Bitcoin ‘could’ consolidate for ‘4 or 5 months,’ but big cup and handle looks promising — Analyst

Analysts say Bitcoin price could range trade for up to 5 months, but longer-term technical and on-chain data continues to point to a 6-figure BTC price target.

According to Capriole Investments founder Charles Edwards, stock and crypto market seasonality, along with Bitcoin on-chain data, suggest that BTC price could consolidate for 4 to 5 months.

In a new report, Edwards said that Bitcoin continues to oscillate within the cycle range highs in the $58,000-65,000 region, with continuous weekly closes above the $58,000 “supportive of the long-term trend continuation.”

Likening BTC’s price action to gold, which formed a “massive cup and handle” pattern over the last 13 years, with the “cup” lasting four years, Edwards noted how Bitcoin appears to show the same chart pattern.

Edwards noted that given the similarities between Bitcoin and gold, there is a possibility that BTC could spend “up to 9 months in the range high forming a cup before a measured move up.”

Edwards said,

“The technical picture remains bullish, provided the price holds above $58K. The longer we spend in the range highs, the more likely this structure will merge into a classic ‘cup and handle’ pattern, which would typically see strong price appreciation following.”

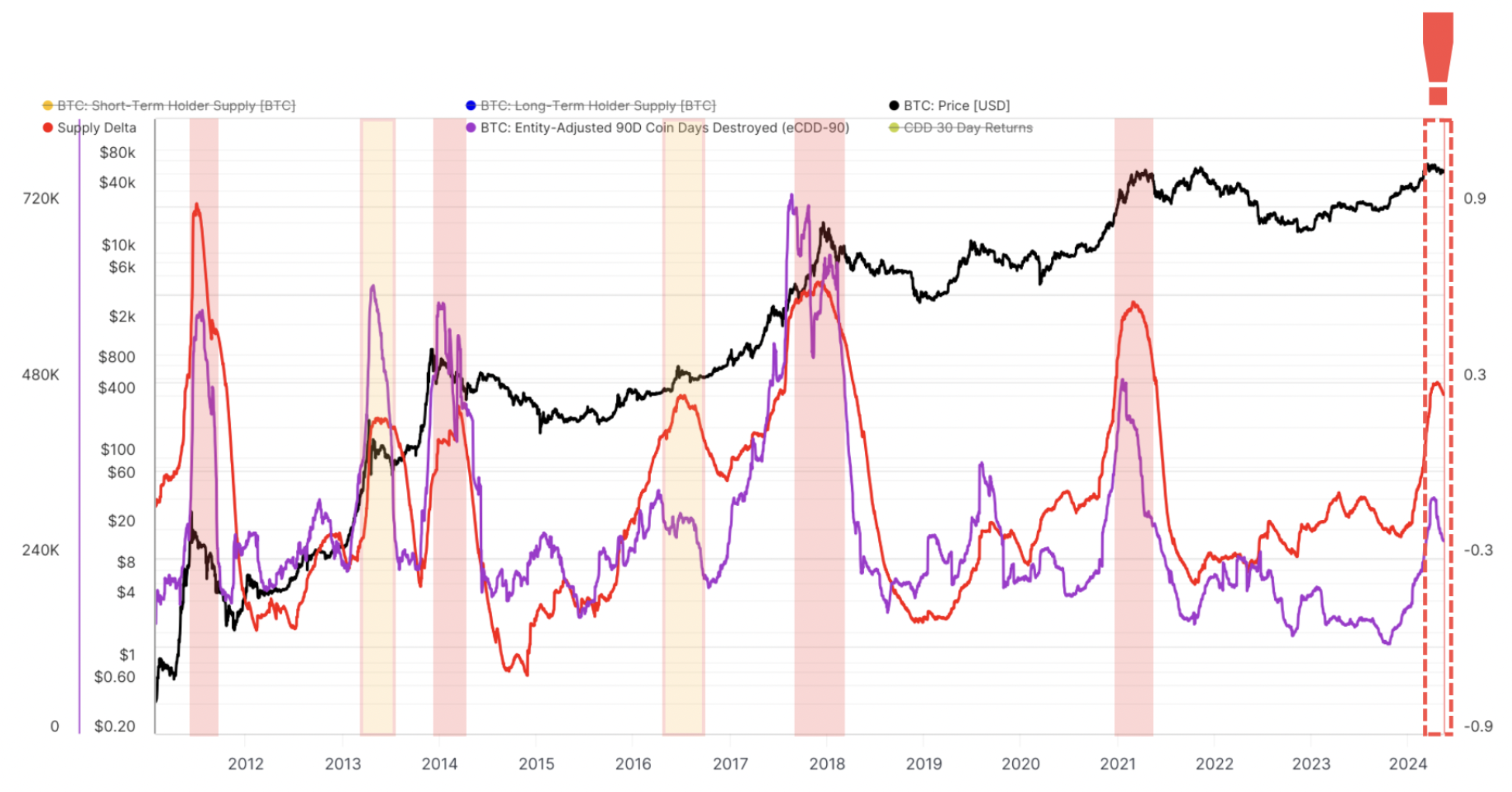

Despite the promise of the cup and handle pattern, Edwards observed that Bitcoin’s Supply Delta and 90-Day Coin Days Destroyed (CDD) metrics had formed rounded tops. Edwards explained that Capriole Investments uses each to identify cycle tops and that “we are at a comparable mid-cycle pit stop.”

“Regardless, this chart is telling us to expect at least a few months (possibly up to 6 months) of sideways chop and volatility before trend resumption. We are at the two-month mark today.”

Edwards also said he was closely observing the Capriole Bitcoin Macro Index, an indicator combining more than 50 of the most powerful Bitcoin on-chain and macro market metrics that reveals that BTC “continues to be risk off.”

Risk-off describes a market sentiment where investors reduce their risk exposure and focus on protecting their capital.

However, the report noted that “most of the other metrics still suggest this cycle has quite some room to run.”

Related: Bitcoin analysis sees $74K next as BTC price tries to hold 7.5% gains

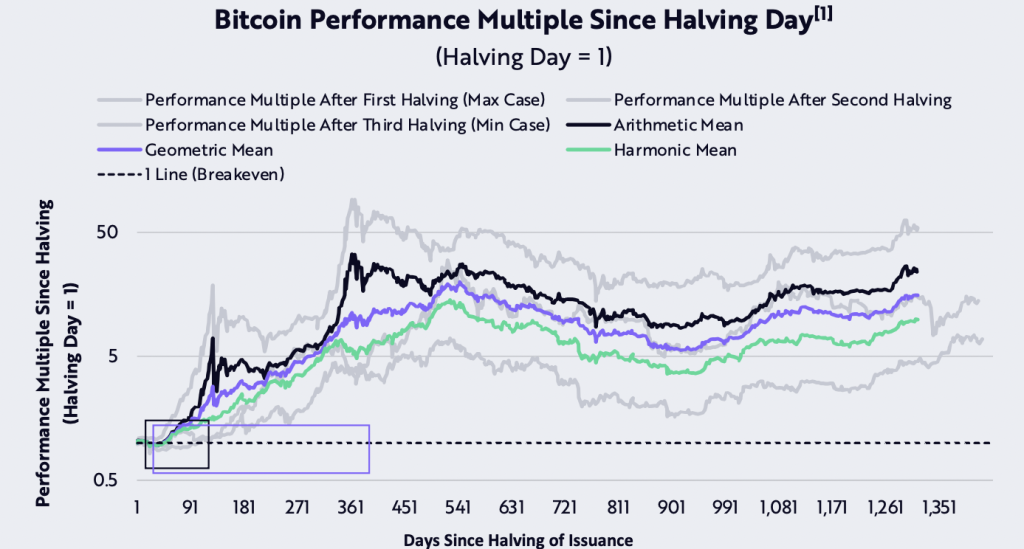

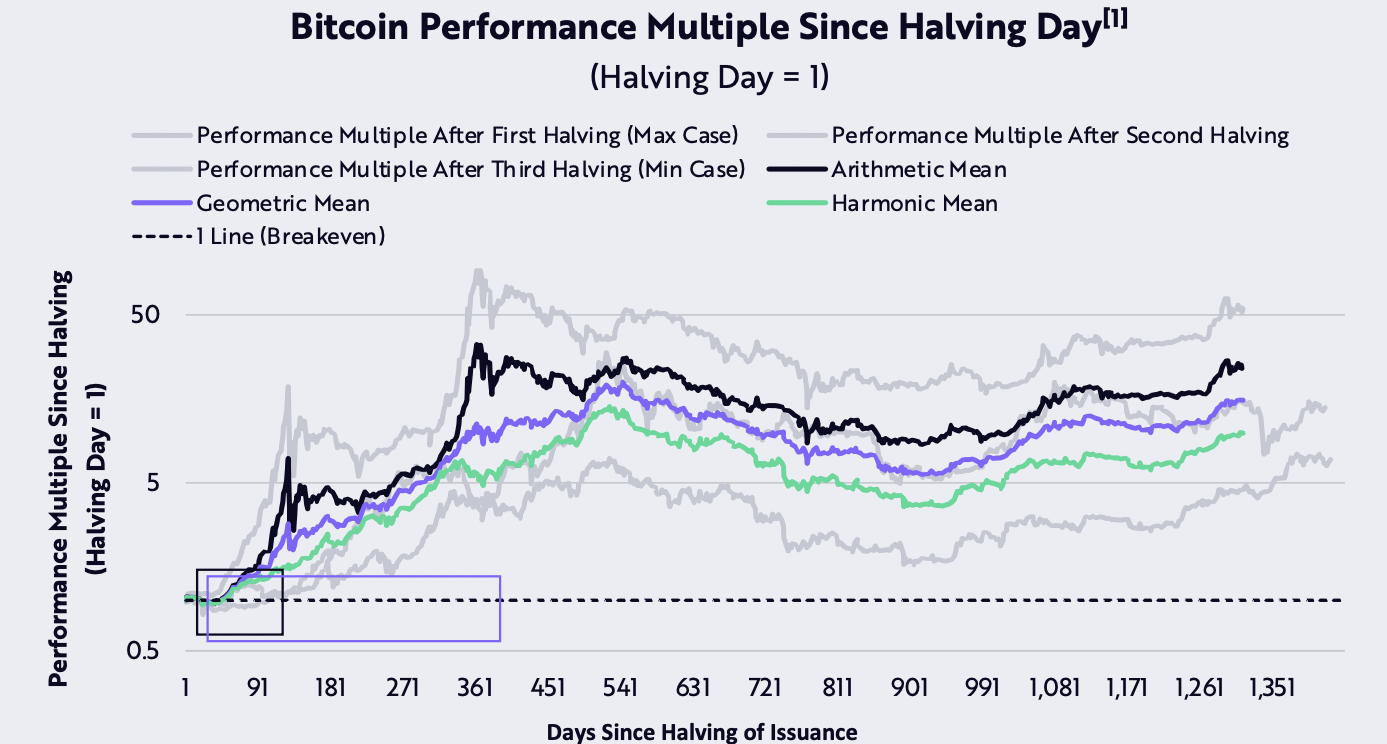

Investment management firm ARK Invest corroborated Edward’s views, agreeing that Bitcoin is still bullish. ARK Invest analysts demonstrated that previous halving events set the stage for long-term momentum for BTC.

The report noted that each halving has been a “precursor to upward momentum on a long-term time horizon,” adding,

“Assuming a 3x Bitcoin price increase a year after the halving this time around might be too optimistic. That said, this chart highlights the case for Bitcoin’s increasing scarcity over a meaningful time horizon.”

If the halving cycle plays out as expected, Bitcoin’s price could enter a parabolic uptrend, topping between the $180,000 and $200,00 price range if it makes a 3X increase in BTC price.

Responses