Japanese exchange DMM loses $305M in Bitcoin via private key hack

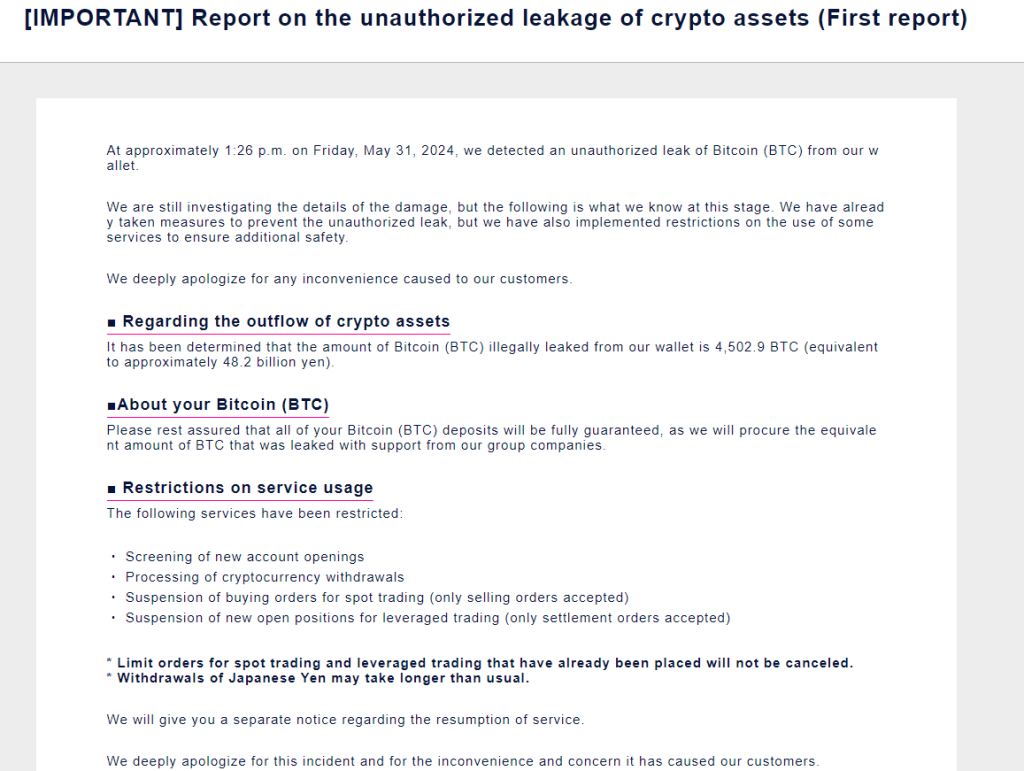

The cryptocurrency exchange lost 4,502.9 BTC due to a hack of its private key; withdrawals have been temporarily suspended.

Centralized cryptocurrency exchange DMM has lost more than $305 million worth of Bitcoin (BTC) due to a hack of its servers on May 30. The exchange confirmed the hack on its website and stated that all user deposits “will be fully guaranteed.”

The exchange has temporarily halted withdrawals, new account openings, new spot buy orders, and all new leveraged orders. However, limit orders that have already been placed will not be canceled.

Crypto users began to discuss the attack on social media platform X at 10:14 pm UTC on May 30, when analytics platform Whale Alert posted, “4,502 #BTC (308,948,771 USD) transferred from unknown wallet to unknown new wallet.” The post linked to blockchain data that showed an outflow of 4,502.9 BTC, worth $305 million at current prices, from a single wallet.

At the time, Whale Alert listed the wallet’s owner as “unknown.” However, DMM later confirmed on its website that it lost exactly 4,502 BTC in an attack, implying that itwas likely the cause of that particular transaction.

The exchange said it has “already taken measures to prevent the unauthorized leak.” It will “procure the equivalent amount of BTC” to make sure that all users are compensated. These funds will be acquired “with support from our group companies.”

The team encouraged users to keep an eye out for notices, as a new alert will be posted once all services resume.

DMM exchange is owned by the e-commerce conglomerate DMM Group. It launched in January 2018. The company also owns a crypto mining firm.

Hacks and scams continue to pose a problem for crypto exchange users. In November, the Poloniex exchange lost more than $100 million when an attacker gained control of its private key. A similar attack against GDAC in April 2023 resulted in $14 million in losses.

Magazine: Crypto exposes sudden rift among Democrats months ahead of election

Responses