia. This year, we signed an agreement with Yidindji to develop the Allodial Unity Digital Dollar (AUDD) to facilitate cross-border payments among Indigenous nations in Australia.

CT: What technological innovations are at the core of the AUDD cross-border payment network, and how does it differ from traditional systems like SWIFT regarding efficiency and inclusivity?

PSY: AUDD and the participating nations’ currencies, such as the Sovereign Yidindji Dollar, are MetaMUI central bank digital currency (CBDC)-based tokenized currencies, with an algorithmic central bank dynamically regulating currency conversion and circulating volume.

AUDD will utilize MetaMUI’s offline CBDC technology, Chained Cash, to facilitate instant wallet-to-wallet money transfers. Its offline payment capability ensures that people in remote areas can also use CBDC, which is crucial for achieving financial inclusion for Indigenous nations.

CT: To celebrate Earth Day, you have launched the United Net-Zero Nation (UNZN) as a sustainable digital twin of the planet. What is your vision for this project?

PSY: We use “digital twin” instead of “metaverse” to emphasize the connection between the real and virtual worlds. We envision a digital utopia that influences and transforms the physical world into a sustainable environment.

The UNZN showcases the digital infrastructure and economic model proposed by MetaMUI. Each UNZN citizen will have a digital identity linked to their wallet on their device, enabling participation in climate project crowdfunding and borderless digital currency payments. Every activity within the UNZN will positively impact the physical world.

CT: What are the most critical aspects achieved with UNZN that would help create a sustainable civilization?

PSY: In the UNZN, every citizen offsets their carbon footprint to achieve personalized net-zero status by reducing emissions, purchasing carbon credits, donating to environmental, social and governance (ESG) projects or investing in climate projects. If everyone achieves net zero, it could significantly impact climate change.

UNZN is a membership-based service with a 10-euro annual fee, providing a citizen card. Future plans include offering digital infrastructure services such as passwordless authentication, certified messaging, contract signing, notarization and tokenized asset trading.

CT: How do you envision the widespread adoption of digital certificates and notarization changing traditional bureaucratic processes, and what challenges do you anticipate in this transition?

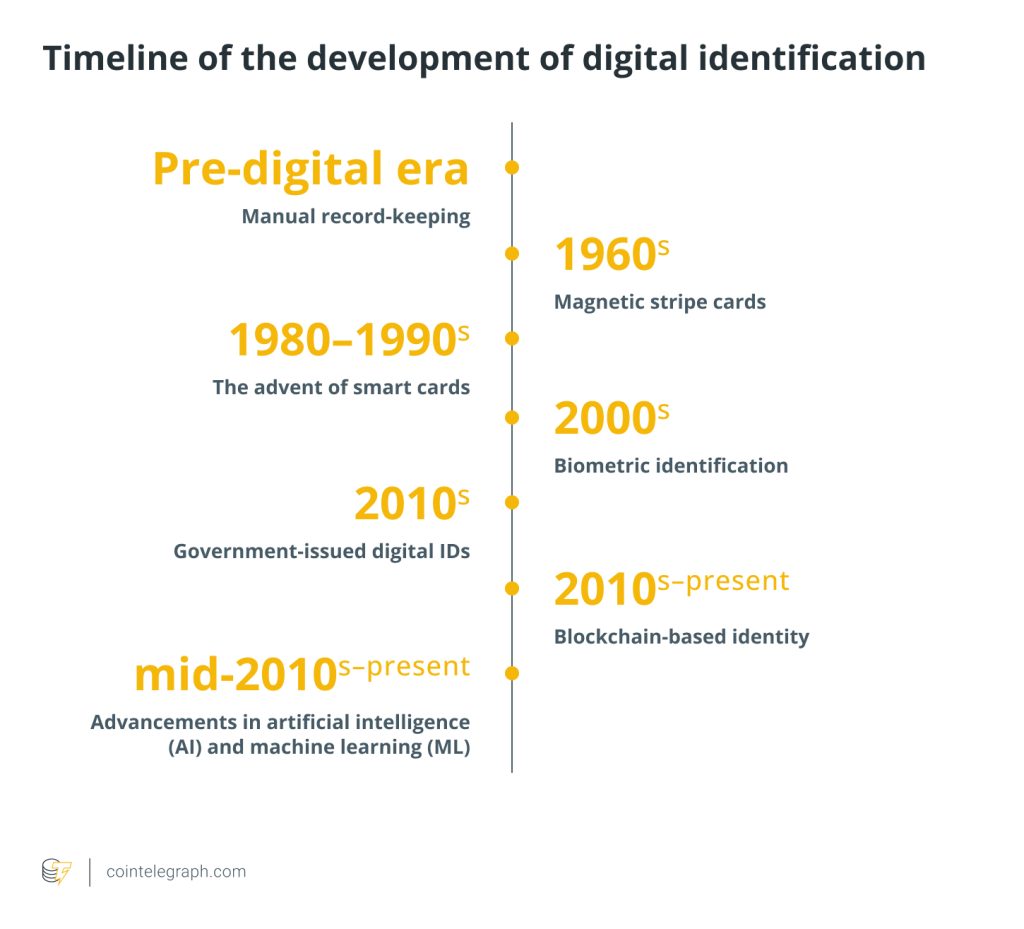

PSY: Digital certification and notarizations are the final stages in digitizing social infrastructures, requiring a decentralized public key infrastructure. MetaMUI’s identity blockchain supports this system, which provides globally compatible digital IDs and verifiable digital signatures. Integrating existing infrastructures presents challenges, so Sovereign Wallet plans to start with nations lacking current infrastructure and build a fully integrated system from the ground up.

Responses