3 solid Bitcoin indicators predicting BTC price rise to $75K in June

A breakout from Bitcoin’s symmetrical triangle pattern is imminent as long-term holders continue to accumulate.

Bitcoin (BTC) has surged by over 60% year-to-date as of May 2024, helped by capital inflows toward its newly-introduced exchange-traded funds (ETF) in the U.S. and expectations of interest rate cuts by the Federal Reserve.

According to a mix of on-chain, fundamental, and technical indicators, the benchmark cryptocurrency may witness further gains in June, potentially reaching $75,000 by the end of the month. Let’s discuss these indicators in detail.

Bitcoin is nearing symmetrical triangle breakout

From the technical perspective, Bitcoin’s ability to reach $75,000 comes from its prevailing symmetrical triangle pattern, characterized by the price consolidating between two converging trendlines connecting a series of sequential peaks and troughs.

Typically, a symmetrical triangle’s formation during an uptrend signals bullish continuation, resolving when the price breaks above the upper trendline and rises by as much as the maximum distance between the upper and the lower trendline.

As of May 31, BTC’s price was nearing the triangle’s apex, where its two trendlines converge. The cryptocurrency now eyes a break above the upper trendline, which, per the technical rule mentioned above, could propel its price toward $74,000-75,000 in June, depending on the breakout point.

This breakout point could be around $69,000, a level coinciding with Bitcoin’s ongoing ascending trendline support (the magenta line).

Bitcoin ETF buyers return

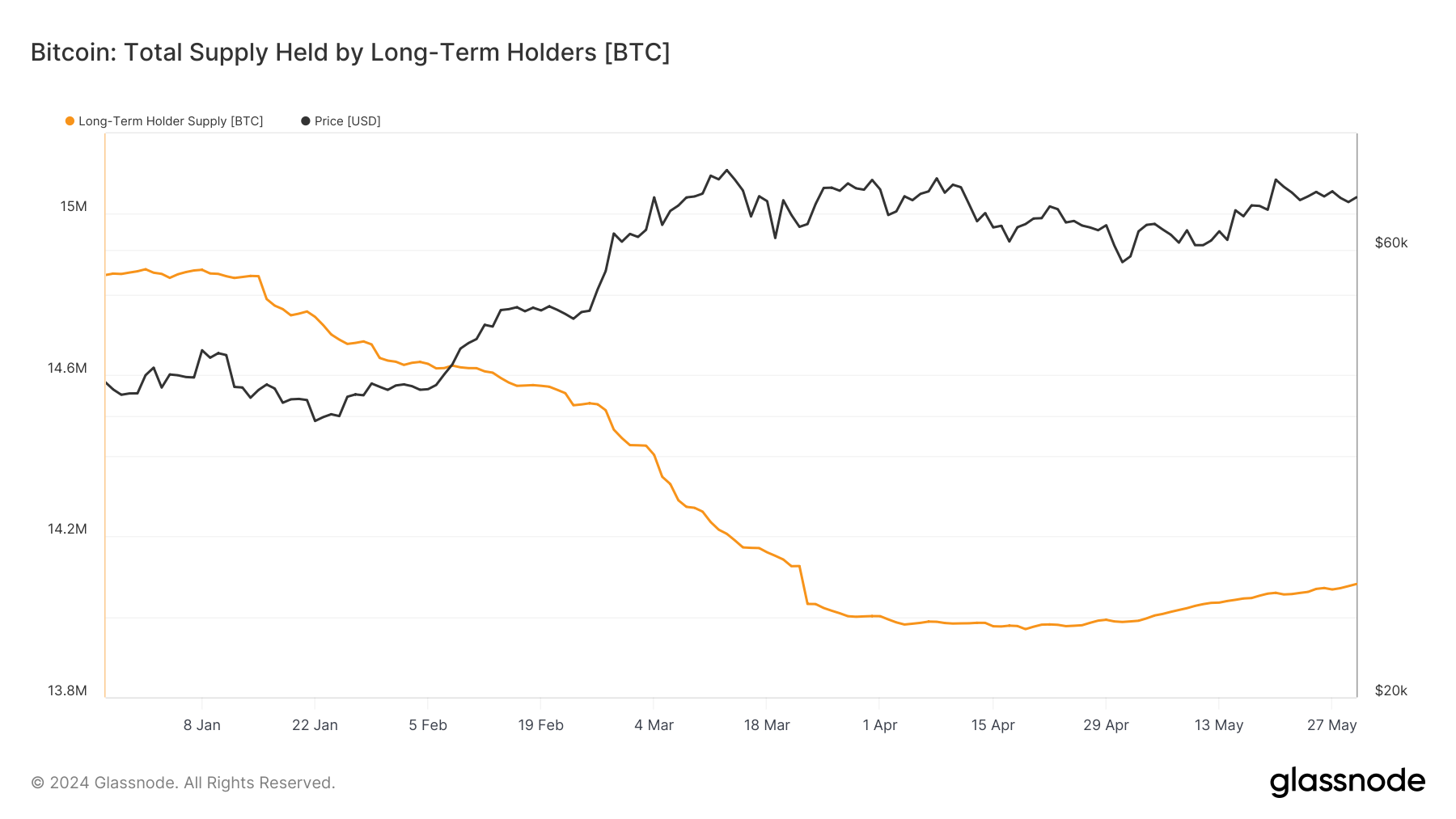

Bitcoin reached a new all-time high of around $73,000 in early March. This surge coincided with long-term holders selling a significant volume of their holdings, creating a supply overhang that led to a correction and consolidation period.

As prices dropped and sellers became exhausted, the market gradually transitioned into a re-accumulation phase.

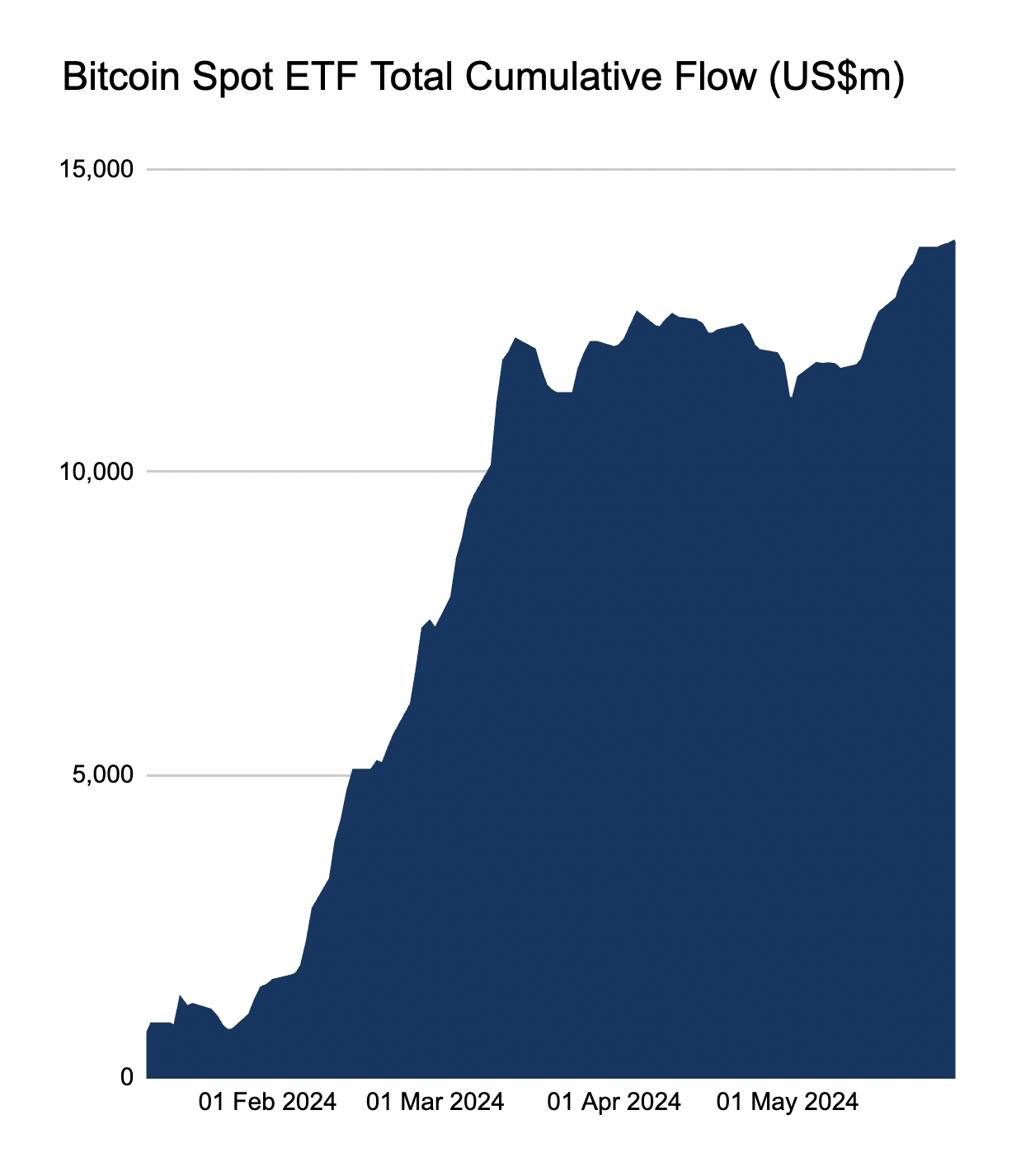

This shift is evident in the Bitcoin ETF flows, which saw a regime of net outflows throughout April. During the market sell-off to a local low of around $57,500, ETFs experienced substantial net outflows, averaging -$148 million daily.

This period of outflows marked a form of micro-capitulation, but the trend has since reversed sharply.

Last week, Bitcoin ETFs reported a remarkable net inflow of $242 million per day, indicating a resurgence in buy-side demand. Given the natural daily sell pressure from miners of $32 million per day since the recent Bitcoin halving, this ETF buy pressure is almost eight times greater.

This underscores the significant upside impact of ETFs on the market and the relatively diminished influence of the halving moving forward. As a result, Bitcoin’s price is well-positioned to continue its rally into June.

Ethereum ETF approval possibilities in June

United States spot Ether (ETH) exchange-traded funds (ETFs) have a “legit possibility” of launching by late June, according to analysts, following a key filing update by BlackRock.

On May 29, BlackRock updated its Form S-1 for its iShares Ethereum Trust (ETHA) with the Securities and Exchange Commission, nearly a week after the regulator approved its 19b-4 filing. Both approvals are required for the ETF to commence trading.

“This is a good sign. We’ll probably see the rest roll in soon,” Bloomberg ETF analyst Eric Balchunas noted in a May 29 post on X.

The successful launch of Ethereum ETFs could set a positive precedent for Bitcoin ETFs, potentially boosting investor confidence and increasing demand in the cryptocurrency market. This further enables Bitcoin to achieve its symmetrical triangle breakout target of $75,000 in June.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Responses