Deutsche Bank joins Singapore's asset tokenization project

Deutsche Bank joined Singapore’s tokenization project soon after reiterating skepticism about transparency about the world’s largest stablecoin, Tether.

Update May 14, 12:35 UTC: This article has been updated to include quotes from Interop Labs CEO Sergey Gorbunov

Deutsche Bank, a German multinational investment bank, is collaborating with Singapore’s central bank on asset tokenization.

Deutsche Bank has joined the Monetary Authority of Singapore’s (MAS) Project Guardian, which focuses on asset tokenization in wholesale funding markets and decentralized finance (DeFi) applications.

As part of the collaboration, Deutsche Bank will test an open architecture and interoperable blockchain platform to service tokenized and digital funds. The bank will also propose protocol standards and identify the best approach to contribute to industry progress.

Deutsche’s Asia Pacific head of securities and technology, Boon-Hiong Chan, will be the bank’s lead for Project Guardian. The bank is expected to work closely with Memento Blockchain, a software-based platform targeting DeFi and digital asset management.

Deutsche and Memento Blockchain previously worked together in 2022 and 2023, successfully completing a proof-of-concept known as Project DAMA, which refers to Digital Assets Management Access.

The initiative aims to unlock the potential for a more efficient, secure and flexible solution for digital fund management and investment servicing.

The new Deutsche Bank’s efforts aim to introduce DAMA 2. The development will involve Interop Labs, the initial developer of the major interoperable blockchain, the Axelar network.

Some major cryptocurrency firms, including Ripple, have been working with the Axelar Foundation to add interoperability to their blockchain networks.

Ripple announced a collaboration with Axelar in February 2024, ultimately planning to tokenize real-world assets (RWA) of the XRP Ledger, made interoperable through Axelar.

“It’s now clear that secure blockchain interoperability is required to unlock the trillion-dollar potential in asset tokenization,” Axelar co-founder and Interop Labs CEO Sergey Gorbunov told Cointelegraph.

“Deutsche Bank and Project Guardian are leading innovation toward establishing the open systems that will enable this technology. Axelar is critical infrastructure for institutional adoption, and we’re excited about this collaboration,” he noted.

Related: RWA protocols are closing in on $8B total value locked: Messari

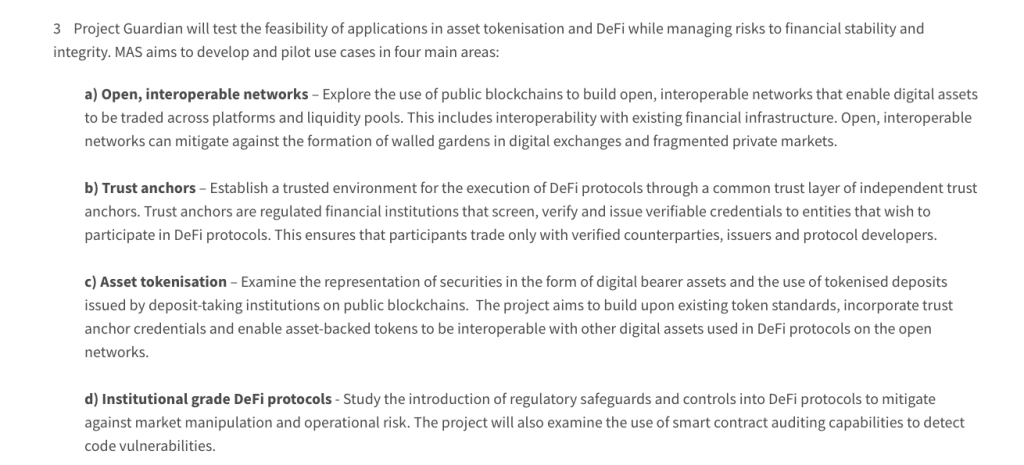

Initiated by Singapore’s MAS and launched in 2022, Project Guardian is a collaborative initiative between the MAS and other financial market players, including the United Kingdom’s Financial Conduct Authority, Switzerland’s Financial Market Supervisory Authority and Japan’s Financial Services Agency.

Deutsche’s entrance to Singapore’s tokenization project comes a few days after the bank issued a report on stablecoins, raising questions about the transparency of major issuers like Tether (USDT).

Tether subsequently slammed Deutsche Bank over its claims, emphasizing that the report failed to provide substantial evidence or concrete data to support the claims.

Tether’s USDT stablecoin has established a major component of the cryptocurrency market, accounting for its biggest share in terms of trades. It’s also the world’s largest stablecoin with a total market value of nearly $111 billion.

Magazine: ‘Sic AIs on each other’ to prevent AI apocalypse: David Brin, sci-fi author

Responses