Uniswap ready to fight for DeFi against SEC, Bitcoin Runes hype fades: Finance Redefined

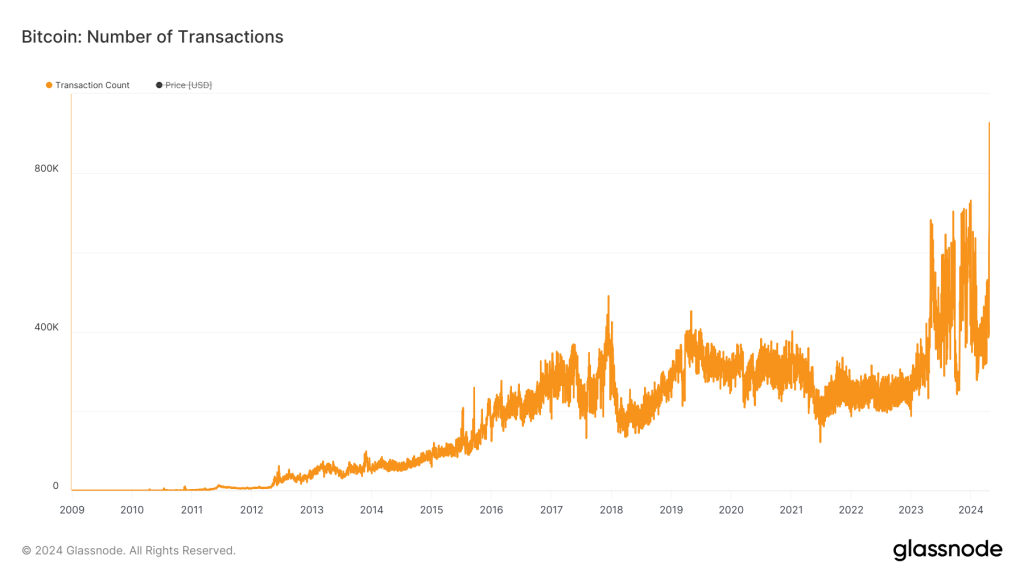

Transactions attributed to the Runes protocol accounted for over 50% of all Bitcoin transactions between April 20 and 24; however, by May 2, this figure had dropped to 11.1%.

The past week in decentralized finance (DeFi) was filled with anticipation for the approval of a United States-based spot Ether exchange-traded fund (ETF), as well as concerns about the regulatory landscape of DeFi. Popular decentralized exchange (DEX) Uniswap vowed to fight the U.S. Securities and Exchange Commission (SEC) in response to a Wells notice issued to the firm by the agency and claimed the SEC’s case is “weak.”

In other news, Bitcoin Runes, which peaked in popularity in April, has seen an 84% decline in transactions since then. Ethereum co-founder Vitalik Buterin called for using zero-knowledge (ZK) likes on the newly launched decentralized social media platform Farcaster to combat preference falsification.

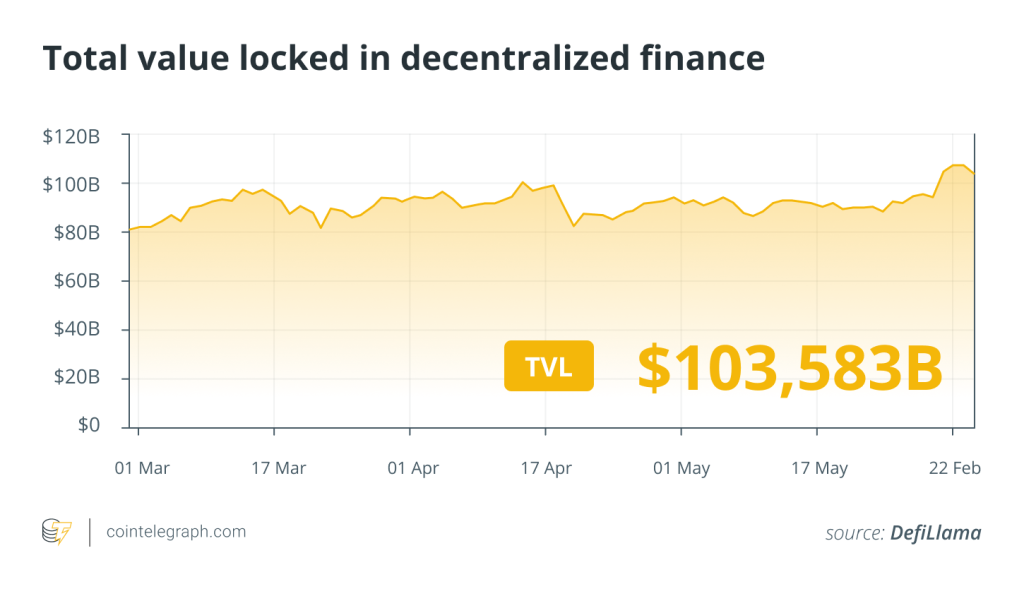

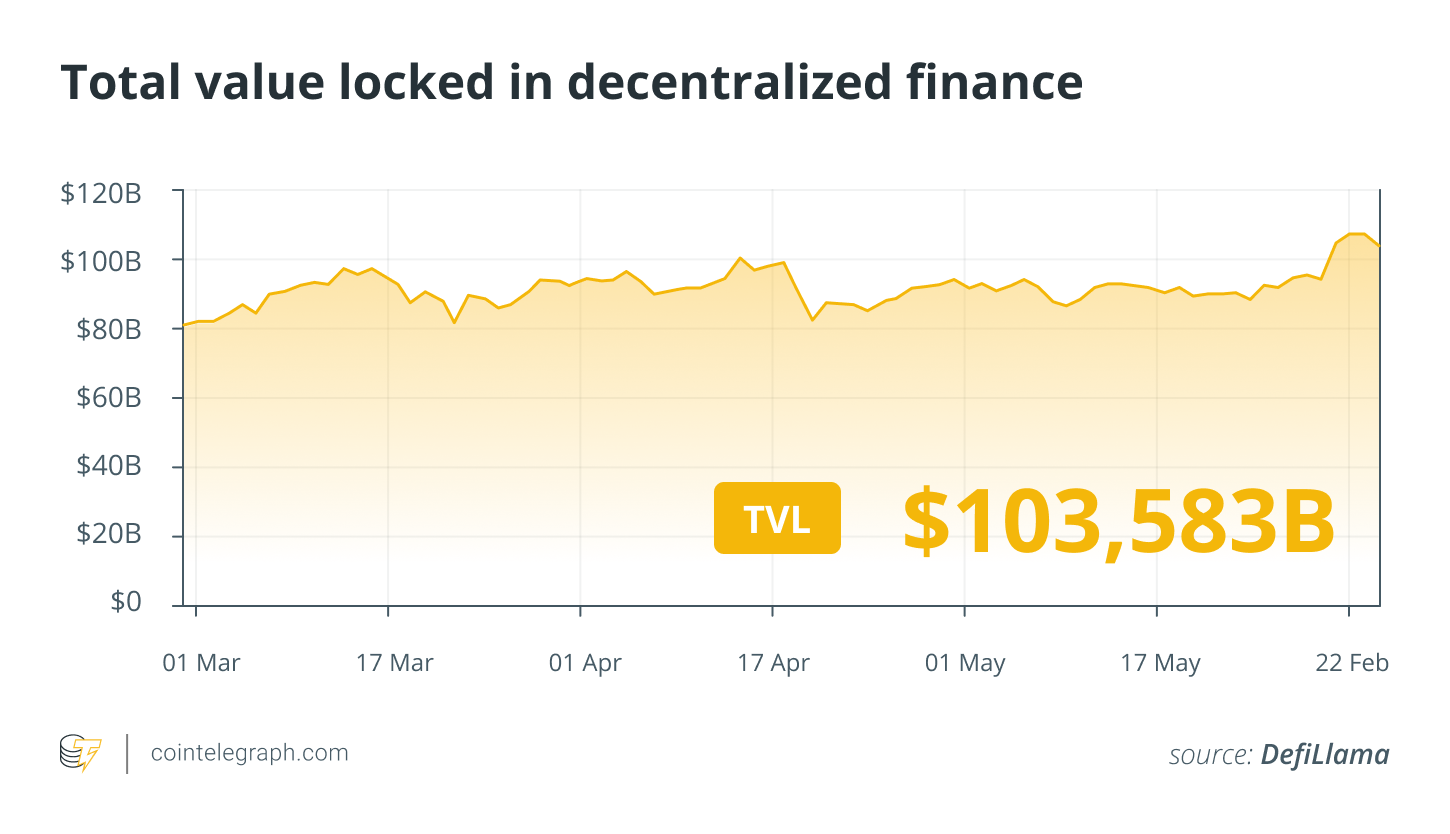

After a bullish week of marketwide price momentum, the total value locked in DeFi protocols jumped $10 billion and rose above $100 billion again.

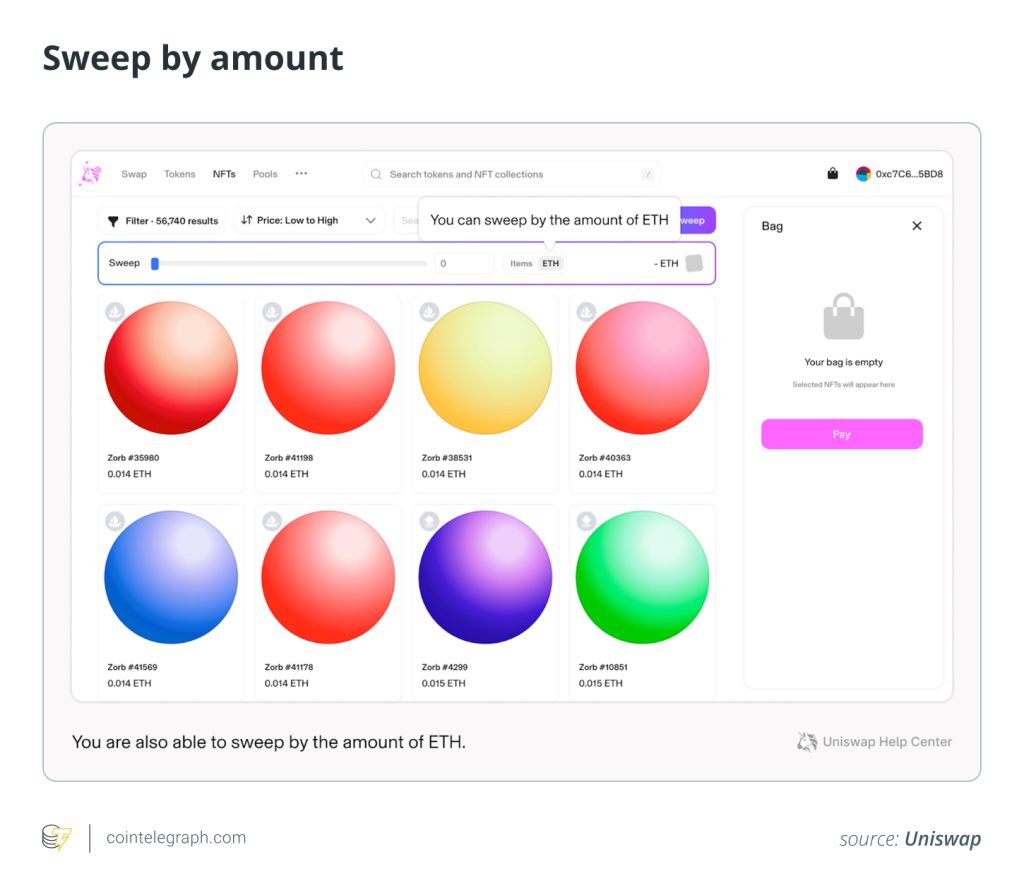

Uniswap responds to SEC Wells notice: “We are ready to fight” for DeFi

Uniswap Labs, the developer behind the Uniswap DEX, has responded to the SEC issuing a Wells notice to the firm, suggesting a potential enforcement action.

In a May 21 blog post, Uniswap claimed the SEC had made “weak” legal arguments in issuing a Wells notice to the exchange and vowed it was “ready to fight” the matter in court if necessary.

The company said its lawyers had successfully represented firms, including Grayscale and Ripple, against the financial regulator. Chief legal officer Marvin Ammori claimed that the SEC’s case was “weak and wrong” based on treating all tokens as securities under its purview.

Continue reading

Bitcoin Runes hype fades, transactions plummet 84%

The Bitcoin Runes protocol is struggling to maintain its share of Bitcoin (BTC) transactions. Since its launch on April 20, Runes transactions have dominated Bitcoin blockchain traffic on eight different days, mostly during the weekends.

The Bitcoin Runes launch coincided with the fourth Bitcoin halving. The resultant hype saw transaction volume shoot up on the Bitcoin blockchain. Revenue from Bitcoin mining exceeded the $100 million mark for the first time, recording an all-time high daily earnings of $107.7 million.

Continue reading

Vitalik Buterin advocates ZK “Likes” on Farcaster after X privacy shift

Ethereum co-founder Vitalik Buterin expressed his support for X engineer Haofei’s announcement on the decentralized social media platform Farcaster. Haofei revealed that X will be making “Likes” private.

On May 20, Buterin took the idea further, suggesting that Farcaster implement ZK likes to combat preference falsification — the misrepresentation of true preference due to social pressure or fear.

Continue reading

StarkWare ZKThreads solution could prevent fund lockups similar to FTX

StarkWare has announced the introduction of ZKThreads, a new scaling framework designed to prevent trapped funds and improve the scalability of decentralized applications.

Louis Guthmann, head of product/market strategy at StarkWare, reflected on the impact of ZKThreads, telling Cointelegraph that the “layer-scaling technology [StarkWare] have built could prevent a disaster like FTX.”

Continue reading

DeFi market overview

Data from Cointelegraph Markets Pro and TradingView shows that DeFi’s top 100 tokens by market capitalization had a bullish week. Most tokens traded in the green on the weekly charts. After weeks of bearish pressure, the total value locked in DeFi protocols crossed the $100 billion mark.

Thanks for reading our summary of this week’s most impactful DeFi developments. Join us next Friday for more stories, insights and education regarding this dynamically advancing space.

Responses