Post-FTX crypto industry needs education before regulation: Former Biden advisor

“What I preach for is regulation that protects and prevents but does not cripple and destroy [innovation],” the senior adviser told Cointelegraph.

The cryptocurrency industry needs to prioritize investor education over stringent regulations as it recovers from the downfall caused by the collapse of the FTX exchange, which resulted in $8.9 billion in user funds lost.

Financial education, especially regarding risk management, should be the fundamental concern of the crypto industry, according to Moe Vela, former senior advisor to President Joe Biden and senior advisor to Unicoin.

Vela told Cointelegraph in an exclusive interview:

“Education is the fundamental key to empowerment… We will not have equality in any form until we have economic parity. We’re not going to have economic parity until we teach people to be, instead of unsophisticated at anything, sophisticated, and that comes through education.”

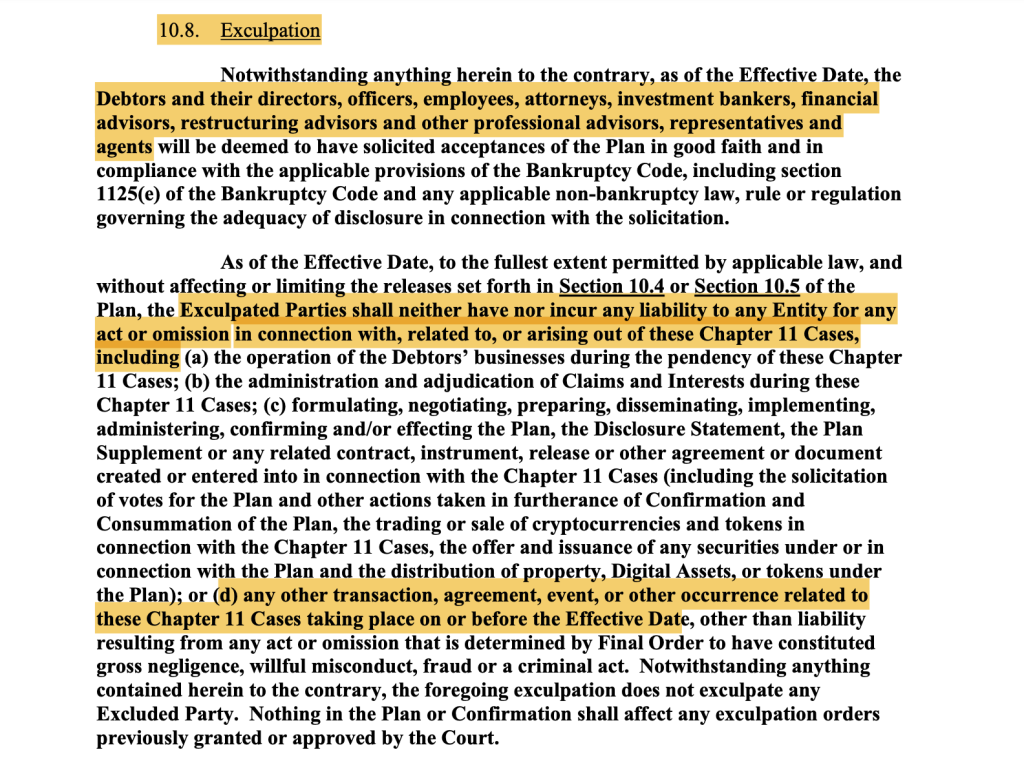

The senior advisor’s comments come a week after FTX’s new amended proposal was released on May 7, promising “billions in compensation” for the users and creditors of the bankrupt exchange who have been unable to access their funds since November 2022.

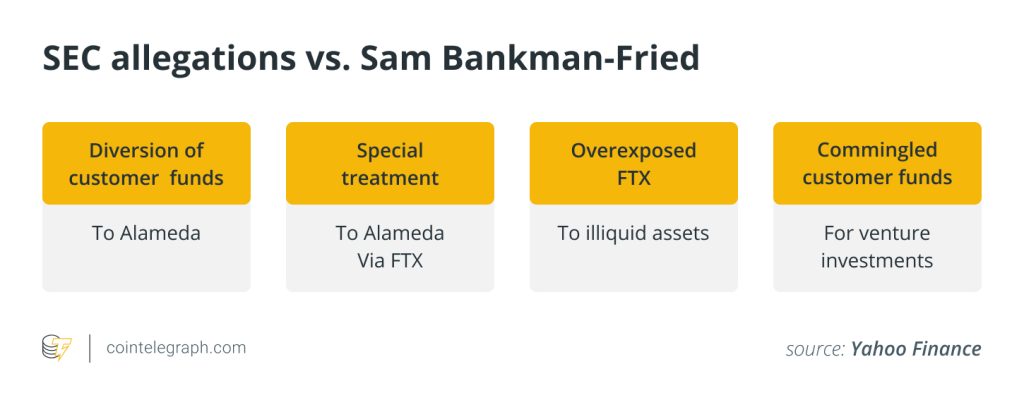

The meltdown of FTX and its over 130 subsidiaries forced regulators to take action and develop investor-safety-oriented regulations, while the United States Securities and Exchange Commission (SEC) started a crackdown on crypto exchanges to avoid another FTX-like meltdown.

However, instead of the regulatory efforts that may stifle digital asset innovation, the industry would benefit more from educating the unsophisticated investors, argued Vela:

“To my fellow Democrats a bit to my left who are a little overzealous on regulation: Stop it. You’re not doing anybody any favors. It might make you feel good because you think you’re protecting the unsophisticated investor, but rather than then having to over-regulate to protect the unsophisticated investor. Why don’t we make the investors sophisticated?”

Vela also serves as an advisor for Unicoin, an asset-backed cryptocurrency that aims to reduce the volatility associated with traditional cryptocurrencies. During the launch of the token, Vela learned that risk mitigation is among the most important factors for both traditional and crypto investors. He explained:

Related: Regulators are cracking down on financial privacy, but ZK-proofs can help

The crypto industry is here to stay and regulators should take note

Since the crypto industry is becoming an integral part of our future, innovation-friendly regulations remain a key priority, according to Vela:

“How do we create regulation that empowers, protects, and educates? But does not hinder the growth of this sector. Because this industry is here to stay. It is an integral part of our global future… So let’s foster smart growth and safe growth.”

Following the collapse of FTX, crypto exchanges worldwide have been striving for more transparent operations, spearheaded by Binance, the world’s largest exchange, which could not escape the SEC’s hawkish stance.

In June 2023, the SEC sued Coinbase and Binance Exchange for alleged securities violations. In the lawsuit against Binance, the SEC alleged that the company and its founder, Changpeng Zhao, had misappropriated billions of dollars of user funds.

Despite no evidence of user fund misappropriation, Binance was charged with violating Anti-Money Laundering laws and settled to pay $4.3 billion, one of the largest criminal fines in history.

This type of regulatory enforcement is in contrast with the innovation-friendly approach advocated by Vela, who said:

“What I preach for is regulation that protects and prevents but does not cripple and destroy [innovation].”

Related: GameStop tops Bitcoin’s yearly gains in one day — Will GME spark an altcoin rally?

Responses