Ethereum ETF decision due in hours as BTC price gets $80K May target

Bitcoin and Ethereum markets face a crunch day with volatility predicted around the Ether ETF decision.

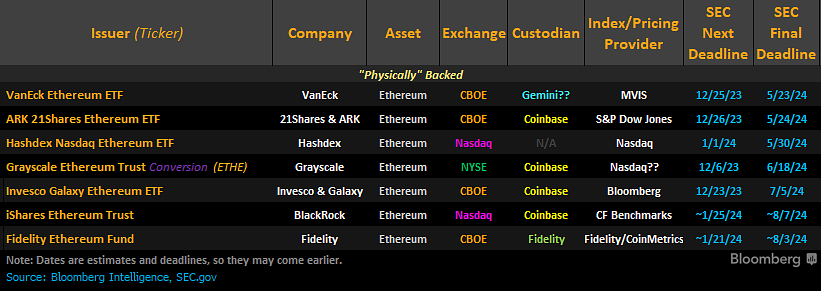

Bitcoin (BTC) lurked near old all-time highs on May 23 as the hours ticked down to a decision on spot Ethereum (ETH) exchange-traded funds (ETFs).

BTC price targets get Ethereum boost

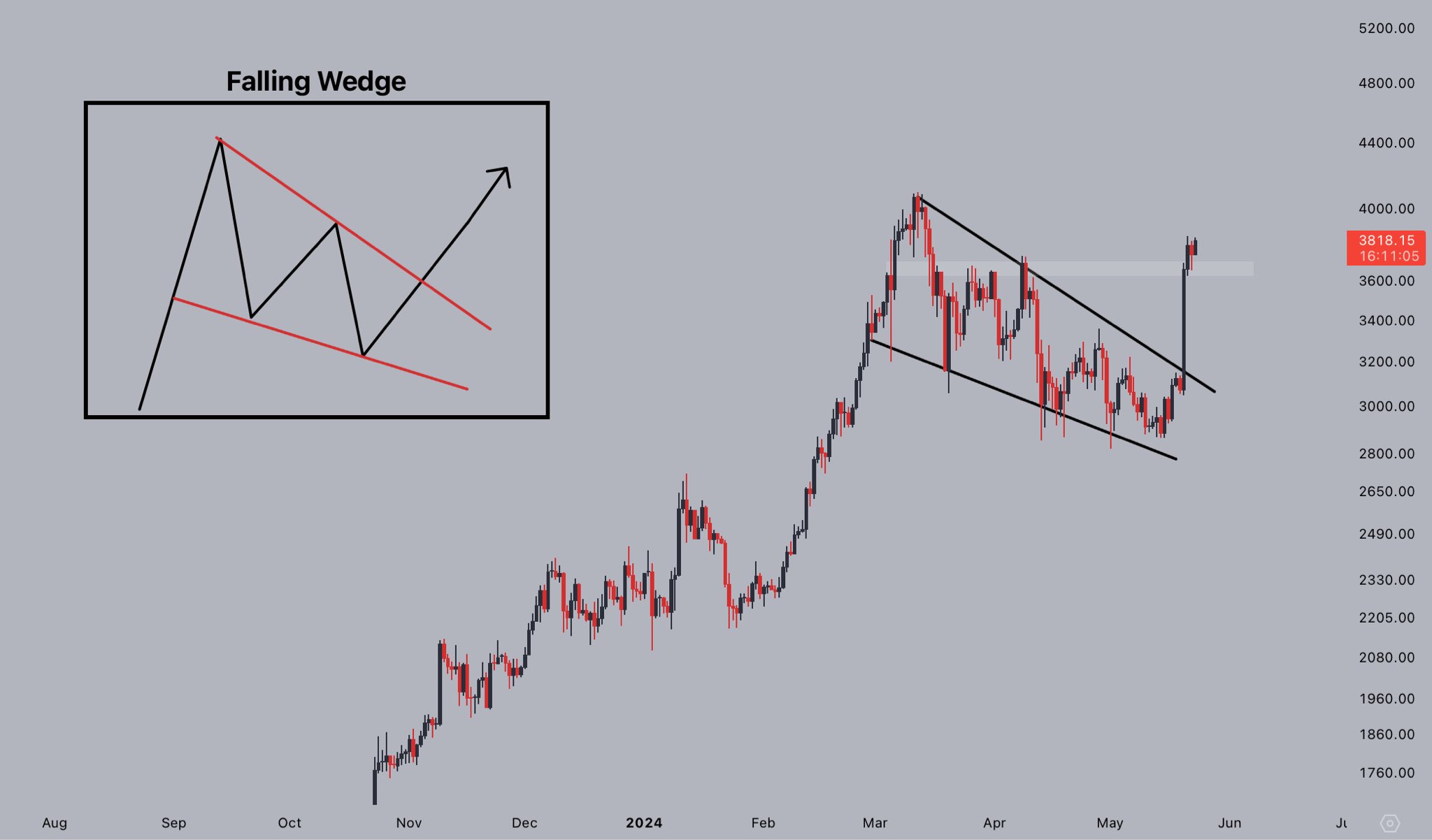

Data from Cointelegraph Markets Pro and TradingView showed BTC price action above $69,000 after two dips below the day prior.

A sense of anticipation pervaded markets as expectations saw United States regulators approving the Ethereum ETF products — a sharp turnaround from just weeks ago.

Those hopes accompanied fresh upside for both Bitcoin and altcoins, Cointelegraph reporting on potential targets, which include $80,000 for BTC/USD.

“Very clean price action on $BTC,” Michaël van de Poppe, founder and CEO of trading firm MNTrading, wrote in his latest analysis on X (formerly Twitter).

“Expecting a test at $67,500-68,000 before continuation. Everything is in anticipation of a potential Ethereum ETF to be approved.”

Continuing the topside theme, popular commentator BitQuant eyed $80,000 in May preceding a trip to a local top of $95,000 next month.

“Yes, $95K will extend to June, but the sharp decline from this local top will also occur in June, so the overall timeline for this local top hasn’t changed,” part of his latest X post read.

In a subsequent discussion, BitQuant, who notably predicted that Bitcoin would hit new all-time highs before last month’s block subsidy halving, gave Q3 this year as the deadline for a “global top.”

Traders see $6,000 ETH price on back of ETF greenlight

Considering where Ether price action might head in the event of an approval, trading firm QCP Capital put the upside potential at 60%.

Related: ETFs buy 3X new BTC supply — 5 Things to know in Bitcoin this week

“We think an approval is now highly likely with trading expected as early as next week,” it wrote in part of its latest update to Telegram channel subscribers.

The target of 60% higher than current spot price — approximately $6,000 — was based on Bitcoin’s performance in the months after its own U.S. spot ETF go-ahead in January.

Popular trader Jelle, meanwhile, was one of many assuming that the stars would align for Ether bulls on the day.

“ETF decision this afternoon, but the chart looks like it knows the outcome. Higher,” he wrote in part of an X post on the topic.

The ETF decision announcement is expected around 8.30 pm UTC.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Responses