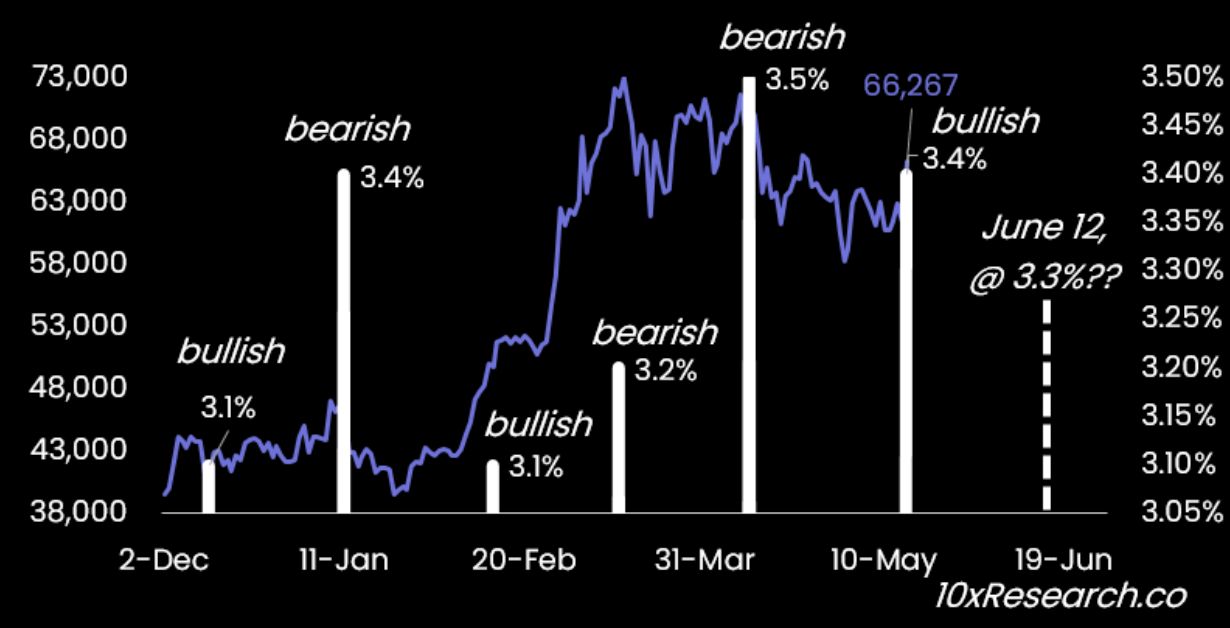

Bitcoin needs ‘3.3% or lower’ CPI print to reach new ATH

Bitcoin price movements may “appear random,” but critical drivers such as inflation are what’s making it move, according to a crypto analyst.

Bitcoin (BTC) will need to see a slowdown in United States inflation when results are released next month before it can consider surpassing its all-time highs reached in March, according to a crypto analyst.

“If inflation prints 3.3% or lower, Bitcoin should make a new all-time high,” 10x Research head researcher Markus Thielen stated in a May 29 report ahead of the United States Bureau of Labor Statistics (BLS) releasing the Consumer Price Index (CPI) results on June 12.

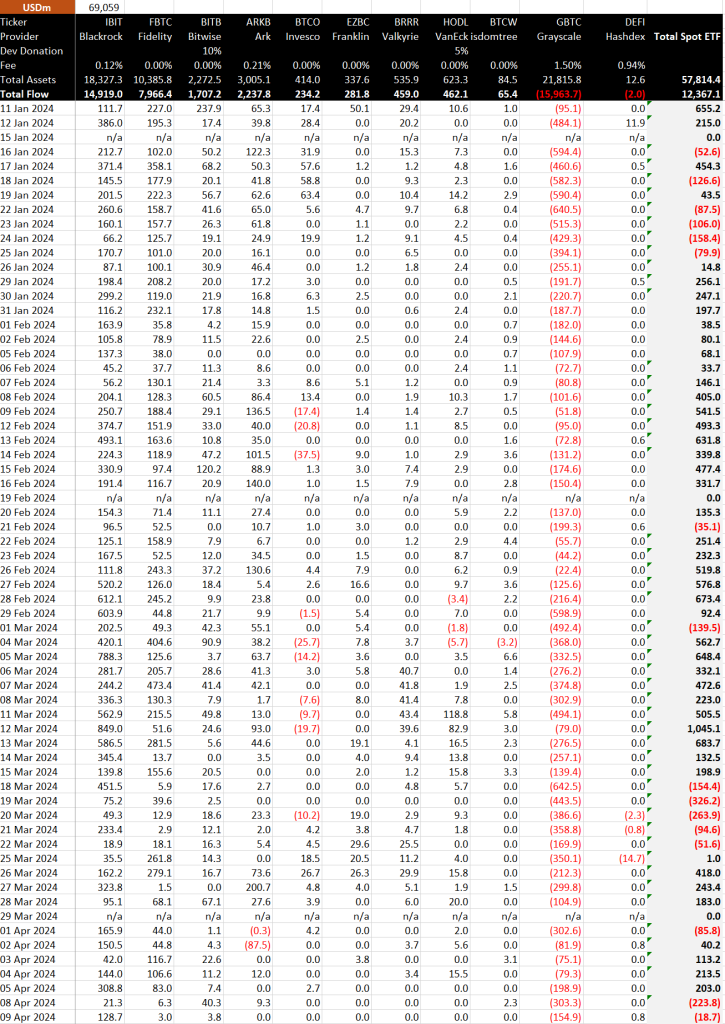

This represents a 0.1 percentage point decrease from the previous CPI result, which came in at 3.4% on May 15. Thielen believes that in these two weeks before the May CPI results are released, spot Bitcoin exchange-traded funds (ETF) inflows will “remain strong” in anticipation.

But, if CPI results turns out to be higher than exp, momentum could weaken, as seen earlier this year.

Over the past two weeks, since May 13, spot Bitcoin ETF inflows tracked by Farside data have been positive day-on-day, with the highest day of total inflows on May 21 at $305.7 million.

Thielen argued that there are no “random” moves in Bitcoin’s price; it all comes down to critical drivers, with its main driver being inflation.

There have been several instances throughout this year when Bitcoin’s price declined following higher-than-expected CPI results.

On April 10, the CPI was printed at 3.5%, just 0.1% higher than expected. Just a few weeks later on April 30, Bitcoin’s price dropped 6.67% to $56,000.

Related: Bitcoin in 42-day ‘boredom zone’ — traders debate next move

Thielen noted that when spot Bitcoin ETFs launched on Jan. 11, despite $611 million in inflows on the first day, the rest of January’s inflows were disappointing.

He claimed that the main reason for this was that CPI results printed “higher” than expected.

“The CPI came in at 3.4%, higher than the 3.2% expected number and higher than the 3.1% recorded in the previous month,” Thielen wrote.

“It is no coincidence that Bitcoin was weak in January and stronger into March but consolidated for two months,” he added.

Responses