Ether ETF confirmed? VanEck spot Ether ETF listed by DTCC

VanEck’s ETF is currently designated inactive on the DTCC website, meaning it cannot be processed until it receives the necessary regulatory approvals

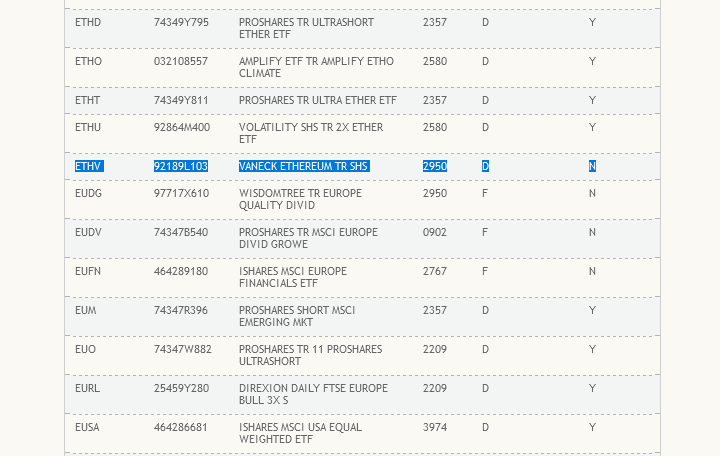

Amid increasing speculation about the possible approval of a spot Ether exchange-traded fund (ETF) on May 23, global investment manager VanEck’s spot ETH ETF has been listed by the Depository Trust and Clearing Corporation (DTCC) under the ticker symbol “ETHV.”

The DTCC is an American financial market infrastructure provider that offers clearing, settlement, and transaction reporting services to financial market players. A listing on DTCC is considered a crucial step before final approval from the Securities and Exchange Commission (SEC).

VanEck’s ETF is currently designated inactive on the DTCC website, meaning it cannot be processed until it receives the necessary regulatory approvals. However, VanEck is not the first Ether (ETH) ETF listed by the DTCC. Franklin Templeton’s spot ETH ETF was listed on the platform a month ago.

The DTCC said that the ETF list includes both active ETFs that may be processed by the DTCC and ETFs that are not yet active and, therefore, cannot be processed.

Another report suggests that SEC officials contacted the Nasdaq, the Chicago Board Options Exchange and the New York Stock Exchange to update and change existing spot Ether ETF applications.

Related: Crypto insiders anxious and divided as spot Ether ETF decision date looms

The significant change in the SEC’s stance over the past week is speculated to be linked to the White House.

Crypto lawyer Jake Chervinsky noted in a post on X that policy is driven by politics, and for months, crypto has been winning the political battle. He also speculated that former president Donald Trump’s endorsement of cryptocurrency compelled the Biden administration to shift its policy.

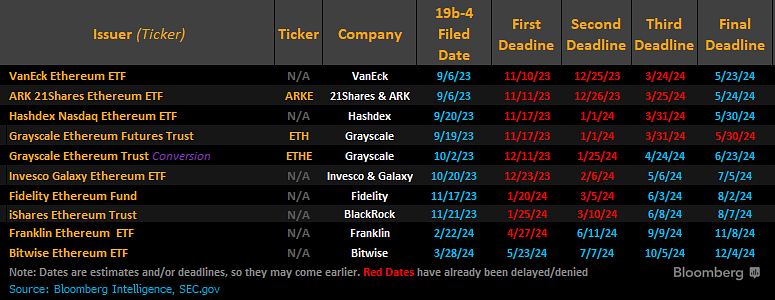

May 23 is the final deadline for the SEC’s decision on the VanEck spot Ether ETF. After months of speculation about a possible denial of the ETH ETF, the SEC took action earlier this week.

The SEC first asked financial managers to amend and refile their 19b-4 filings on their proposed spot Ether ETFs. This move was seen as a positive sign, swinging the potential chance of approval to 75% from the 25% predicted earlier.

Responses