How billions in outflows from Grayscale could impact Ethereum ETF launch

Outflows from the Grayscale Ethereum Trust (ETHE) could dampen the Spot Ethereum ETF approval party but create significant opportunities for traders.

In a surprise for markets, the U.S. Securities and Exchange Commission (SEC) approved eight spot Ethereum ETFs on May 23, leading to a wave of positive sentiment.

But perhaps even more surprisingly, the Ether (ETH) price barely reacted to the news.

Before the SEC announcement on May 23, the price of Ether was $3,742.31. It rose to $3,959.28 on May 27 before falling to $3859.39 on May 28. A consistent bull run has yet to emerge.

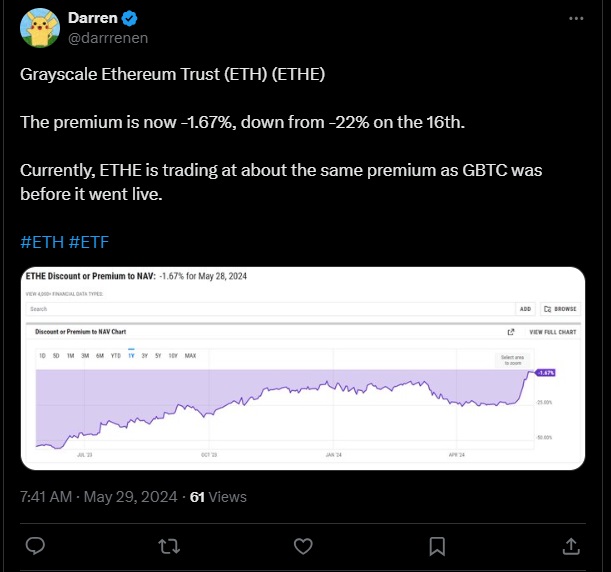

In the days leading up to the approval, Ether’s value had risen by nearly one-third. However, after indications surfaced that the SEC might reverse its decision, concerns about Grayscale’s Ethereum Trust (ETHE), which manages $11 billion in funds, became a significant factor influencing the price action.

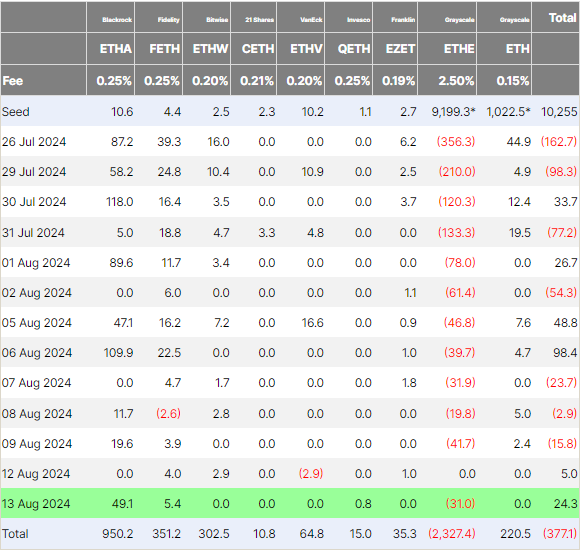

After observing months of significant outflows from the Grayscale Bitcoin Trust (GBTC), which offset the effects of substantial inflows, markets are now concerned about the possibility of a recurrence.

In the month following approval of spot Bitcoin ETFs, GBTC saw $6.5 billion in outflows, amounting to 23% of its assets under management (AUM).

A May 27 report by Kaiko Research estimated that if history repeats itself, average daily outflows from ETHE would amount to $110 million.

Industry expectations

Toni Mateos, co-founder of LAOS Network, a layer-1 platform that enables asset creation on Ethereum Virtual Machine compatible chains, also predicts major outflows from ETHE.

“Significant outflows from Grayscale Ethereum Trust to the new ETF are expected due to the ETF’s higher liquidity, narrower spreads, and lower fees,” Mateos told Cointelegraph. “The ETF targets a broader market than ETHE because of lower entry barriers and fees.”

Though Mateos sees similarities between GBTC and ETHE, he also notes a key difference in the importance of these Grayscale products to their relative markets.

When the spot Bitcoin ETFs were approved GBTC had nearly $30 billion of Bitcoin (BTC), representing 3.5% of the BTC market cap. But ETHE only has $11 billion of Ether, representing 2.2% of the market cap.

“Given ETHE’s smaller market cap percentage, the ETF’s impact should be proportionally larger than BTC’s, as outflows from ETHE to the new ETFs should be more limited,” Mateos said.

But according to Mateos, even if there are short-term outflows, the long-term picture should be positive.

“In the long term, if the ETH ETF adoption leads to a continuous influx of funds, the resulting demand increase should drive prices higher,” he said, adding the Ethereum network was more appealing to Environmental, Social and Governance (ESG) focused investors as it only puts out a tiny fraction of Bitcoin’s carbon emissions.

“Since Ethereum operates on a proof-of-stake model (unlike Bitcoin’s proof-of-work), climate-conscious investors might prefer the ETH ETF over the BTC ETF to gain crypto market exposure, so it could even impact the BTC ETF.”

Kurt Hemecker, CEO of the Mina Foundation, the public benefit corporation serving ZK blockchain Mina Protocol, also stressed the importance of Ethereum’s environmental appeal in its positive long-term outlook.

“For mainstream and institutional investors, the added ESG benefits of a spot ETH ETF would make it an attractive addition to an investment portfolio,” said Hemecker.

Mitigating outflows

A number of factors may mitigate outflows from ETHE. While the example of GBTC may be instructive to a point, Bitcoin and Ethereum are very different assets, making a one-to-one comparison of the two foolhardy.

James Toledano, chief operating officer at Savl, a self-custodial crypto wallet, did not discount the pressures of ETHE outflows, but he also pointed to a number of mitigating factors that could stabilize the market.

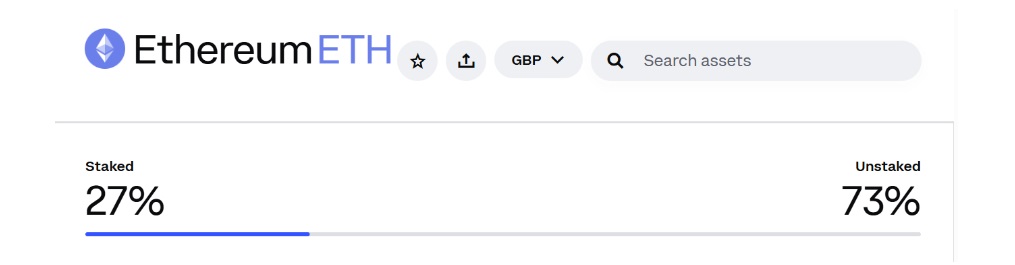

“A low supply of Ethereum on exchanges could mean that there might not be sufficient sell-side liquidity to meet all selling demands from ETHE outflows without significantly impacting the price.”

According to Toledano, this limited supply of available tokens “could provide natural price support, as any significant sell-off would be met with limited available supply, potentially stabilizing prices.”

Manthan Dave, co-founder of digital asset custodian Palisade, backs Teledano on this point. Like Toledano, Dave believes the historic low supply of Ethereum on exchanges could stabilize the price or even see it increase despite outflows.

“This scenario often reflects a long-term investment sentiment as investors move ETH to private wallets or staking, indicating a bullish market outlook,” said Dave.

Other things to consider

The amount of Ethereum on exchanges is just one additional factor among many for consideration,

As Dave puts it: “Ethereum’s market behavior is complex and influenced by various factors beyond exchange supply levels. Therefore, while a reduced exchange supply can mitigate some effects of ETHE outflows, it’s not the sole factor affecting Ethereum’s market dynamics.”

For instance, Toledano said: “Ethereum’s transaction fee-burning mechanism reduces the circulating supply over time, offsetting some of the selling pressure from ETHE outflows. With Ethereum 2.0, a significant amount of ETH is staked and unavailable for sale, further reducing the available supply and mitigating potential price impacts.”

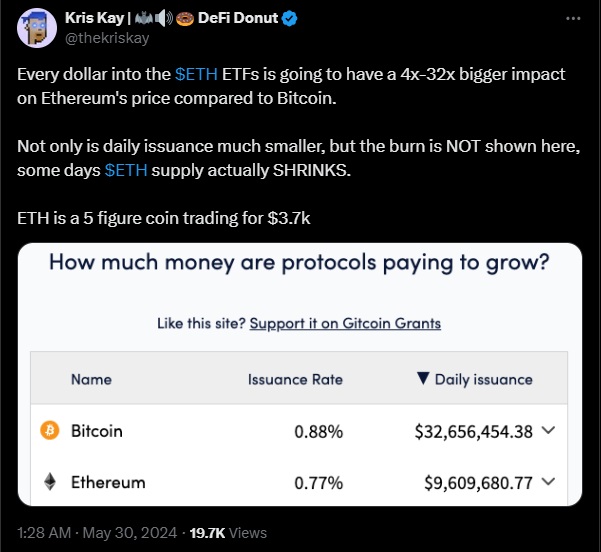

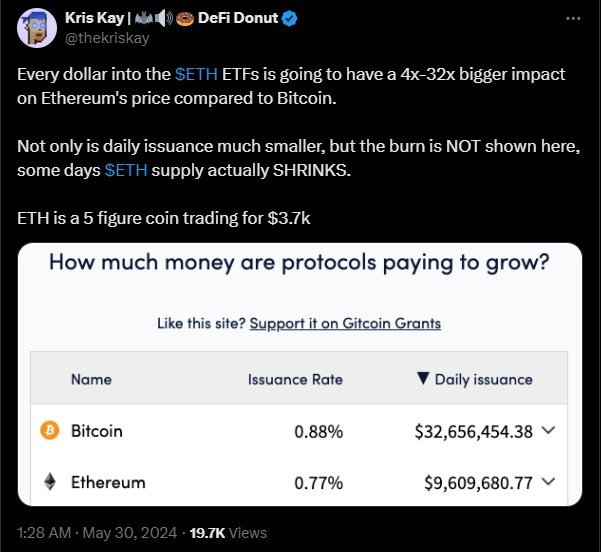

On X, Kris Kay from the DeFi Donut YouTube channel, pointed to the slow issuance rate of ETH, which often turns deflationary, concluding that every dollar flowing into ETH ETFs would result in price appreciation multiple times that of BTC ETFs.

Dave also pointed to other markets outside the U.S., a reminder of crypto’s global status.

“Adding to this momentum, the London Stock Exchange is set to list ETPs for the first time later this month, following the FCA’s approval of prospectuses from WisdomTree (WT) and 21Shares.”

A positive mood

Wherever industry figures come down on the inflow-to-outflow argument, the approval of a spot Ethereum ETF has led to an outbreak of positivity in the market.

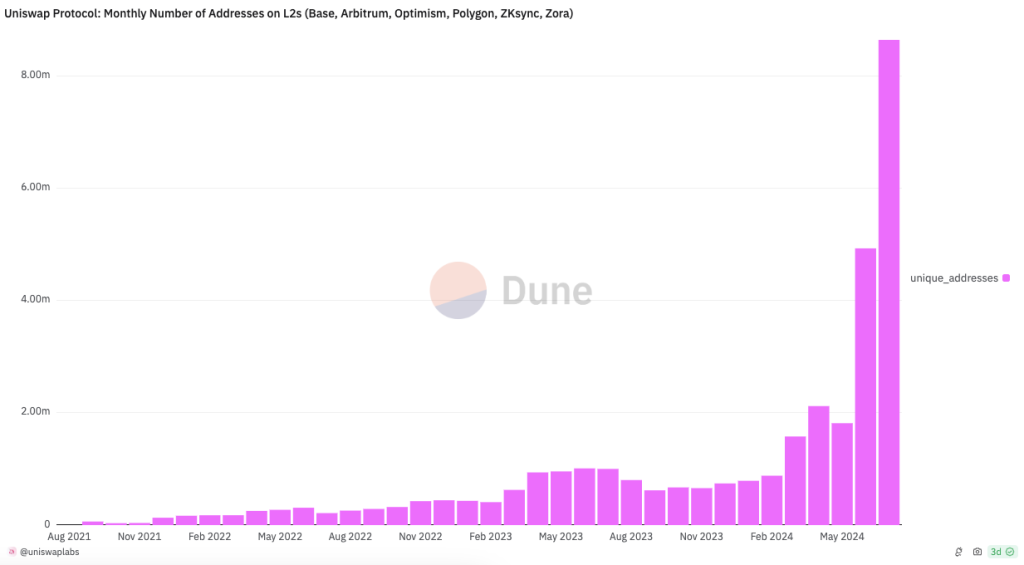

Jess Houlgrave, CEO of the cross-chain wallet app WalletConnect, told Cointelegraph that: “Ultimately, the approval of the ETF is a real confidence boost to the industry,” and that it opens up Ethereum “to a significantly wider range of potential buyers. That combined with positive headwinds in Ethereum overall[…] I think spells positive signs.”

And while most figures were content to simply predict upward price pressure and leave it at that, Oleg Fomenko, co-founder of Web3 fitness app Sweat Economy, gave Cointelegraph his ETH price prediction for the near future.

“The influx of more institutional money that will come through the approved ETFs is going to pump the price. I predict that as a result of this development, ETH’s price could potentially increase up to $7,000 in the next three months,” said Fomenko.

Responses