‘Asia’s MicroStrategy’ Metaplanet smashes all other Japanese stocks

Trading in Metaplanet’s stock was halted for two straight days under Tokyo Stock Exchange rules as its shares rocketed over the last week.

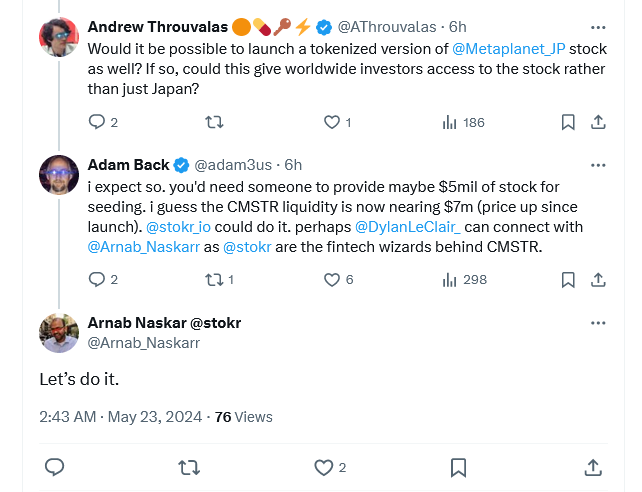

Metaplanet, a Japan-based investment firm borrowing from MicroStrategy’s Bitcoin (BTC) playbook, has seen its shares rocket 158% over the last week — becoming the highest gainer among all Japanese stocks.

Metaplanet’s share price is currently 93 Japanese yen, rising 127% in the last two days. The surge caused the Tokyo Stock Exchange to activate a circuit breaker trading halt at least twice in the last week.

It is now close to breaching a $1 billion market cap ($940 million or 14.8 billion Japanese yen at current prices).

According to TSE rules, listed stocks with a share price below 100 Japanese yen are subject to a maximum daily increase of 30 Japanese yen — which Metaplanet breached two straight days.

The firm’s Director of Bitcoin Strategy, Dylan LeClair, also highlighted the recent performance, remarking that Metaplanet has been the “best-performing stock in Japan” two days in a row.

Since announcing its Bitcoin investment strategy on April 8, the firm has accumulated 117.7 Bitcoin, currently worth $7.2 million. Its stock has risen 389%.

Similar to MicroStrategy — the largest corporate Bitcoin shareholder — Metaplanet said it’ll adopt an “entire range of capital market instruments to strategically bolster its bitcoin reserves” in a May 13 statement.

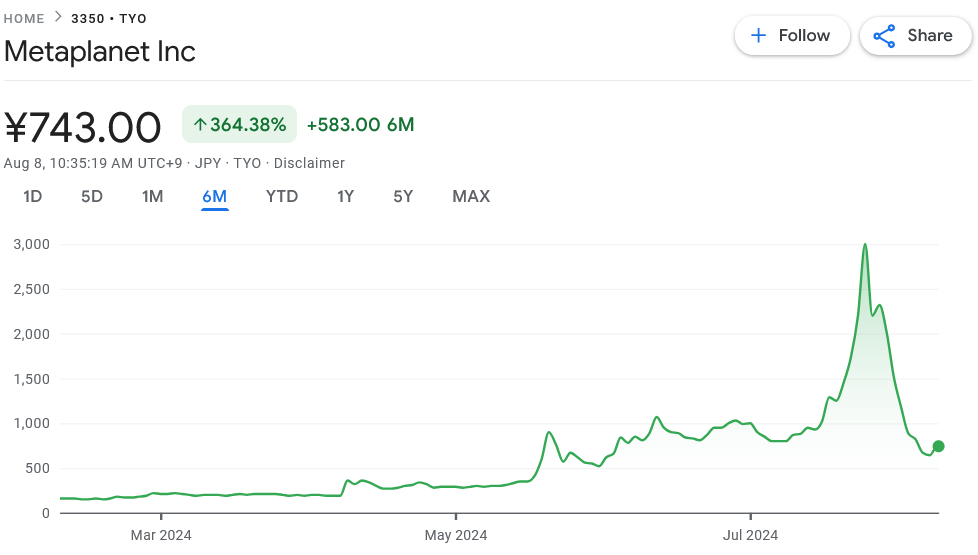

The firm said the move behind its Bitcoin investment strategy is to hedge against Japan’s worsening debt burden and the fastly-depreciating Japanese yen, stating:

“[It’s a] direct response to sustained economic pressures in Japan, notably high government debt levels, prolonged periods of negative real interest rates, and the consequently weak yen.”

Japan’s debt-to-GDP ratio of 261% is the worst among developed countries, Metaplanet added, while the Japanese yen has fallen more than 34% against the United States dollar since the start of 2021.

Meanwhile, Bitcoin is up nearly 190% against the Japanese yen over the last 12 months.

Related: Bitcoin’s recent price move is the ‘real deal market pump’ to $90K

Metaplanet is currently only available on the Tokyo Stock Exchange, walling out access to U.S. investors.

However, one of the founders behind security token platform STOKR, Arnab Naskar, recently expressed an intention to tokenize Metaplanet shares on Bitcoin layer-2 network Liquid in a similar way to how it tokenized MicroStrategy stock.

Responses