LEARN DOLLAR-COST AVERAGING IN 3 MINUTES – BLOCKCHAIN 101

Introduction

Active trading is time-consuming and taxing, and the returns are not always satisfactory. Therefore, in the investment market, some investors always adhere to the “regular investment” strategy to reduce investment risks. Within this regular investment strategy, the average cost method is the most commonly used.

Overview

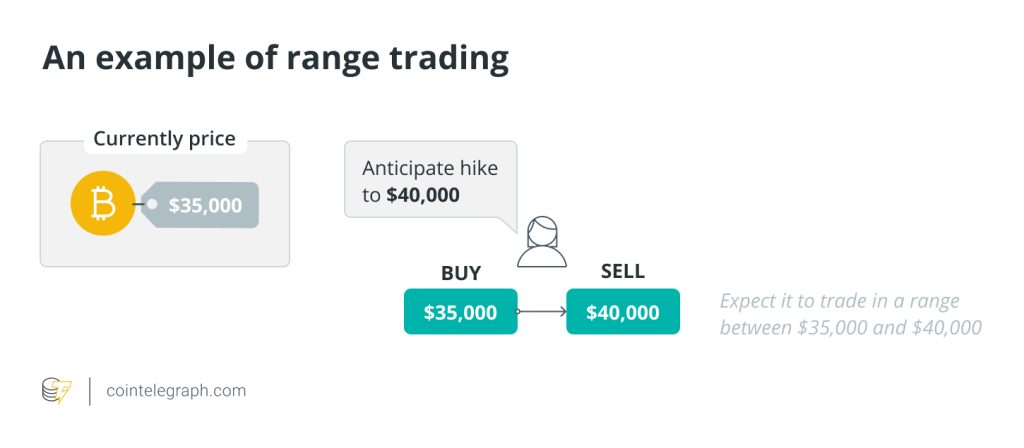

Regular investment refers to investors choosing a fixed time interval (e.g., monthly, quarterly) and then periodically purchasing a certain amount of assets, regardless of whether the price of the asset rises or falls. This means that when the asset price rises, investors will buy fewer units, and when the asset price falls, they will buy more units. In this way, investors can average out their purchase prices, thereby reducing investment risks.

Dollar Cost Averaging (DCA), also known as the average cost method, is familiar to those who study investments. Typically, when we engage in regular investments in mutual funds, stock lotteries, or the crypto market, the strategy we use is Dollar Cost Averaging. It can be considered as one of the most straightforward and easily understood investment strategies that has been proven to yield stable returns over the long term.

How does Dollar Cost Averaging work?

Step 1: Purchase Assets: Investors buy shares of the same asset at regular or irregular intervals, regardless of the price.

Step 2: Record Purchases: Every purchase should be documented with the date of purchase, quantity purchased, and the purchase price.

Step 3: Calculate Average Cost: When the need arises to determine the cost basis, investors combine all the shares they’ve purchased and divide the total cost by the total number of shares to ascertain the average cost.

Step 4: Calculate Capital Appreciation: When determining capital appreciation (or loss), investors compare the current market price to the average cost to determine the asset’s gain or loss.

Example:

Suppose investor Alice decides to purchase a stable coin and adopts the Dollar Cost Averaging method. Here’s her purchase history:

First Purchase (Date: January 1st): Alice buys 100 coins at a rate of 10 USDT per coin. She invests 1,000 USDT.

Second Purchase (Date: February 1st): A month later, Alice buys another 100 coins, but now the price has risen to 12 USDT per coin. She invests another 1,200 USDT.

Third Purchase (Date: March 1st): Another month passes, and Alice buys 100 coins again, but this time the price has dropped to 8 USDT per coin. She invests 800 USDT .

Now, let’s calculate Alice’s average cost:

Total investment = 1,000 USDT (First Purchase) + 1,200 USDT (Second Purchase) + 800 USDT (Third Purchase) = 3,000 USDT. Total number of coins purchased = 100 coins (First Purchase) + 100 coins (Second Purchase) + 100 coins (Third Purchase) = 300 coins.

Average cost = Total Investment / Total number of coins purchased = 3,000 USDT / 300 coins = 10 USDT/coin.

Thus, according to the Dollar Cost Averaging method, Alice’s average investment cost for this asset is 10 USDT/coin. This means that, irrespective of whether the market price of the coin rises or falls, Alice can assess her investment using a 10 USDT average cost.

Suppose one day the market price of the coin surges to 15 USDT/coin. At this rate, the value of Alice’s portfolio is 300 coins x 15 USDT /coin = 4,500 USDT, with a profit of 4,500 USDT – 3,000 USDT = 1,500 USDT.

Through Dollar Cost Averaging, Alice can mitigate the impact of price fluctuations on the value of her portfolio because she diversified her purchase price points, thereby managing market risks more effectively. This is a key advantage of the Dollar Cost Averaging method.

Advantages of Dollar Cost Averaging

The Dollar Cost Averaging method, as an investment strategy, has multiple advantages, making it suitable for a broad range of investors, particularly long-term investors. Here are some of the primary benefits of Dollar Cost Averaging:

Risk Diversification: Dollar Cost Averaging helps in diversifying market risks. Investors don’t have to attempt to buy assets at market peaks nor be concerned about immediate market fluctuations. They distribute their investment across multiple time points and price levels, thereby reducing the impact of price volatility on their portfolio.

Simplicity: It’s a relatively straightforward strategy, eliminating the need for investors to undertake complex market analysis or timing decisions. Investors just make regular investments according to a predetermined schedule and amount.

Emotional Control: Dollar Cost Averaging aids in minimizing emotionally-driven investment decisions. It insulates investors from market sentiments, ensuring they don’t make decisions based on short-term market fluctuations.

Suitable for Systematic Investment Plans: For those investors who follow a systematic, regular investment plan, Dollar Cost Averaging is an ideal computation method. It ensures they invest according to a set plan without worrying about market volatility.

Reduces Market Timing Risk: The method helps in reducing market timing risks. Investors don’t need to try and predict the market’s bottom or top but average out the market price through multiple investments.

Long-term Benefits: Particularly for long-term investors, Dollar Cost Averaging can help reap benefits in the long-term market trend. It emphasizes the importance of holding assets for a longer period, thus assisting in achieving long-term investment objectives.

Dollar Cost Averaging Calculator:

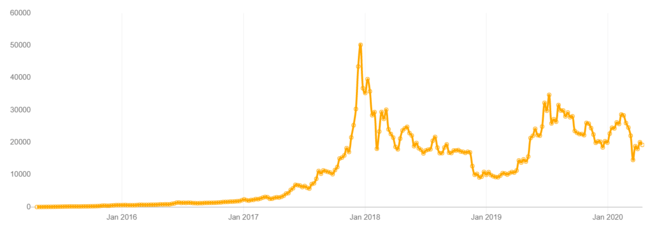

Using dcabtc.com, one can access a simple Bitcoin Dollar Cost Averaging calculator. By selecting the amount, time span, and intervals, users can understand the performance of various strategies within a defined period. Taking Bitcoin as an example, due to its consistent upward trajectory, this strategy has worked effectively.

Suppose over the past five years, one bought Bitcoin worth 10 dollars every week. Here’s a detailed performance: a weekly investment of 10 dollars might seem insignificant, but by April 2020, your cumulative investment would be around 2,600 dollars, with the Bitcoin value being approximately 20,000 dollars.

It’s essential to note that Dollar Cost Averaging isn’t a one-size-fits-all strategy. In certain market situations, like prolonged downtrends, lump-sum investments might be more beneficial. Investors should choose their investment strategy based on their individual goals, risk tolerance, and market conditions.

Responses