Ether security debate continues as SEC ETF decision deadline looms

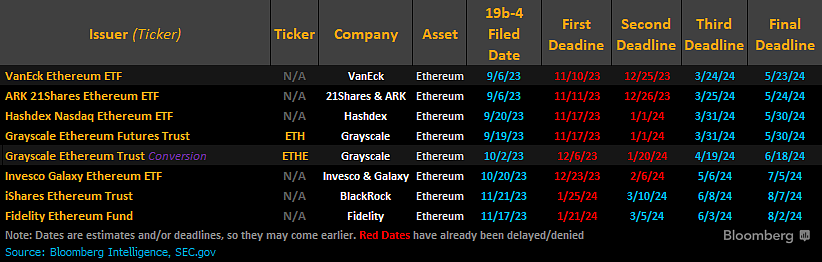

The SEC’s decision on VanEck’s spot Ether ETF application is due by May 23, and experts believe the recent debate over Ether’s status as a security could hamper its chances.

The debate around whether Ether is a security has taken center stage in the crypto ecosystem as the United States Securities and Exchange Commission’s (SEC) deadline for deciding on whether to approve a spot Ether exchange-traded fund (ETF) is just one day away.

The final deadline for the SEC to decide on VanEck’s spot Ether (ETH) ETF application is May 23.

Ether — the second-largest cryptocurrency after Bitcoin (BTC) — is nearing a crucial milestone, and much will depend on whether the SEC views Ether as a commodity or a security.

The SEC approved spot Bitcoin ETFs on Jan. 10, solidifying BTC’s status as a commodity in the eyes of regulators.

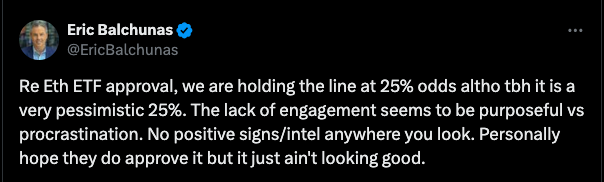

The fate of an Ether ETF is not so certain, with the SEC again questioning whether ETH is a security, leading many analysts to a more pessimistic outlook regarding the ETF’s approval chances.

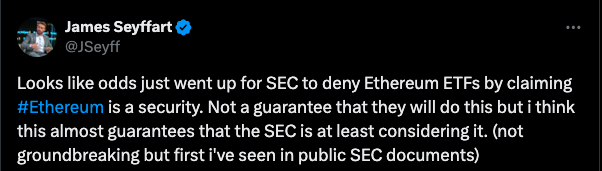

Bloomberg ETF analyst Eric Balchunas — who a few weeks ago gave the approval of a spot Ether ETF a 70% chance — said the current odds are at a “very pessimistic 25%.”

How did Ether’s security status come into the picture?

The biggest roadblock to spot Ether ETFs is an ongoing investigation by the head of the SEC’s Division of Enforcement, Gurbir Grewal, into Ether’s status as a security. According to the new filings in March, the SEC established a five-member commission approved by the Division of Enforcement’s “Ethereum 2.0” investigation on April 13, 2023.

Blockchain and Web3 software company Consensys sued the securities regulator in April, challenging its authority to regulate Ether as a security.

Recent: Freedom of speech isn’t a ‘trump card’ for Tornado Cash developers

Cointelegraph talked to Jamie Wright, a legal expert and the CEO of the Wright Law Firm, to understand the jurisdictions of U.S. regulatory bodies.

Asked which decision would prevail in the case of a conflict of interest between the SEC, which regulates securities, and the Commodity Futures Trading Commission (CFTC), which regulates commodities, Wright said that he believes the SEC may prevail because securities regulation is more comprehensive regarding investor protection, which is a high priority for the SEC:

“The CFTC focuses on commodities, traditionally subject to less direct oversight than securities. Without a dedicated cryptocurrency regulator, the SEC’s emphasis on investor protection and disclosure requirements might make their position more influential.”

SEC Chair Gary Gensler himself cast a vote on whether to approve spot BTC ETFs, leading many to believe his vote may have secured their approval.

However, internal documents suggest that Gensler thinks Ether is a security, and his vote might become a deciding factor against approving a spot Ether ETF.

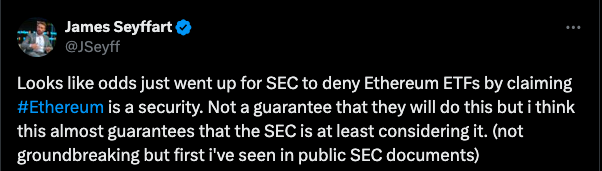

Finance lawyer Scott Johnsson said the SEC “is considering the security question for ETH in this upcoming spot ETF order.”

He said this is evident from the SEC’s inclusion of “notice of the grounds for disapproval” in its decision. According to Johnsson, this clause was never present in the Bitcoin ETF decision.

Johnsson further stated that the purpose of this query could be to “deny on the basis that these spot filings are improperly filed as commodity-based trust shares and do not qualify if they are holding a security.”

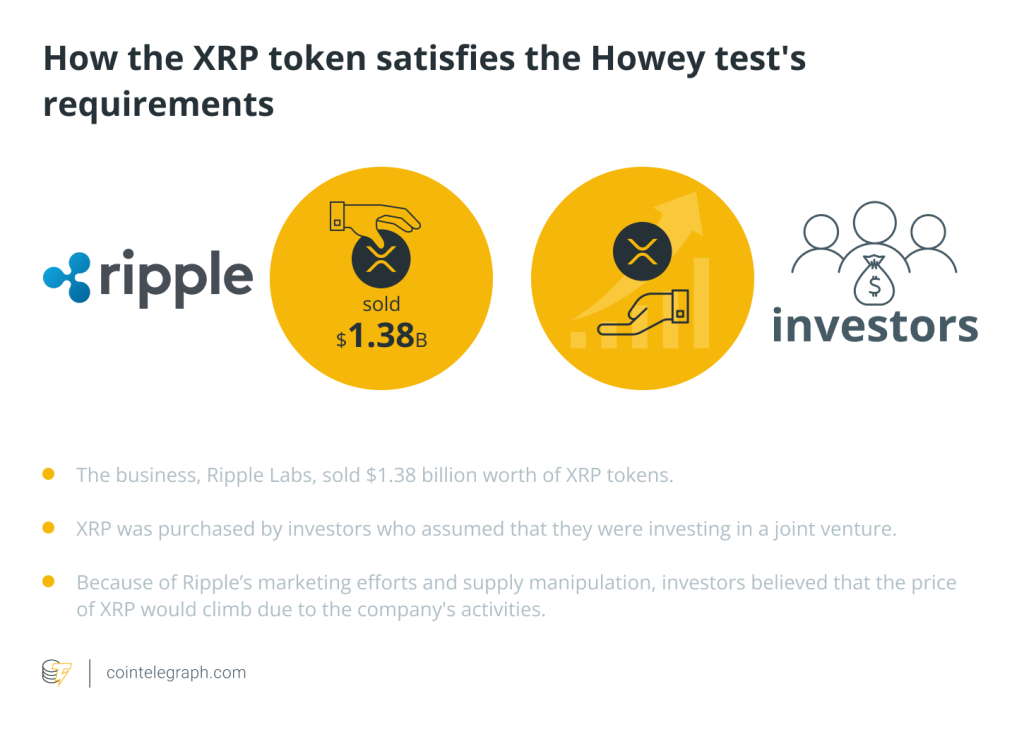

Adam Berker, senior legal counsel at global payments platform Mercuryo, told Cointelegraph that the SEC and Gensler have consistently emphasized their stance of treating all digital tokens apart from Bitcoin as securities:

“[The] SEC’s approach stems from two main factors. Firstly, Gensler adopts a global perspective, using the Howey test to equate cryptocurrencies with securities. Secondly, the SEC can see global investor interest in cryptocurrencies alongside traditional securities, prompting efforts to regulate this sector thoroughly under its control.”

He added that the SEC singled out Bitcoin because it lacks a central authority that oversees it, which complicates the regulator’s approach.

Staking could be a problem for the ETH ETF

A financial instrument is considered a security if there is an expectation of profit from a passive investment of money based on the work of others in a common financial enterprise.

Ether’s early stage pre-mining and its initial coin offering, along with the presence of a centralized organization — the Ethereum Foundation — make it closer to a security in the eyes of regulators.

The ability for ETH holders to earn staking rewards from the network is another reason the SEC believes it could be a security.

With Ethereum’s proof-of-stake (PoS) protocol, validators are chosen to create new blocks and validate transactions based on the number of coins they hold and are willing to “stake” as collateral. Rewards are distributed based on the amount staked.

PundiX CEO Peko Wan told Cointelegraph that while the move to PoS introduces elements that could align with the Howey test criteria for an investment contract, it does not mean that ETH will be classified as security:

“Ethereum still maintains significant utility beyond investment purposes, such as facilitating smart contracts and decentralized applications. This utility could support arguments against classifying ETH as a security.”

On May 22, perhaps in anticipation of the difficulties that staking could pose to SEC approval, five ETF applicants submitted amended filings removing language regarding staking.

The amendments added “very clear language that the Fund’s ETH cannot be staked by anyone,” according to Bloomberg ETF analyst James Seyffart.

Could the presidential elections affect ETF approval?

Many experts and market pundits believe that the upcoming U.S. presidential election could play a key role in deciding the fate of spot Ether ETFs.

Kadan Stadelmann, chief technology officer at Komodo, told Cointelegraph that cryptocurrency has become a growing issue this election season, especially in light of former president Donald Trump’s advocacy for crypto assets and recent votes in the U.S. House of Representatives and Senate to overturn the SECs Staff Accounting Bulletin No. 121 (SAB 121). He explained:

“Gensler and the Biden administration have maintained a hostile stance toward the crypto industry. Trump has publicly stated that he is fine with cryptocurrency. Since the president of the United States personally appoints the SEC chair, a Trump victory would likely lead to a more crypto-friendly SEC in 2025 and going forward.”

A change in government could potentially bring a new era for cryptocurrency and regulations amid growing institutional demand. However, these are just assumptions, and experts warn that Trump’s advocacy might not mean much after the elections.

Recent: Real-word asset tokens can stabilize DeFi — Market observers

Some in the crypto community celebrated Gensler taking charge of the SEC as a win for crypto, citing his background and understanding of the crypto space.

However, as SEC chair, he has taken what many in the crypto space have characterized as a hard line against the industry.

Wright said that a new administration might change policy priorities and regulatory approaches, potentially “influencing how the SEC and other regulators view Ether. He added that “shifts in key regulatory positions and the overall political climate could lead to a reevaluation of current stances, making the regulatory environment for cryptocurrencies more dynamic and subject to change.”

Responses