Hong Kong spot Bitcoin and Ether ETFs struggle to gain traction

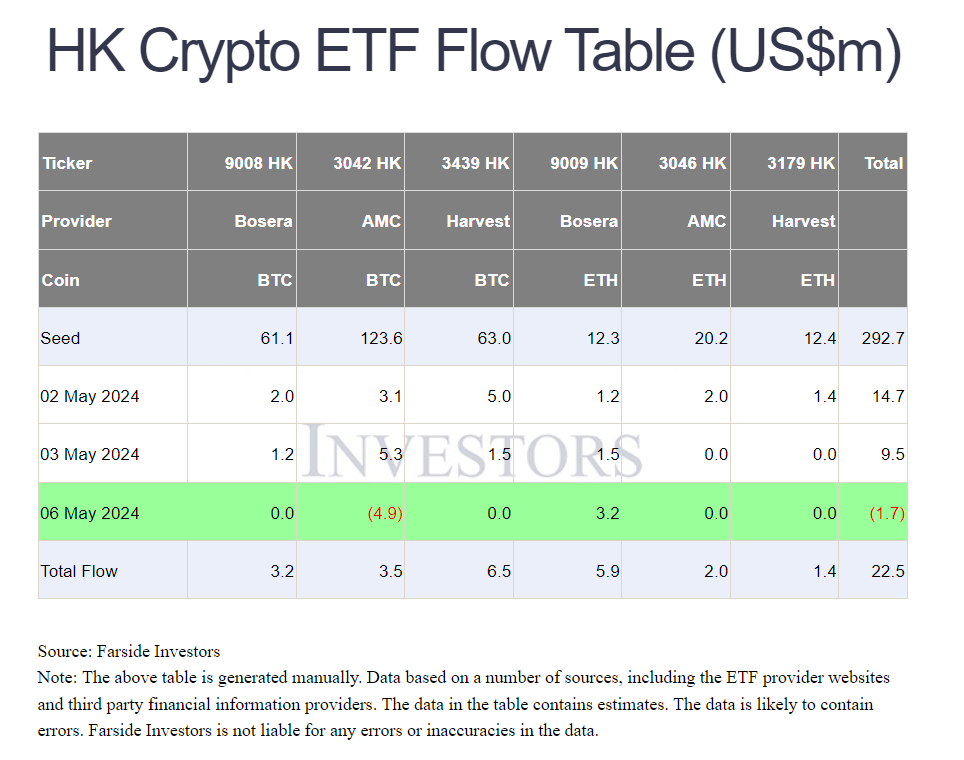

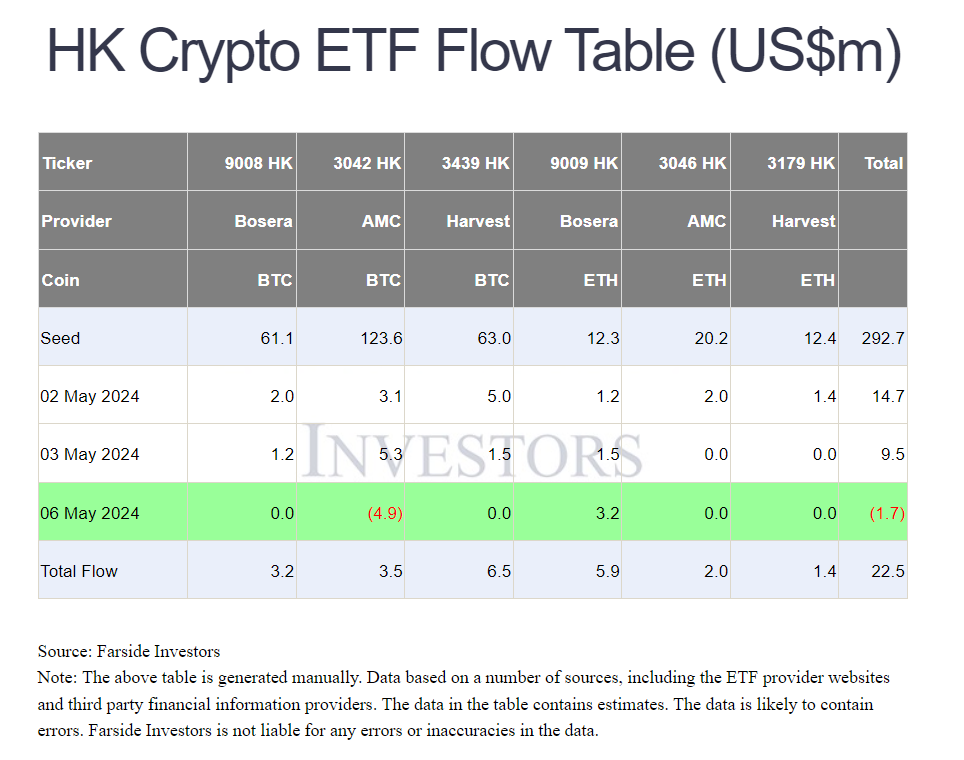

The exchange-traded funds only managed to attract around $22.5 million inflows during their first week of launch.

Hong Kong spot Bitcoin exchange-traded funds (ETFs) are far underperforming their U.S. counterparts in the first week of launch.

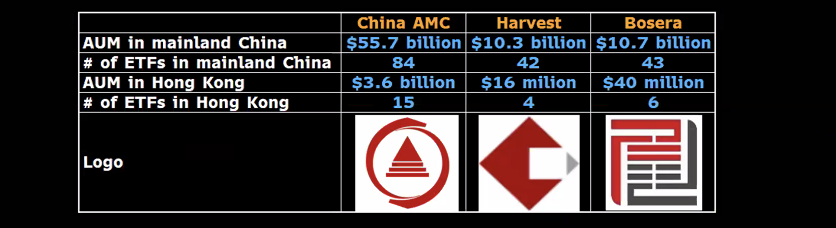

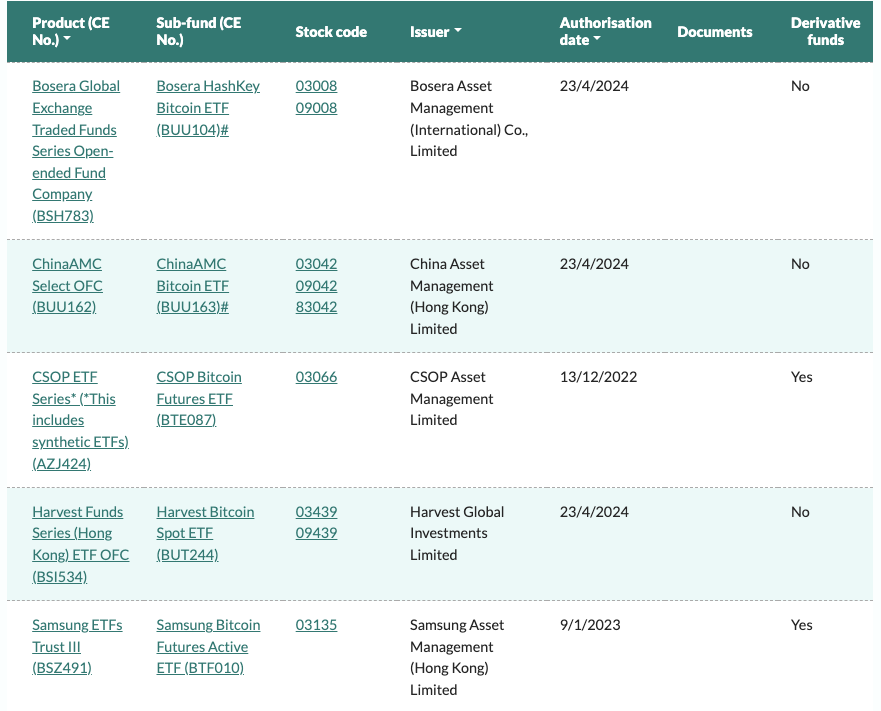

According to data compiled by Farside Investors, the three spot Bitcoin (BTC) ETFs that launched on April 30 in the East Asian City have attracted a total of $262 million in assets under management (AUM), the vast majority of which was subscribed to before the listing. Meanwhile, their asset inflows amounted to less than $14 million in the first week of launch, far below the billions that flowed into U.S. spot Bitcoin ETFs in January.

“In our view, the launch of the Bitcoin and Ethereum ETFs in Hong Kong, is a far less significant moment that the US ETFs,” Farside Investors commented. Meanwhile, Hong Kong spot Ether (ETH) ETFs, the first of their kind in the world, also did not impress, with a cumulative $54.2 million in AUM and $9.3 million in total inflows as of May 6.

The Hong Kong spot crypto ETFs were seen as significant improvements to their U.S. counterparts. They are denominated in three fiat currencies and feature in-kind transfers so investors can buy and redeem ETF units directly via Bitcoin or Ether.

“[A]s we advised, don’t expect big numbers in HK vs the US,” wrote senior Bloomberg ETF analyst Eric Balchunas regarding the results. “[B]ut.. the the HK ETFs at $310m is equal to $50b in the US market. So in that regard, these ETFs are already as big to their local mkt as US ones are to its,” he added.

The Hong Kong equities sector is a relatively small one, with a total market cap of $4.5 trillion compared to $50 trillion worth of listed equities across all U.S. exchanges. The Hong Kong equities sector is also far more illiquid due to slower economic growth in Mainland China since 2022.

In a recent study, crypto exchange OSL found that nearly 80% of crypto-savvy investors in Hong Kong plan to invest in the new spot Bitcoin and Ether ETFs. The assets, however, are currently not accessible to Mainland Chinese investors unless they also possess Hong Kong residency. “Mainland Chinese RMB investors are not allowed to purchase, and incremental funds may be limited, resulting in low transaction volume,” commented researchers at SoSoValue, who added:

“This Hong Kong cryptocurrency ETF still has strict restrictions on investor qualifications, and mainland investors cannot participate in transactions. Taking Futu Securities as an example, the account holder is required to be a non-resident of mainland China and the United States before trading can be conducted. The market expects mainland funds to be traded through southbound Hong Kong Stock Connect, which is currently not allowed and is expected to be difficult to open for a long time.”

SoSoValue researchers also noted that after an initial teaser fee period, the management fees of Hong Kong crypto ETFs range from 0.85% to 1.99% annually, far above the 0.25% average annual management fees charged by U.S. issuers. “Due to the fee difference, for institutional investors who are optimistic about the crypto market and want to hold it for a long time, the holding cost of the U.S. Bitcoin ETF is lower,” SoSoValue said.

Related: Hong Kong Bitcoin, Ether ETFs attract over $200M on day 1

Responses