Bankruptcy law firm S&C absolved from misconduct according to new FTX proposal

FTX’s amended plan contains an exculpation clause that could absolve Sullivan & Cromwell, along with all debtors, of future liabilities.

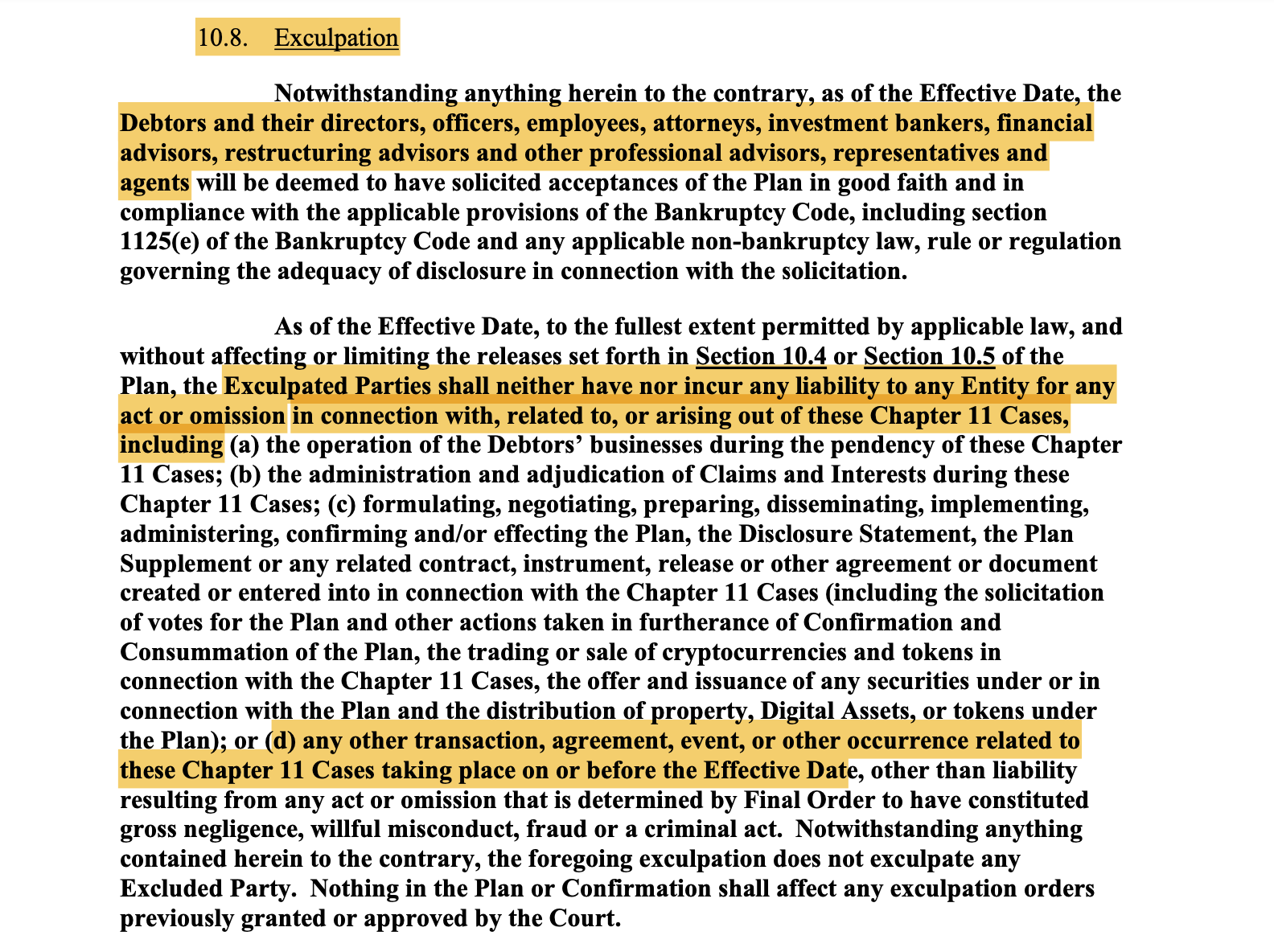

While FTX’s new amended proposal promised “billions in compensation,” creditors are unhappy with a particular clause related to law firm Sullivan & Cromwell (S&C).

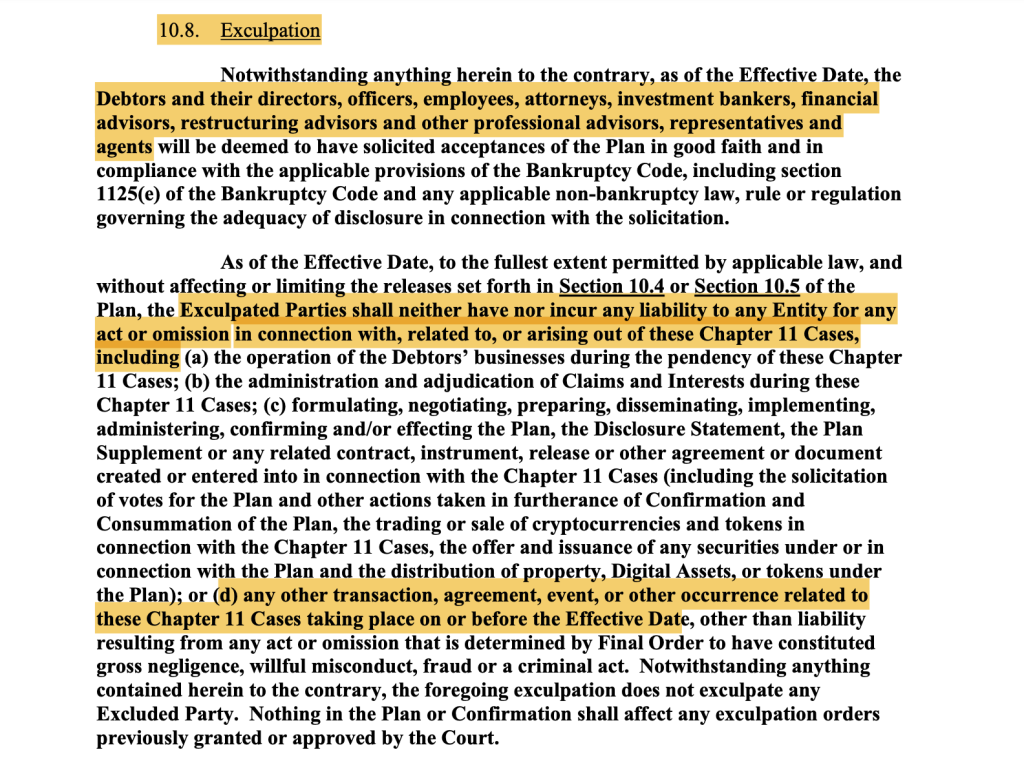

FTX’s new amended proposal to repay creditors, released on May 7, contains an exculpatory clause, which is a provision that relieves certain parties of liability if damages are caused during the execution of the bankruptcy process.

In the case of FTX, S&C may have included the clause to absolve themselves from any potential liabilities, according to popular FTX creditor Sunil, who is part of the largest group of over 1,500 FTX creditors, the FTX Customer Ad-Hoc Committee.

In a May 8 X post, Sunil wrote:

“S&C included an exculpation clause so they can not be held liable for misconduct — selling FTX assets at 70% to 90% discounts to their own clients and insiders (Ledger X, Galaxy), not restarting FTX 2.0, etc if we accept the plan.”

The controversial clause comes nearly three months after the top FTX creditors sued bankruptcy firm Sullivan & Cromwell (S&C). The creditors alleged that S&C took an active part in the “FTX Group’s multibillion-dollar fraud,” claiming the firm benefited financially from FTX’s fraud, a court filing on Feb. 16:

“S&C knew of FTX US and FTX Trading Ltd.’s omissions, untruthful and fraudulent conduct, and misappropriation of Class Members’ funds. Despite this knowledge, S&C stood to gain financially from the FTX Group’s misconduct and so agreed, at least impliedly, to assist that unlawful conduct for its own gain.”

Sullivan & Cromwell is the century-old law firm overseeing the FTX bankruptcy proceedings. Previously, the firm reportedly served as outside counsel to the exchange in several deals, including FTX’s bid for the assets of Voyager Digital and its acquisition of LedgerX, receiving significant payments for its services.

FTX owed up to $1.45 billion in legal bankruptcy fees to the S&C law firm, according to compensation filings from December 2023.

Related: First Bitcoin-backed synthetic dollar to launch with 25% yield

Will FTX’s amended plan be turned down?

FTX’s new plan caused widespread outrage among crypto investors, mainly due to the exculpatory clause, which could prompt creditors to vote no, including pseudonymous FTX creditor Rob, who is also the head of growth at Paradex. In a May 8 X post, Rob wrote:

“Icing on the cake from the team that destroyed billions of potential value for FTX customers. This can’t be allowed. I’m voting NO on this plan.”

While FTX debtors said they would give over 98% of creditors an 11% payout, plus “billions in compensation” to the rest, some don’t consider this unfair, considering that debtors are compensating holders based on a $16,800 Bitcoin (BTC) price, which has appreciated significantly since the collapse.

None of the FTX creditors will accept this compensation structure, according to Mike Belshe, the CEO of BitGo, who wrote in a May 8 X post:

“0% of FTX creditors agree that receiving $16800 for your bitcoin is fully compensated. I understand why the bankruptcy process needs to work this way but let’s not pretend victims are getting their money back or that FTX wasn’t as awful as it was.”

Related: FTX addresses transferred $8.3M one day before amended proposal deadline

Responses