Bitcoin dormant for 5 years or more awakens in new ‘distribution’

Bitcoin long-term holder “inactivity” is being slowly challenged as BTC emerges from hibernation, in some cases lasting over a decade.

Bitcoin dormant in wallets for up to a decade is on the move, the latest data shows.

According to on-chain analytics platform CryptoQuant, thousands of coins are “waking up” daily as Bitcoin (BTC) price action challenges $70,000.

“Old” tranches of BTC move on-chain

Bitcoin on-chain volume is the source of intrigue this month as “older” coins return to circulation — in their thousands.

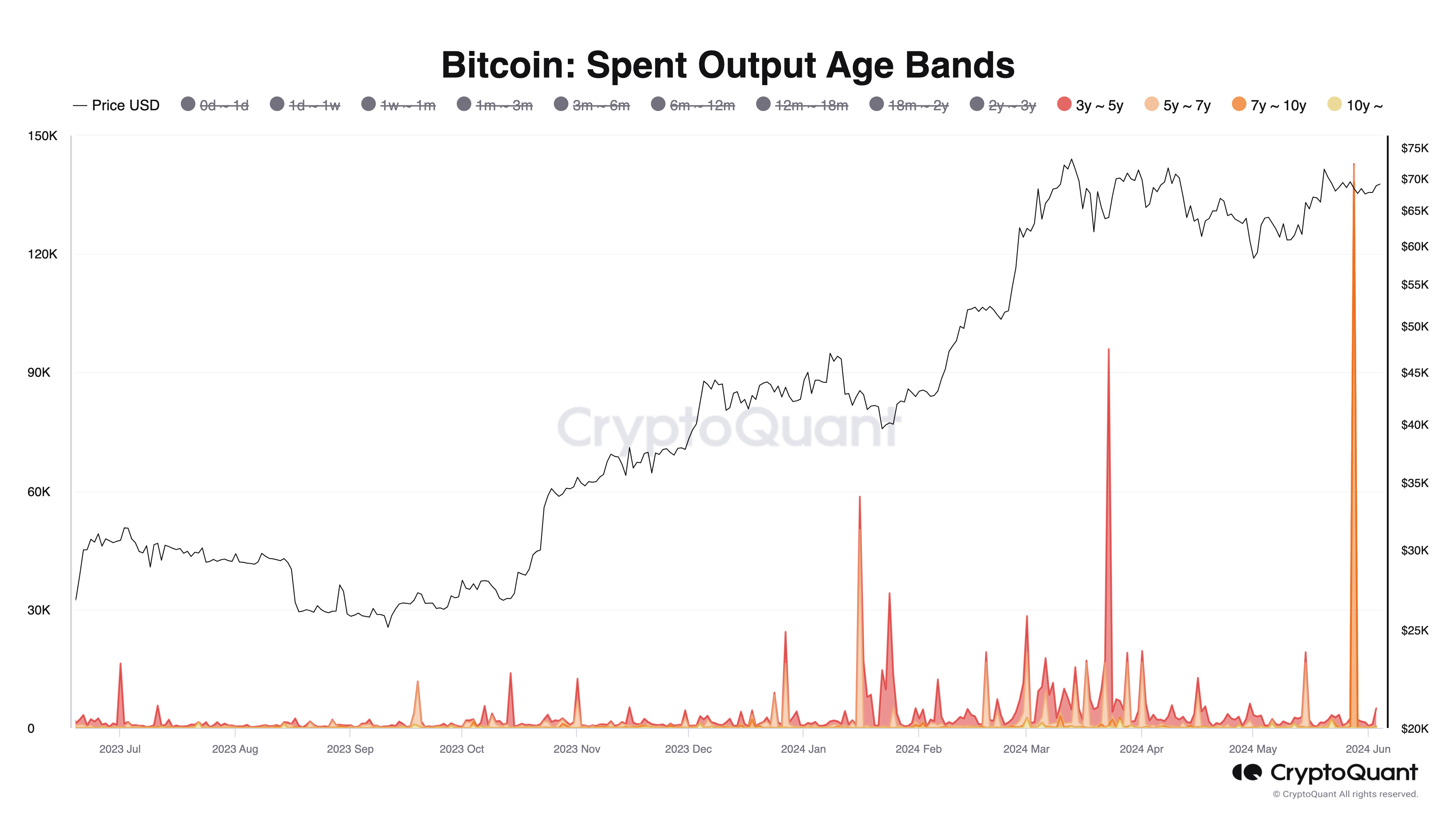

CryptoQuant’s spent output age bands metric shows that on June 2 alone, 2,800 BTC moved on-chain for the first time in between two and three years.

The tally for coins stationary for four to five years was even larger, at 4,500 BTC. June 3 also saw 210 BTC move, which had previously been in its wallet for a decade or more.

“Old coins moving, after old coins moving, after old coins moving,” CryptoQuant contributing analyst J. A. Maartunn wrote in part of the accompanying commentary on X.

“In other words, distribution.”

Decade-old coins moving on-chain in fact occurs fairly regularly, but the latest stage of the Bitcoin bull market has seen an uptick in frequency.

CryptoQuant data shows this “oldest” cohort of BTC becoming more active beginning at the end of February — in the run-up to what remains Bitcoin’s all-time high of $73,800.

Bitcoin long-term holders in a state of “inactivity”

As Cointelegraph reported, Bitcoin’s long-term holders (LTHs) — entities holding a given amount of BTC without selling it for 155 days or more — continue to broadly resist the temptation to divest themselves of coins.

Related: Bitcoin hash ribbons flash the first buy signal since $25K BTC price

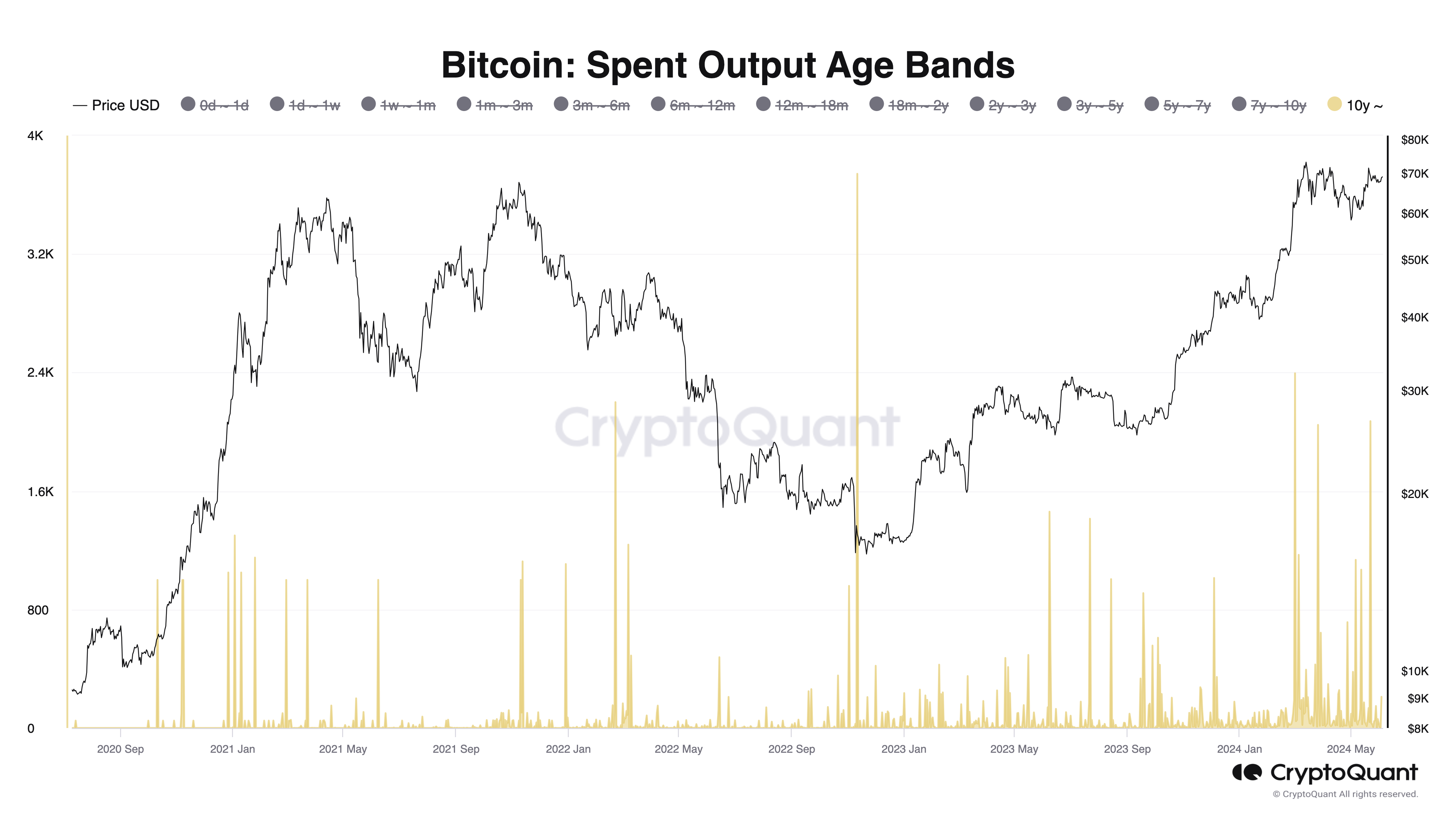

As CryptoQuant noted last week, “newer” LTHs — owning coins dormant for one to two years — have indeed cooled distribution behavior.

“As Bitcoin’s price recovers from the recent correction to $56,000, we notice a shift in holder behavior. The 1-year+ and 2-year+ cohorts have ceased selling, transitioning from a distribution phase to a holding phase,” fellow contributor Onchained wrote in a Quicktake market update.

“This change indicates a renewed confidence in Bitcoin’s future price potential, as these cohorts choose to retain their holdings rather than liquidate them at current prices.”

An accompanying chart compared levels of inactivity among several LTH cohorts.

Onchained added that various on-chain indicators point to “strong underlying bullish sentiment,” chiming with subsequent findings from popular trader Alan Tardigrade this weekend.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Responses