Bitcoin post-halving price consolidation could last 2 months, says Bitfinex

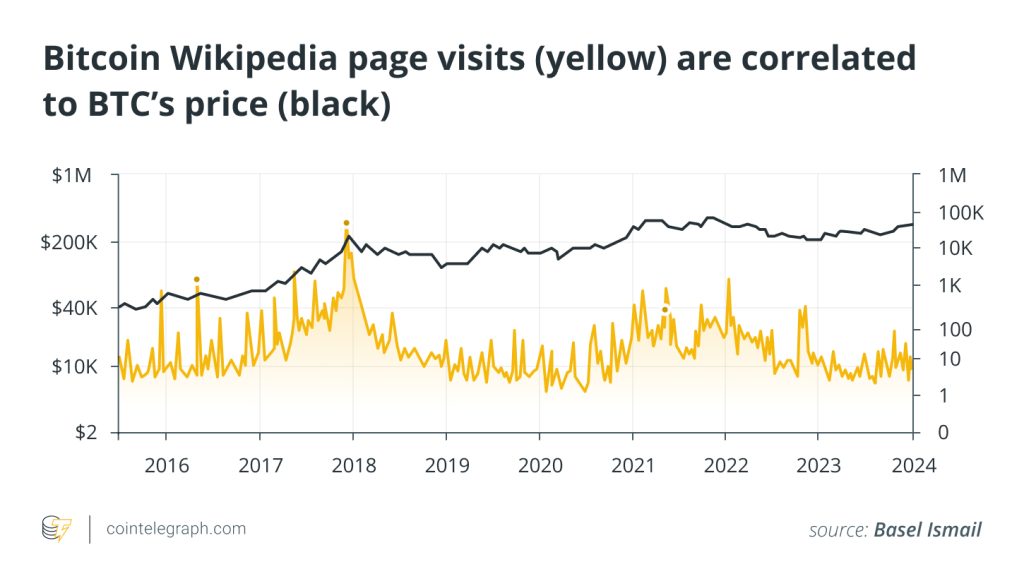

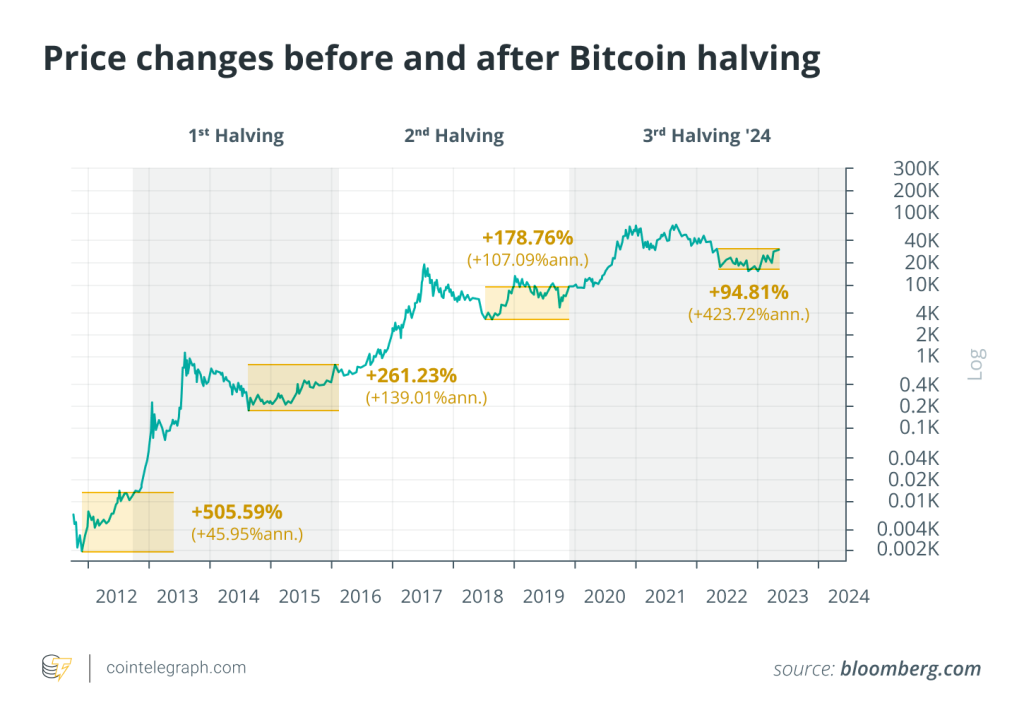

The Bitcoin halving is widely expected to have a positive impact on the price of the preeminent cryptocurrency, but analysts expect volatile price consolidation in the short term.

According to analysts at cryptocurrency exchange Bitfinex, Bitcoin (BTC) could experience up to two months of price consolidation following the halving.

The latest edition of the Bitfinex Alpha market report notes that Bitcoin could continue to be the price action benchmark for the crypto market in May and the leading indicator for the entire cryptocurrency market cap.

According to the report, the macroeconomic environment is more resilient than in previous years and the likelihood of rate cuts remains low in the short term.

Furthermore, the analysts said that general consumers and businesses are “better prepared and informed” about the state of the underlying economy when compared to previous crypto market cycles

“Consequently, we believe we could see a 1-2 month consolidation in Bitcoin prices, trading in a range with swings of $10,000 on either side.”

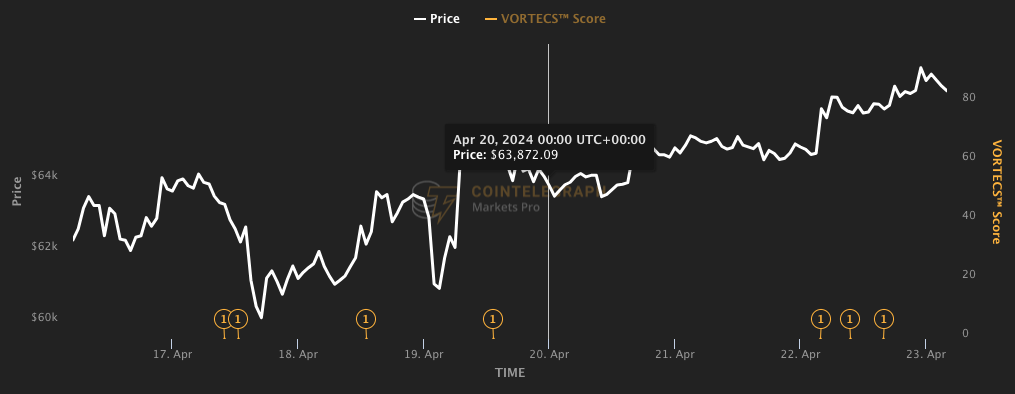

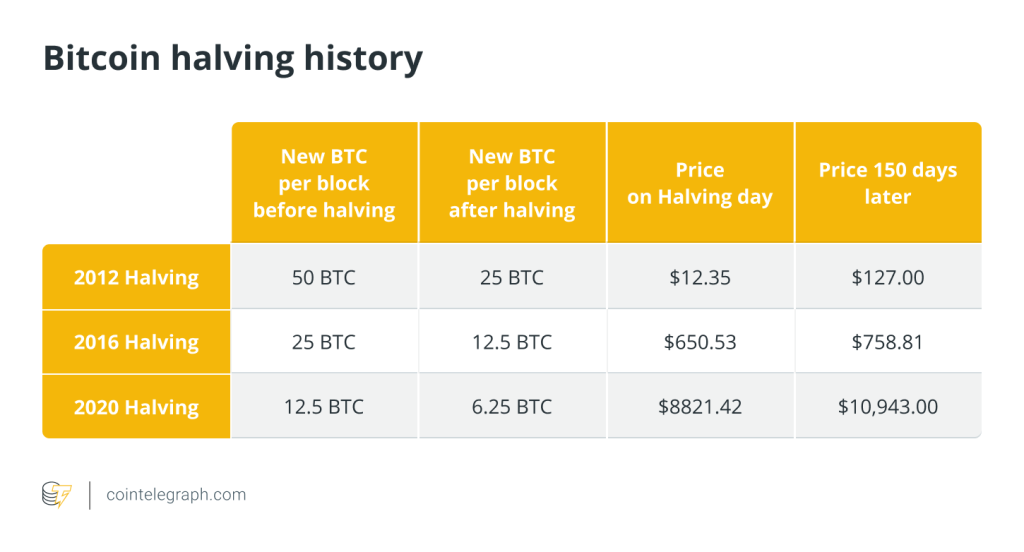

The report adds that any positive impact on Bitcoin’s price following the halving, which has reduced the supply of new BTC to the market, will be seen in later months.

“At this point, the economy is also expected to be performing better, having achieved a soft landing and avoiding a recession, providing further impetus to crypto assets,” the analysts wrote.

Related: The reasons Bitcoin price is down 11% since the halving

Various cryptocurrency traders are offering similar views on Bitcoin’s recent consolidation from its all-time highs over a month ago.

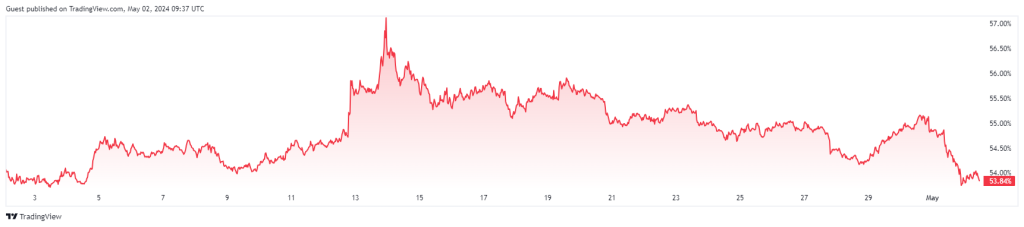

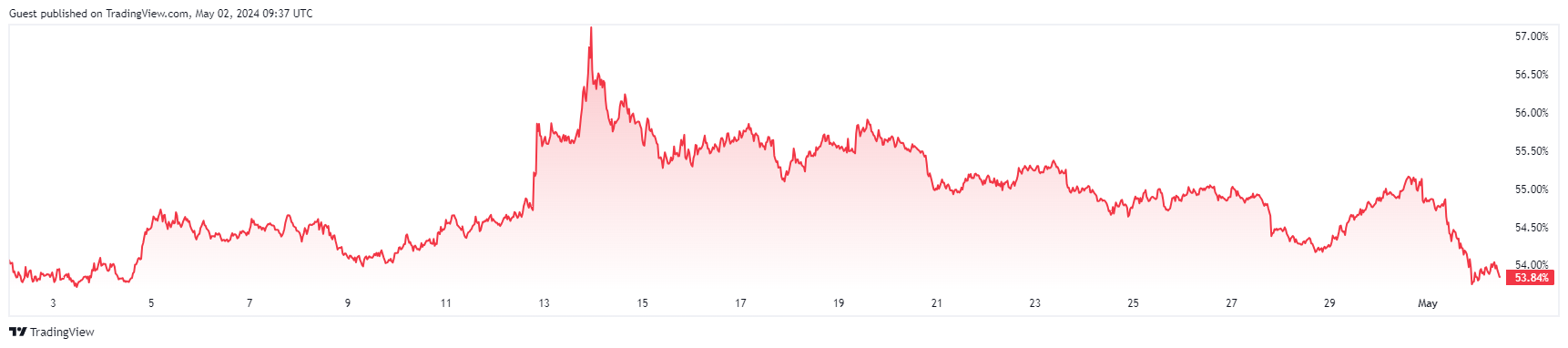

Michaël van de Poppe, founder of trading firm MNTrading, suggests that Bitcoin’s dominance may have peaked as traders begin to shift liquidity to altcoins. Crypto trader Matthew Hyland echoed this, also highlighting Bitcoin market dominance losing major support.

The Bitfinex Alpha report also dived into technical details of Bitcoin’s dropping market dominance. It notes that Bitcoin halvings historically see attention shift towards altcoins which rally and gain market share.

“This shift occurs as Bitcoin’s reduced supply growth rate is seen as a long-term bullish development, which increases investor risk appetite, leading investors to seek potential higher returns from alternative cryptocurrencies,” the report states.

Related: Bitcoin 4% dip may ‘panic’ short-term holders as price falls below average cost

Ether’s (ETH) recent market performance has seen it outperform Bitcoin in gains for two consecutive weeks, a metric which last occurred in February 2023. Bitfinex analysts add that a 7.5% increase in the ETH/BTC metric marks ETH’s strongest weekly gain against Bitcoin since the start of the year.

The report also highlights Ether’s long term role as a proxy for the altcoin market, making it a historical first mover before other altcoins catch up in terms of market trends.

Checkmate, the lead on-chain analyst at blockchain data firm Glassnode, also commented on Bitcoin’s recent consolidation. He explained that a gradual “de-leveraging” across Bitcoin futures has been ongoing since Bitcoin’s latest all-time highs in mid-March.

Responses