Susquehanna International Group adds $1B in Bitcoin ETFs to portfolio

According to a filing with the U.S. SEC, Susquehanna International Group invested more than $1 billion in Bitcoin ETFs in Q1 2024.

According to a 13F-HR filing on May 7, quantitative trading firm Susquehanna International Group purchased more than $1 billion worth of shares of Bitcoin (BTC) exchange-traded funds (ETFs) in the first quarter of 2024.

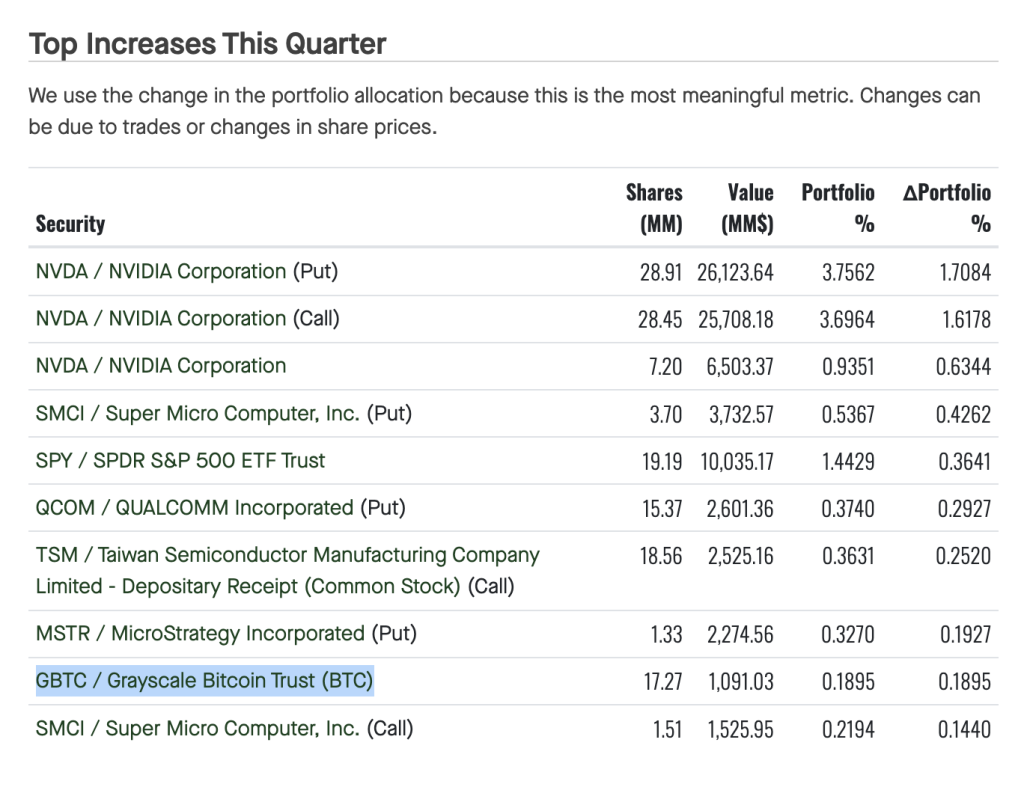

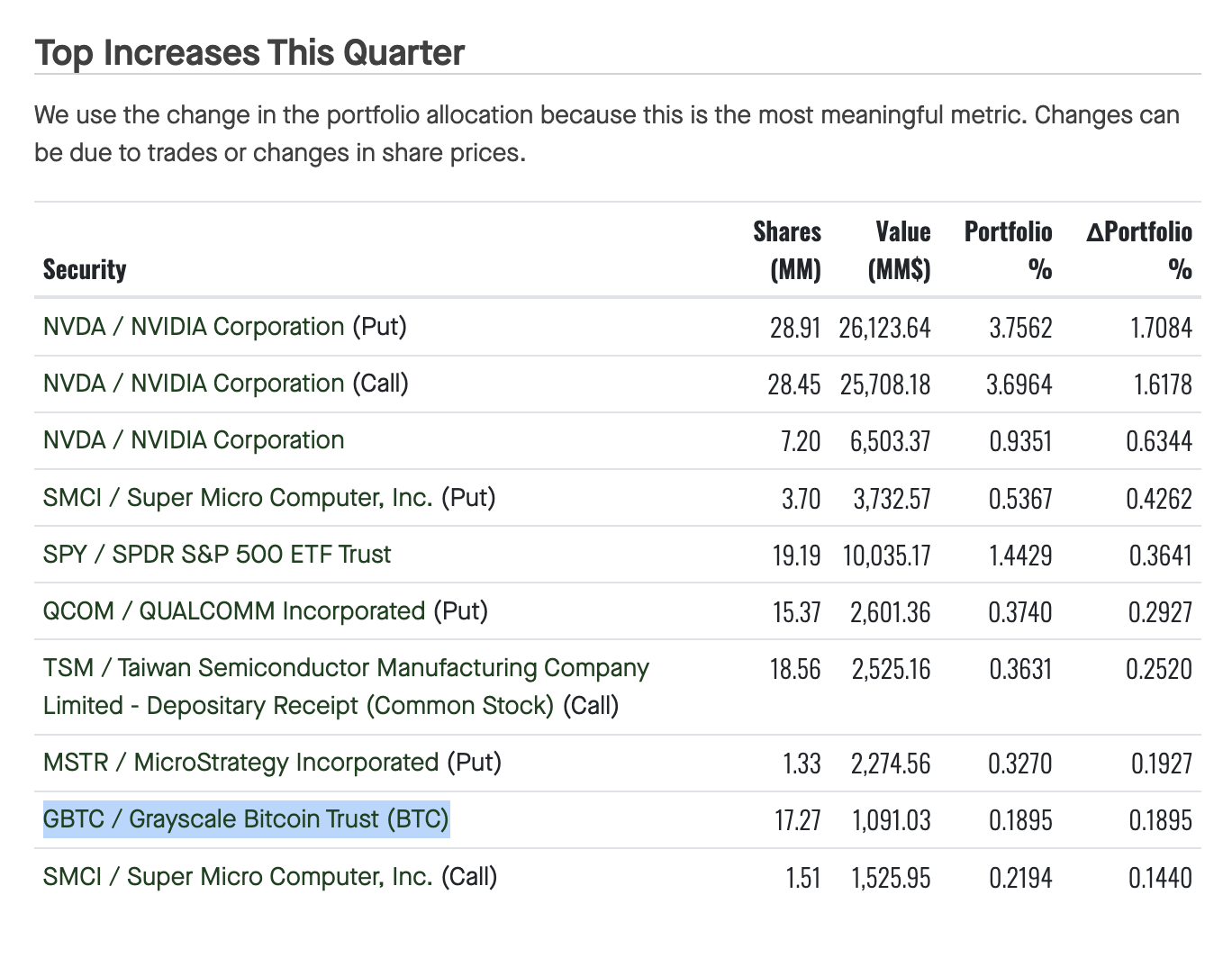

The firm disclosed to the Securities and Exchange Commission ownership of 17,271,326 shares in the Grayscale Bitcoin Trust (GBTC), with a market value of approximately $1.09 billion as of March 31, 2024. Additionally, Susquehanna reported owning 1,349,414 shares of the Fidelity Wise Origin Bitcoin Fund (FBTC), valued at roughly $83.74 million on the same date.

Moreover, the firm increased its stake in the ProShares Bitcoin Strategy ETF (BITO), which gives investors exposure to Bitcoin futures contracts. According to investment research firm Fintel, Susquehanna owned 7,907,827 shares of BITO as of March 31, valued at approximately $255.42 million — up 57.59% from a February filing that listed 5,021,149 shares.

The company had indirect exposure to Bitcoin’s spot price through MicroStrategy stock (MSTR), which holds 214,400 BTC on its balance sheet. However, Susquehanna reduced its stake in MicroStrategy by nearly 15% during the portfolio rebalancing, from 287,180 shares in February to 244,863 shares on March 31.

Overall, Susquehanna’s cryptocurrency allocation represents a tiny fraction of the trading firm’s portfolio, which ended the first quarter valued at more than $575.8 billion.

Among the company’s top investments are NVIDIA Corporation and the index-tied SPDR S&P 500 ETF Trust. In addition to Bitcoin funds, Susquehanna’s new holdings for the past quarter include shares of the convertible bonds firm Convertible Zero, bonds from NRG Energy Inc., and preferred stocks in Albemarle Corporation.

Bitcoin funds are increasingly being used by trading firms and financial advisers to gain exposure to digital assets. In April, Fidelity’s Bitcoin ETF secured $40 million from two traditional financial advisers, Legacy Wealth Management and United Capital Management of Kansas. Each fund invested $20 million in FBTC, joining the fund’s top shareholders.

The advisers are popular among a significant population of baby boomers, who own a sizable share of the country’s wealth. Legacy Wealth Management manages assets exceeding $359 million, while United Capital Management of Kansas oversees more than $436 million in assets.

Responses