Wells Fargo reports exposure to Grayscale and ProShares Bitcoin ETFs

The bank reported holding $143,111 worth of shares of the ProShares Bitcoin Strategy ETF, Grayscale Bitcoin Trust and Bitcoin Depot.

Major United States-based financial services firm Wells Fargo has disclosed investments in Bitcoin (BTC) exchange-traded funds offered by Grayscale and ProShares.

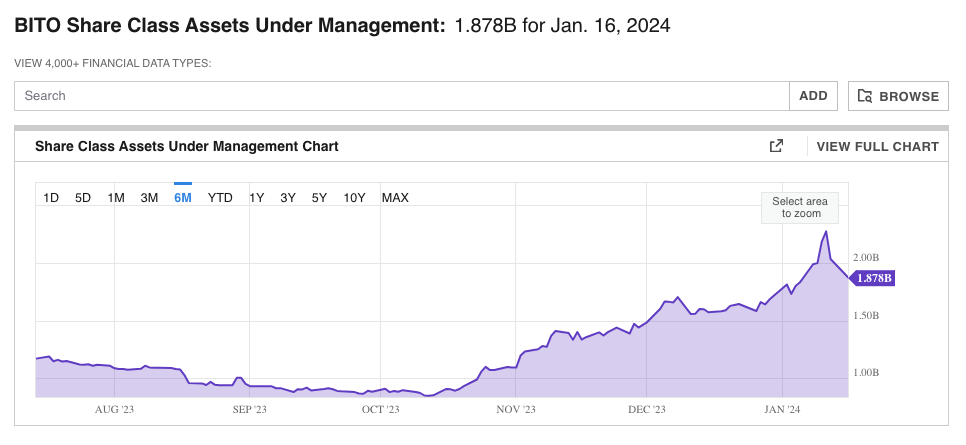

In a May 10 filing with the U.S. Securities and Exchange Commission (SEC), Wells Fargo reported it held 37 shares of the ProShares Bitcoin Strategy ETF, which offers exposure to BTC futures, and 2,245 shares of Grayscale Bitcoin Trust, which was converted to an ETF. The firm also reported 52 shares in Bitcoin Depot, a crypto ATM provider.

The total value of the three Bitcoin-related investments was $143,111, a significantly small holding for the major bank. Wells Fargo reported roughly $1.7 trillion in assets as of June 2023, making it the third-largest bank in the U.S. by holdings. The SEC added that observers should not assume that the information provided by the financial firm was “accurate and complete.”

This is a developing story, and further information will be added as it becomes available.

Responses