Mastercard's crypto credentials P2P pilot program goes live

The credit card company hopes to streamline transactions and limit user error through an alias credentialing system.

Mastercard has launched its crypto credentials P2P pilot program in hopes of streamlining crypto transactions and eliminating user error for customers.

The test includes Mastercard’s exchange partners Bit2Me, Lirium, Mercado, and wallet provider FoxBit. Mastercard’s executive vice president for product and engineering for Latin America, Walter Pimenta, remarked:

“As interest in blockchain and digital assets continues to surge in Latin America and around the world, it is essential to keep delivering trusted and verifiable interactions across public blockchain networks.”

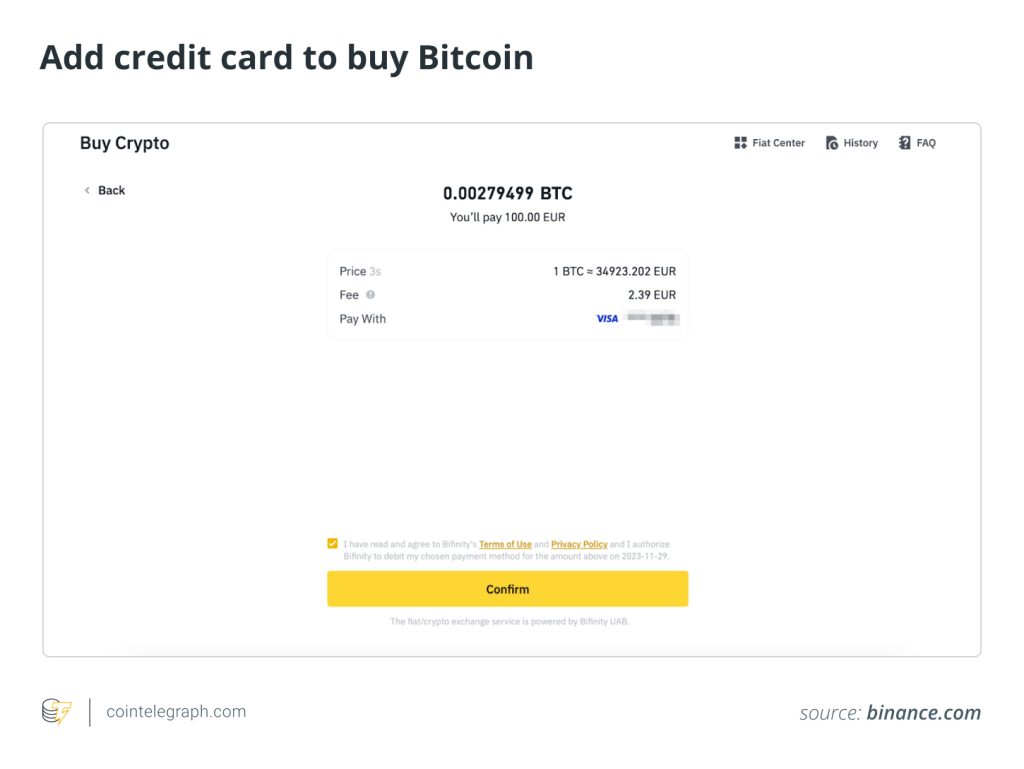

The credit giant’s crypto credentials system assigns human-readable ‘aliases’ to individuals, which are verified by Mastercard so that users no longer have to rely on sending and verifying the long string of numbers and letters characterizing traditional wallet addresses.

Additionally, the crypto credentials program is attempting to mitigate financial loss by pre-screening transactions to prevent users from sending incompatible crypto assets to the recipient’s address.

Related: Breaking barriers: A platform aims to overcome self-custody wallet challenges

The UX, UI problem

Cryptocurrencies and other digital assets have long suffered from complex user interfaces that present technical challenges and can be somewhat daunting for the new or untrained user.

Complex addresses, technical jargon, and the prospect of permanent financial loss due to sending assets to the wrong chain are enough to keep users accustomed to Venmo, PayPal, and online banking apps far away from the crypto space.

Crypto analyst and influencer Miles Deutscher outlined the problem back in 2022 and claimed it was preventing mass adoption.

Concerns surrounding centralization

Despite Mastercard’s initiative to streamline the crypto transaction process, concerns regarding centralization persist.

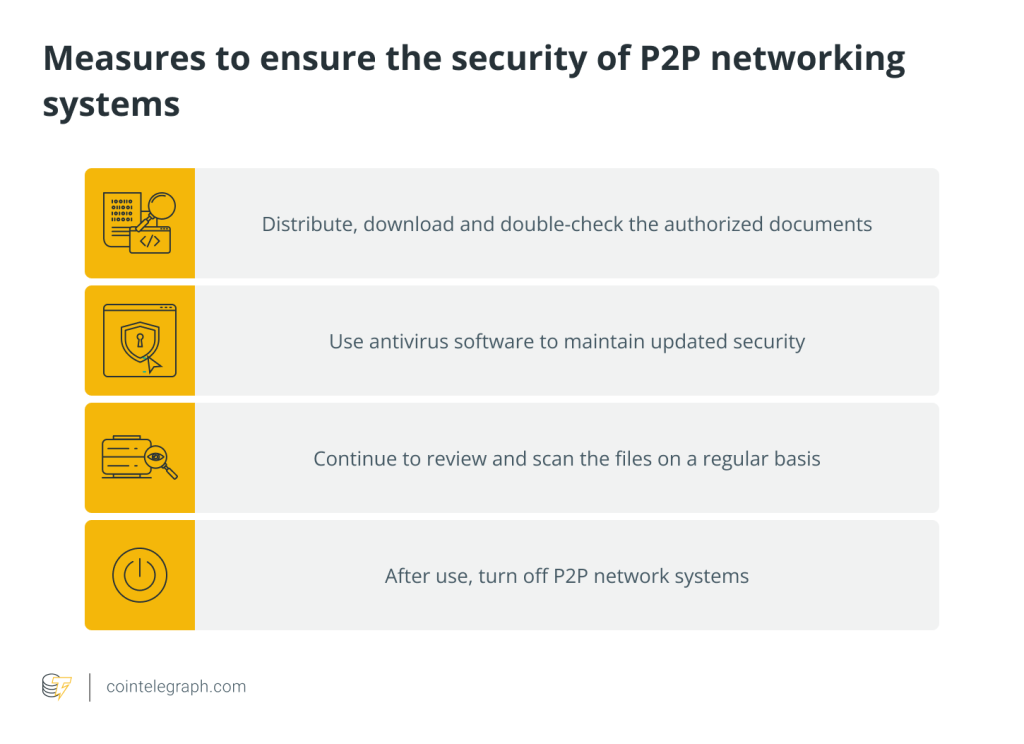

The credit company’s crypto credentials program is not a decentralized initiative and relies on Mastercard as an intermediary to verify a user’s identity and screen the transaction for any issues that may cause funds to be lost.

Additional Know Your Customer verification and storage of sensitive data with Mastercard also present concerns for security-minded individuals.

Mastercard has been the subject of several high-profile data breaches that occurred through malicious attacks on its payment processing partners and retail clients.

Since 2005, well over 40 million Mastercard accounts have been exposed to hackers and malicious actors targeting centralized points of failure in Mastercard’s broad network of payment processors, retail clients, and information technology partners.

Responses