Turkish crypto bill: 5 things to know before it’s introduced

Turkey was expected to introduce crypto legislation in early 2024, but the local parliament is yet to report on the process.

The government of Turkey, one of the biggest cryptocurrency economies in the world, is expected to introduce crypto-related legislation sometime this year.

Turkish Treasury and Finance Minister Mehmet Simsek announced in January that local crypto legislation was almost complete. Many expected the Turkish parliament to start regulating the crypto market in early 2024, but the draft legislation is yet to be introduced.

As Turkey’s regulatory silence on crypto may leave one wondering when the legislation is coming and what is the current status of crypto regulation in Turkey, Cointelegraph spoke to some local industry enthusiasts to clarify some of the issues.

Turkey already has some “light” crypto regulations

While the Turkish government has yet to introduce crypto legislation, it doesn’t mean that there are no rules to regulate the market in the country today.

According to local cryptocurrency mentor Ismail Hakki Polat, there are currently “very slight regulations” targeting crypto in Turkey, but parliament does not set them.

Turkey has two main crypto-related regulations: One was initiated by the Central Bank of the Republic of Turkey in 2021, which prohibits crypto holders from making payments in cryptocurrencies like Bitcoin (BTC) as such assets are not legal tender.

“Since it’s not a regulation passed by the parliament, nobody knows what are the consequences, penalties and fines of violating these rules,” Polat told Cointelegraph. “Let’s say, this regulation is with no legs on the ground,” he added.

The second regulation relates to Anti-Money Laundering (AML) measures and works under the supervision of the Ministry of Finance’s financial intelligence unit, the Financial Crimes Investigation Board, also known as MASAK.

This regulation requires exchanges to collect certain Know Your Customer (KYC) data from users in order to prevent illicit activities like money laundering and terrorism financing.

According to Mindstone Blockchain Labs CEO Tansel Kaya, there is also crypto-related guidance by the Capital Markets Board of Turkey (CMB), known as SPK (Sermaye Piyasası Kurulu).

“The SPK said anybody or any institution related to the authority shall not trade cryptocurrencies,” Kaya said, adding that this includes Turkish banks, broker dealers and others. He emphasized that this regulation is “very old” as the CMB issued this guidance in 2017.

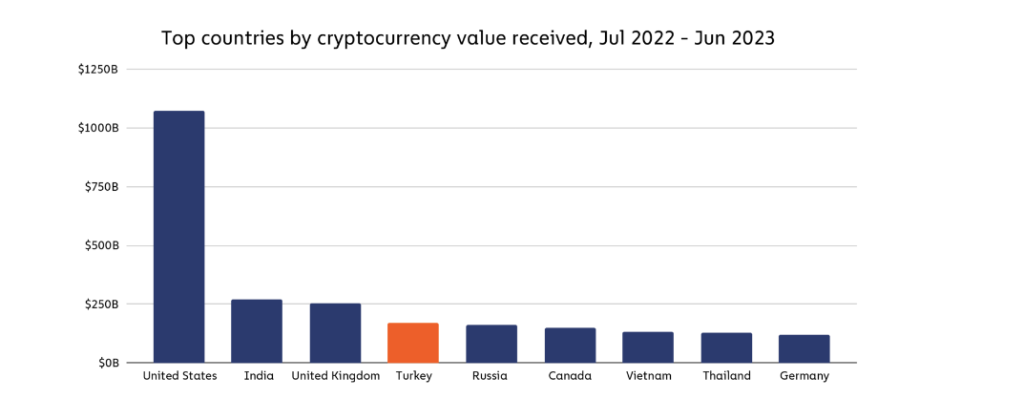

Turkey is the fourth-largest crypto trading market in the world

Turkey is a major global cryptocurrency economy and is one of the countries with the highest adoption rate of crypto in the world.

According to data from Chainanalysis, Turkey is the fourth-largest crypto market worldwide in terms of estimated trading volume of $170 billion, ahead of countries like Russia, Canada, Vietnam, Thailand and Germany.

In September 2023, Turkey’s national currency, the lira, became the top cryptocurrency trading pair on Binance, accounting for 75% of all fiat trading volume. The event was attributed to a significant influx of crypto investors in the Turkish market.

Some studies claimed that Turkey’s adoption rate has more than doubled in the past few years, reaching 40%. That study suggested that two in every five Turkish citizens hold crypto.

“The number of Turkish cryptocurrency investors is estimated to be 20 million, among 85 million of the total population of our country,” Polat said.

Why does Turkey want to adopt crypto regulations in 2024?

Turkey’s anticipated crypto legislation is poised to aid the country in exiting the Financial Action Task Force’s (FATF) “gray list” associated with Anti-Money Laundering (AML) measures. The regulator placed Turkey on its “gray list” in October 2021 over disproportionate regulation of the nonprofit organization sector.

According to Polat, Turkey is required to solve 39 action items in order to be upgraded from the FATF’s “gray list,” with one of them being related to the crypto industry. The FATF requires countries to comply with its framework to ensure that virtual assets are not used for criminal activities.

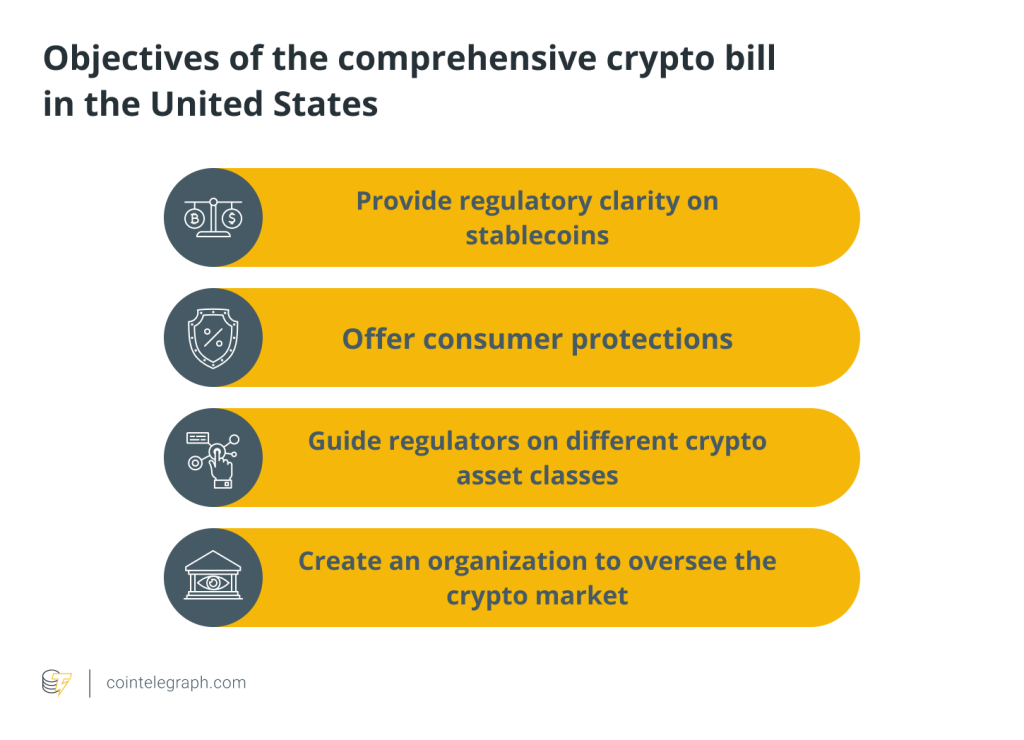

Turkey’s crypto law will address crypto exchanges, taxes and more

Turkey’s upcoming crypto regulatory legislation will mainly address regulation and licensing crypto exchanges.

The regulation will define the liabilities and responsibilities of exchanges, referred to as virtual asset service providers (VASPs) in the FATF’s framework. The law will also focus on standards related to safe custody, or the storage of crypto assets by VASPs in order to ensure maximum protection of investors.

The investor protection aspect became a burning issue in Turkey after the collapse of a major local crypto exchange called Thodex. The Thodex exchange abruptly halted trading and withdrawals in April 2021. Thodex founder Faruk Fatih Özer was eventually sentenced to 11,196 years in 2023 on indictment of fraud estimated at as high as $2 billion.

In addition to VASP regulations, the upcoming crypto law is expected to finally provide a legal foundation for crypto taxes in Turkey.

Related: Turkey tops the world in stablecoin buying share vs. GDP

According to local reports, Turkey’s Revenue Administration plans to impose low-rate transaction taxes on crypto, one of which is the Banking and Insurance Transactions Tax (BSMV), whose rate is 5% today.

The government is also expected to require citizens to declare their earnings on crypto but reportedly plans to set the withholding tax rate to zero.

Additionally, the upcoming bill is expected to address regulation of tokenizing real-world assets.

When Turkey is expected to introduce crypto legislation?

It is unclear when Turkey is expected to finally release its crypto legislation despite many publications expecting to see some progress early this year.

Some industry observers have linked the timing of the introduction of Turkey’s crypto law to the upcoming meeting of the U.S. Office of Foreign Assets Control in June.

“That’s when they will consider removing Turkey from the gray list. The law likely has to be passed and then the regulations have to be in effect before that,” Kaya told Cointelegraph, adding that the regulation is expected in May.

“My view or my guess is it will be at the end of this parliamentary season, which is, let’s say, June,” Polat noted, adding:

“But if they are not able to, then it means that it will be shifted to autumn or maybe the end of the year. So in my view the gray list issue is now a bit dropped from the agenda.”

Responses