Ethereum ETF excitement? ETH futures tell a different story

ETH futures reflect pessimism with crypto regulation and potential delay in the spot ETF launch.

On May 23, the U.S. Securities and Exchange Commission (SEC) greenlit spot Ethereum exchange-traded funds (ETFs), but the actual trading of these instruments in U.S. markets will take longer as the regulator has yet to approve each of the eight funds’ individual S-1 filings. Given the uncertainty, Ether’s (ETH) price has struggled to surpass the $3,900 resistance, and the answer may lie in Ether’s futures markets.

Ethereum spot ETF uncertainty regarding launch date and potential outflows

Part of the discomfort among Ether investors, even those assuming that the effective spot ETF launch in the U.S. is imminent, stems from the Grayscale Ethereum Trust (ETHE) conversion into a spot instrument. If the fund administrator decides to maintain its $11 billion fund fees at levels much higher than its incumbents, the likely result will mirror Grayscale’s GBTC outflows, thus offsetting inflows from competitors including BlackRock, Fidelity, VanEck, and ARK 21Shares.

Some analysts have claimed that the SEC’s decision to approve the spot Ethereum was heavily influenced by last-minute political pressure from Democrats to win over swing voters in the U.S. Presidential election this November. However, analysts note that the SEC knew the Ethereum instrument shared the same regulatory setup as the spot Bitcoin ETFs, so according to Bernstein’s analysts, the “SEC took a more pragmatic approach and avoided a legal battle.”

Traders are debating whether bullish bets are being made through ETH derivatives markets or if the price of Ether is being artificially suppressed due to bets on the spot Ether ETF taking longer than expected. This uncertainty stems from the mixed signals in the crypto market, particularly the recent actions of U.S. President Joe Biden, who vetoed a Congressional resolution aimed at repealing the SEC’s SAB 121 guidance, which has raised concerns about the regulatory environment for cryptocurrencies.

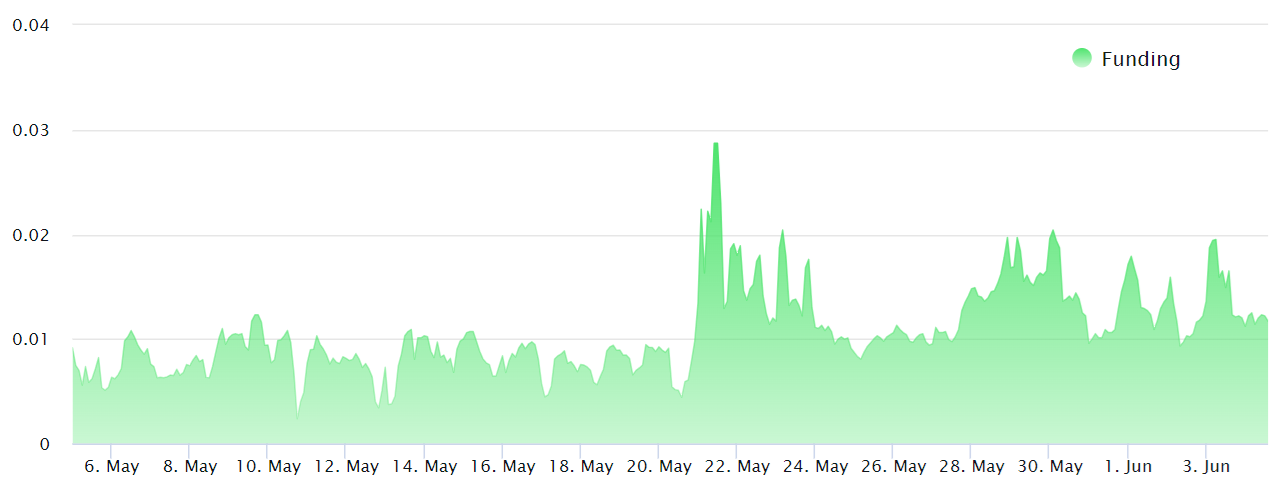

Predicting how long it will take the SEC to approve the necessary S-1 filings for each Ethereum spot ETF is nearly impossible, so attention should shift to trading metrics to understand if traders are leaning bearish after multiple failed attempts to sustain prices above $3,900. Perpetual contracts, also known as inverse swaps, incorporate an embedded rate recalculated every eight hours. In short, a positive rate indicates a preference for higher leverage being utilized by longs (buyers).

Apart from a brief spike near 0.03% per 8-hour on May 21, which is equivalent to 0.6% per week, the funding cost for ETH leverage has been insignificant, meaning there has been balanced demand between longs and shorts using perpetual contracts.

Monthly ETH futures reflect investors’ optimism slowly fading away

To exclude externalities specific to perpetual contracts, one should monitor the ETH monthly futures annualized premium (basis rate). These contracts rarely track the spot Ether price as their longer settlement period causes sellers to demand a 5% to 10% premium. In periods of excitement, however, this difference can easily reach 20% as buyers are willing to pay a higher premium for leverage.

Ether’s monthly futures premium rose to 15% on May 21 following the ETH price rally to $3,800. However, the moderate optimism began to fade on June 3 as the indicator moved back to 13%, which is still slightly above the neutral threshold but not a sign of short-term bullishness.

Related: Who governs Ethereum? Galaxy report reveals all

This data does not necessarily mean that investors are not confident in the spot Ethereum ETF launch, given the stricter regulations around the world. For example, Hong Kong banned unlicensed exchanges in the region, Paraguay seized unregistered crypto mining equipment, and a couple of U.S. Senators claimed that Iran is using digital assets to bypass sanctions, including funding terrorist organizations.

For now, ETH derivatives reflect low trust in strong U.S. spot ETF net inflows, regardless of whether the reason is the delay in S-1 approval from the regulator or the fear of outflows from Grayscale’s ETHE instrument. Consequently, the odds for a rally above $4,000 in the near term are slim according to ETH futures pricing.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Responses