Bitcoin halving 'danger zone' has 2 days left with BTC price retesting $60K

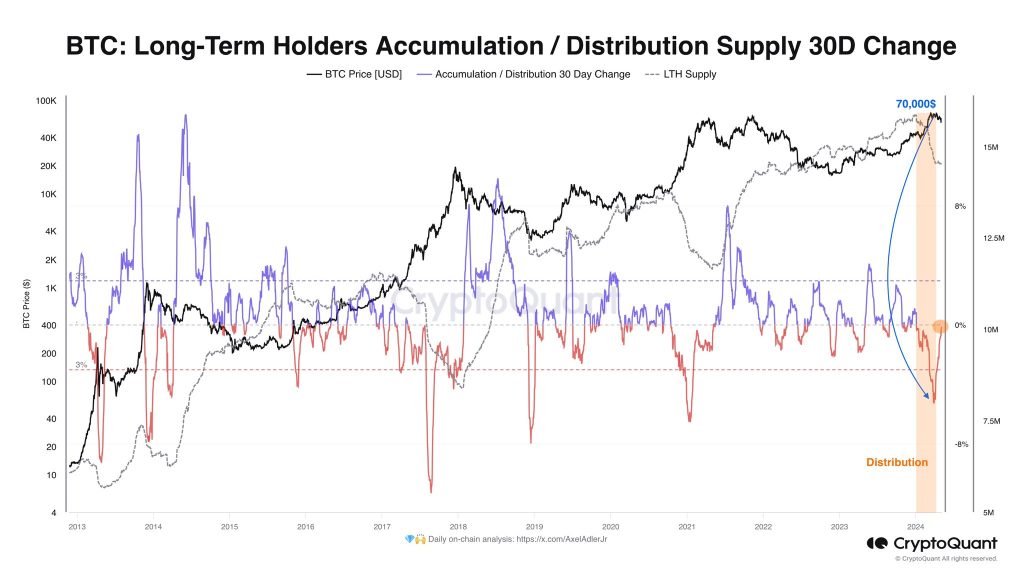

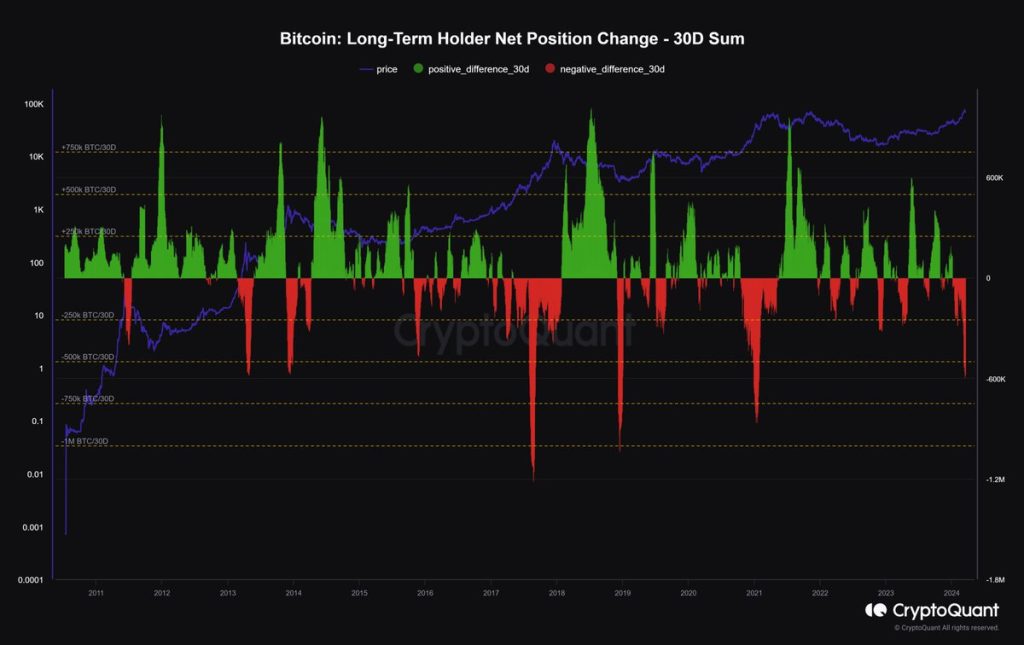

Bitcoin has almost completed its prime BTC price drawdown phase after April’s halving, the latest analysis confirms.

Bitcoin (BTC) challenged $60,000 support into the May 10 daily close as the classic post-halving “danger zone” spooked bulls.

BTC price gives up gains above $60,000

Data from Cointelegraph Markets Pro and TradingView showed intraday BTC price lows of $60,190 on Bitstamp.

A sudden drop foiled attempts to hold levels around $63,000, with explanations mixed as to the impetus behind it.

“Monthly open has been swept again as well monthly buyers taken out. If bulls want higher & want to break this downtrend its here imo,” popular trader Skew wrote in part of his latest market coverage on X (formerly Twitter) after the bulk of the downside.

“Specifically key area for bulls to do something is $60.8K – $61K (also happens to be range low).”

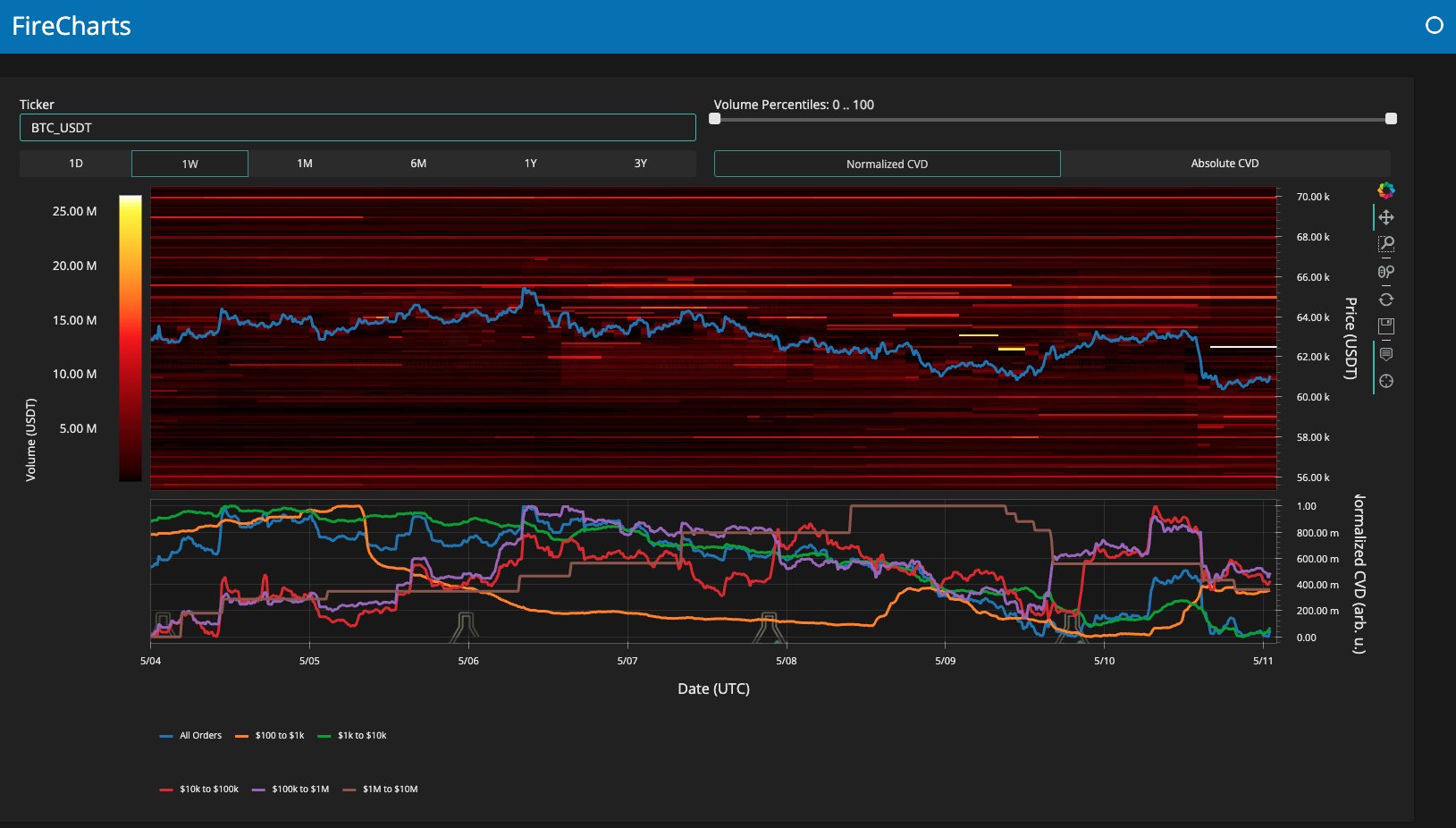

Commenting on the events, trading resource Material Indicators suggested that large-volume institutional players may be at work.

“Speculating that some institutional entity may not want to see Bitcoin breakout over the weekend while the BTC ETF market is closed,” part of an X post read.

An accompanying chart showed order book liquidity on the largest global exchange, Binance, including a new block around $62,500, which Material Indicators predicted could be lifted after the weekly close.

“I won’t be the least bit surprised if this sell wall moves lower to push price down. I also won’t be surprised if we see a roof pull after the W candle closes on Sunday,” the post continued.

“Danger zone” ends with Bitcoin weekly close

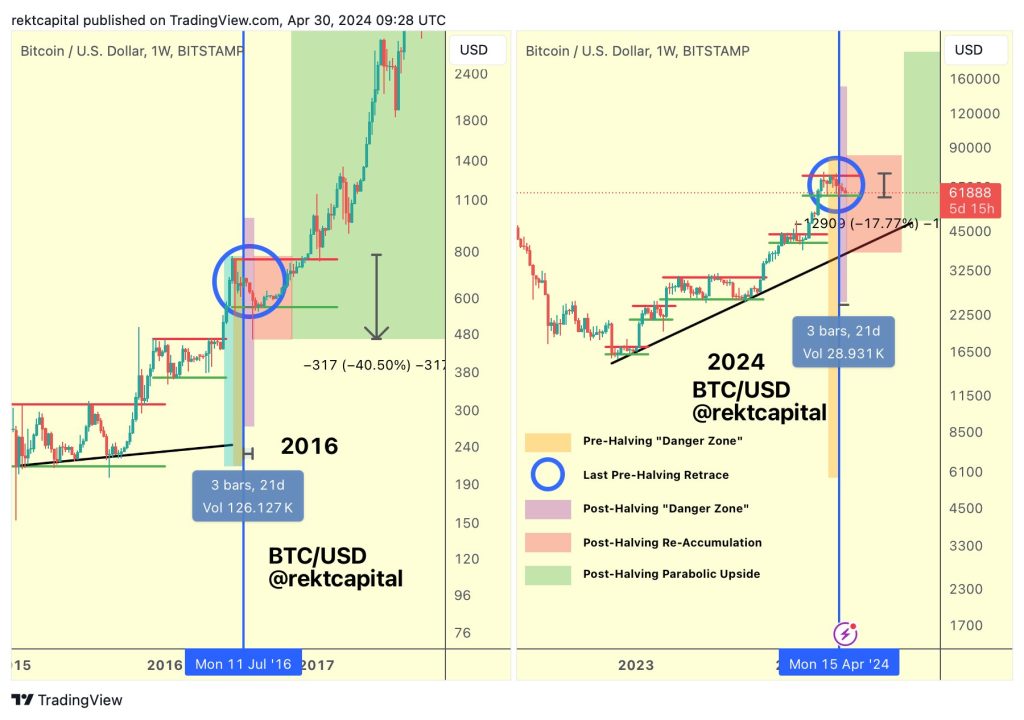

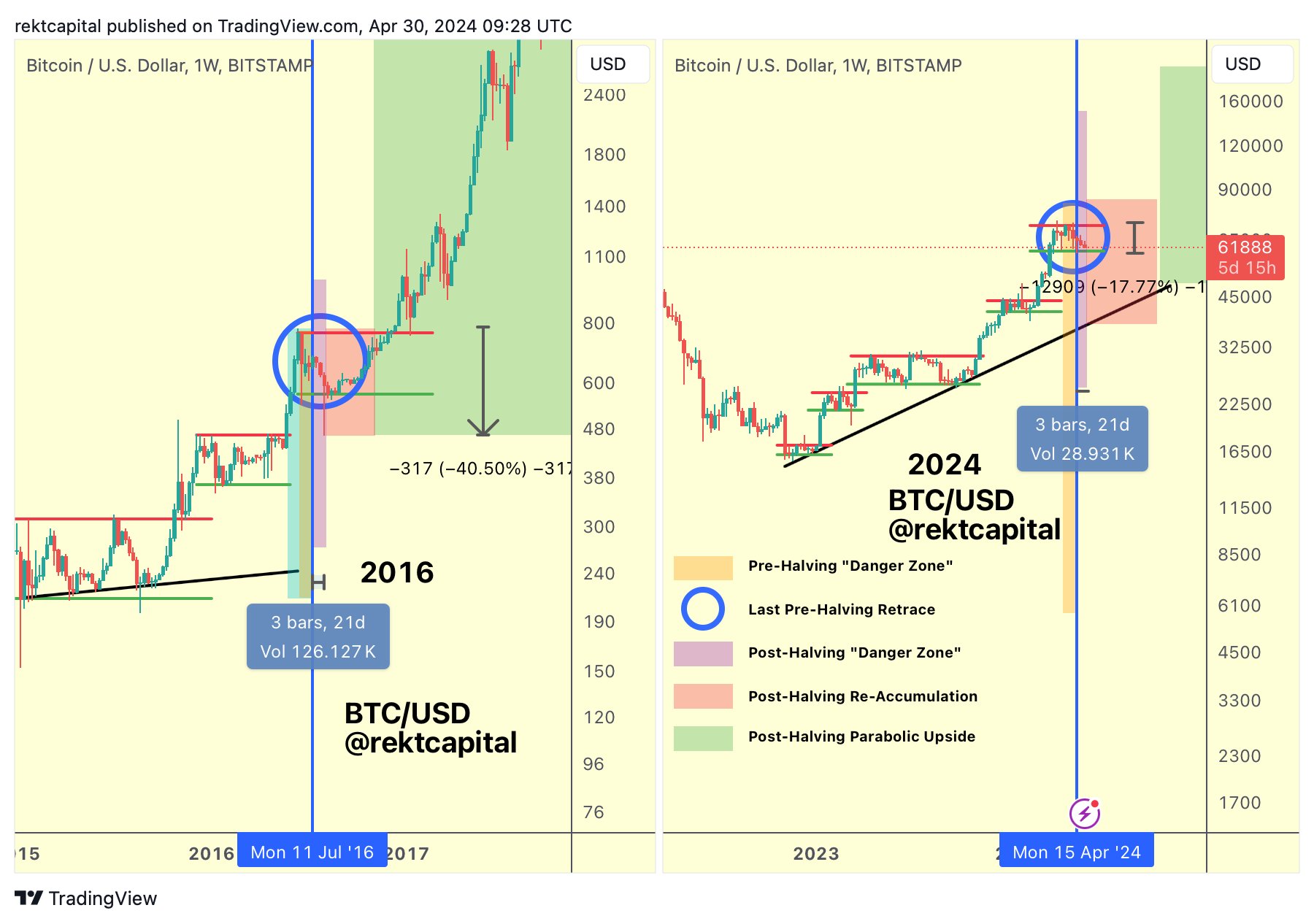

Updating his perspective of BTC price behavior following last month’s block subsidy halving, meanwhile, popular trader and analyst Rekt Capital called time on current weakness.

Related: Ethereum ‘speculatory divergence’ sees ETH price cling to $3K support

BTC/USD has tended to drop in the weeks following a halving event, and this “danger zone” is now coming to an end.

At the end of April, Rekt Capital predicted a major bout of downside for Bitcoin within a two-week period — something which ultimately came true in the form of a trip to two-month lows $56,500.

“Bitcoin indeed downside wicked below the Re-Accumulation Range Low just like in 2016. Thus price-wise, the Post-Halving ‘Danger Zone’ purple has been satisfied,” he stated on the day.

“Time-wise however, the ‘Danger Zone’ officially ends in 2 days.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Responses