Exodus CEO frustrated as SEC delays listing amid celebrations

Exodus hits regulatory roadblock despite previous approval as “numerous employees and their families” arrive in NYC to face disappointment

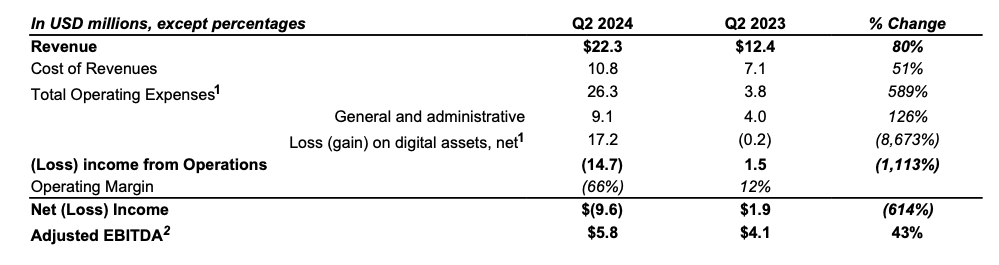

Exodus Movement, Inc. (Exodus) is facing a delay in its NYSE (New York Stock Exchange) American listing pending completion of the SEC’s review of its registration statement — which went into effect on April 28.

The NYSE American previously approved the listing of Exodus’ shares of Class A common stock at a par value of $0.000001, expected to begin trading on May 9. However, due to the backpedal, Exodus’ transition from the OTCQX to the NYSE American will be put on hold until the SEC completes its regulatory compliance process.

The delay in listing carries heavy implications for Exodus as the move to NYSE American would affect its visibility and potential financial market growth. This regulatory hurdle demonstrates a bottleneck crypto companies face when pursuing traditional finance (TradFi) regulated ventures.

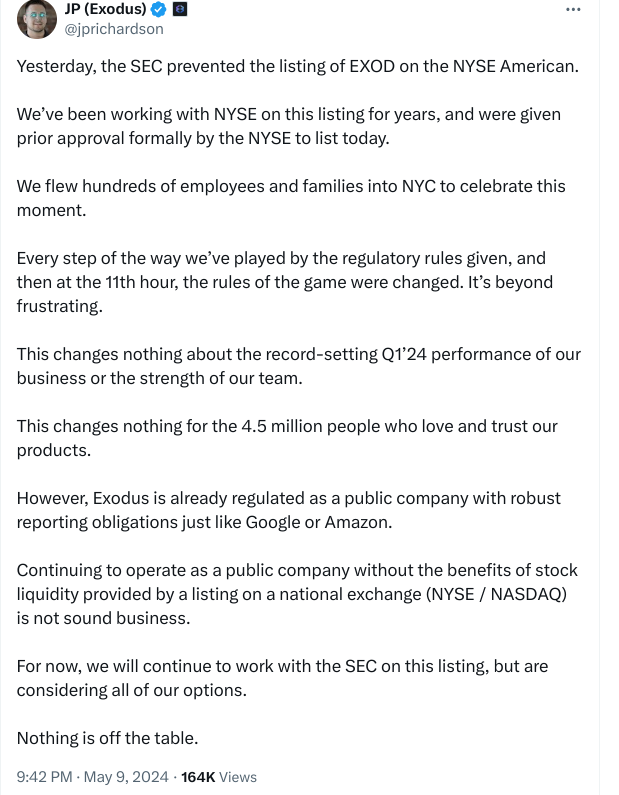

Exodus CEO, JP Richardson, expressed his surprise and confusion at the delay, stating:

“We remain hopeful that the SEC will follow through on its commitment to treat us as the law intends. Exodus has been fully transparent and responsive throughout this process and we expect a swift resolution in this matter. In the meantime, we will continue to provide the best possible service and value for our customers and shareholders.”

Richardson later explained that numerous employees and their families had gathered in New York City “to celebrate the moment.”

“Every step of the way we’ve played by the regulatory rules given, and then at the 11th hour, the rules of the game were changed. It’s beyond frustrating” he said.

Exodus explained that it may reconsider the decision to list again post-SEC review, depending upon the outcome, and that stockholders do not need to take any action at this time.

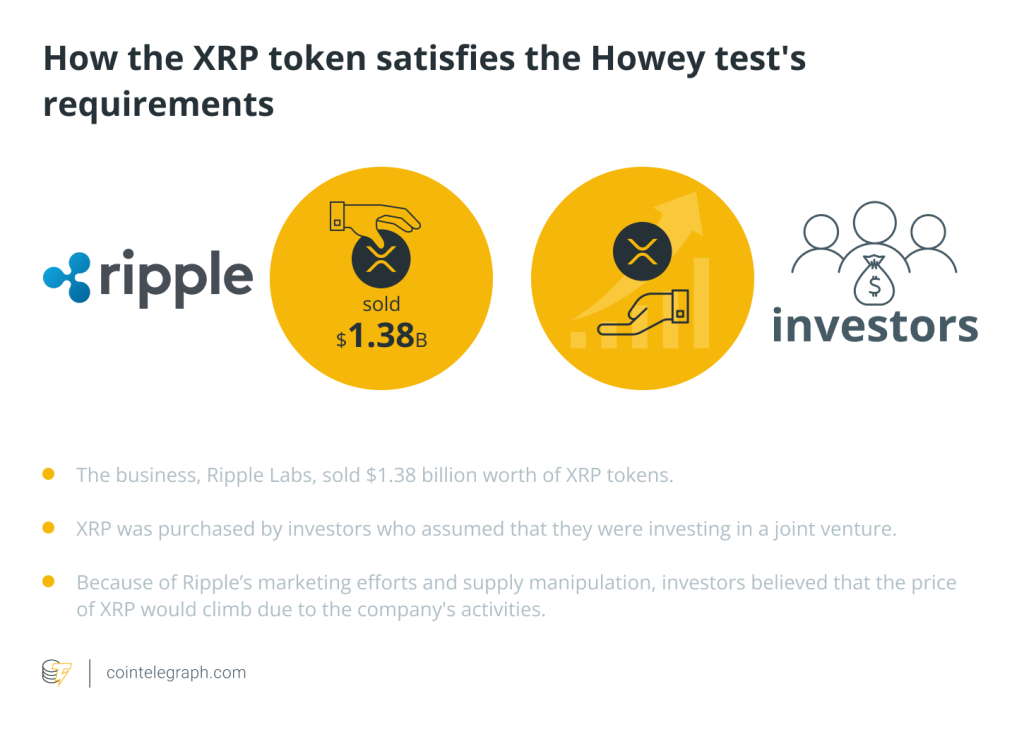

Entrepreneur and crypto personality Lark Davis commented on the situation, stating that the SEC are “probably about to sue.”

Though potentially satirical in nature, Davis’ comment does highlight concerns within the crypto community — heightened by the recent United States House of Representatives vote to nullify the SEC’s anti-crypto banking guidance, SAB 121.

The bipartisan bill, dubbed H.J.Res.109, was put to the House by Republican Party Representative Mike Flood and passed on May 8. Passing 228 to 182 votes, Flood described the SAB 121 as unfair on banks seeking crypto custody, due to custodial assets always being considered “off-balance sheet.”

These legislative endeavours reflect upon the tension growing between financial institutions and regulatory entities as the crypto market progressively attempts to enter TradFi.

Responses