Indian enforcement agency collaborates with Binance to bust scam app

The law enforcement agency managed to track the funds linked to the E-Nugget scam app to different crypto exchanges and, with their help, seized over $10.5 million in crypto assets.

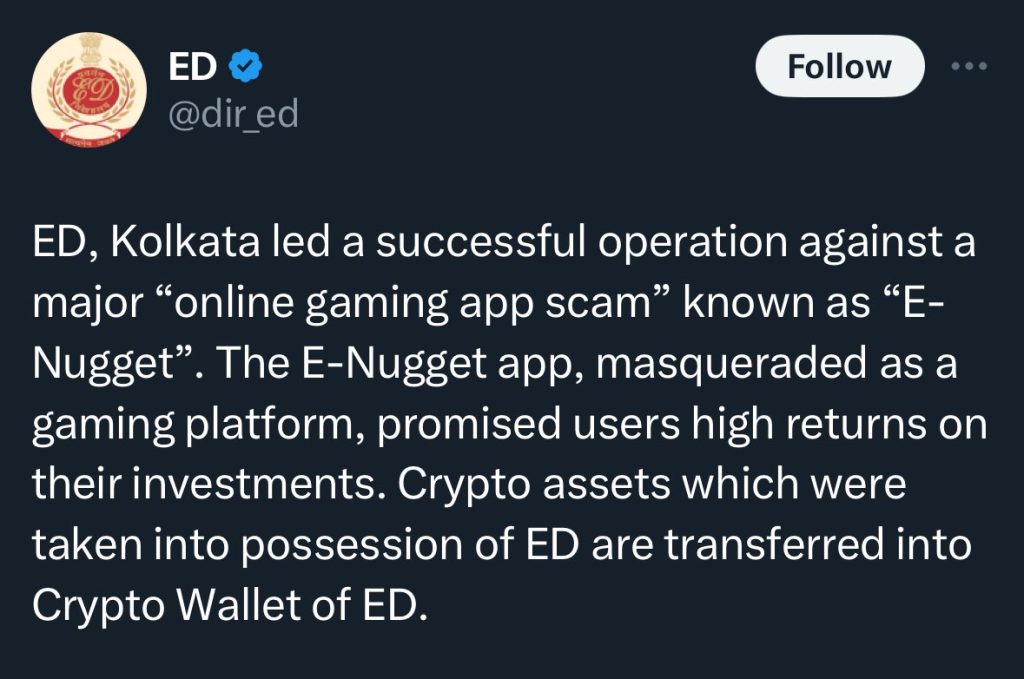

The Enforcement Directorate (ED) — an Indian law enforcement agency — seized 90 crores ($10.5 million) from an online scam app called E-Nuggets with the help of crypto exchanges such as Binance, ZebPay and WazirX.

According to a report published by the Hindu, the online gaming app E-Nugget had cryptocurrencies worth $10 million stored in 70 different crypto wallet accounts spread across the three crypto exchanges.

The ED contacted these exchanges to block the wallet addresses and transfer the crypto assets to the agency’s wallet.

In its report, the ED alleged that the E-Nugget app purportedly offered customers large returns on investment while disguising itself as a gaming platform.

The app presented a lucrative investment opportunity with several alluring real-money games that offered large commissions and were designed for users to wager on. However, as soon as money was invested, the app went dark, leaving investors stuck and unable to get their money back.

Related: Australia’s top exchange may approve spot Bitcoin ETFs this year: Report

The agency has attached and seized properties valued at over 163 crores ($19.5 million), including cash, cryptocurrency, account balances and office space.

The scam app first came under the radar in 2022 when some of the funds from the company were invested in digital assets. The ED investigation found 2,500 dummy bank accounts 19 crores ($2.2 million) worth of cash was found.

The suspected scheme mastermind, Aamir Khan, was arrested along with his accomplice Romen Agarwal and is currently in custody.

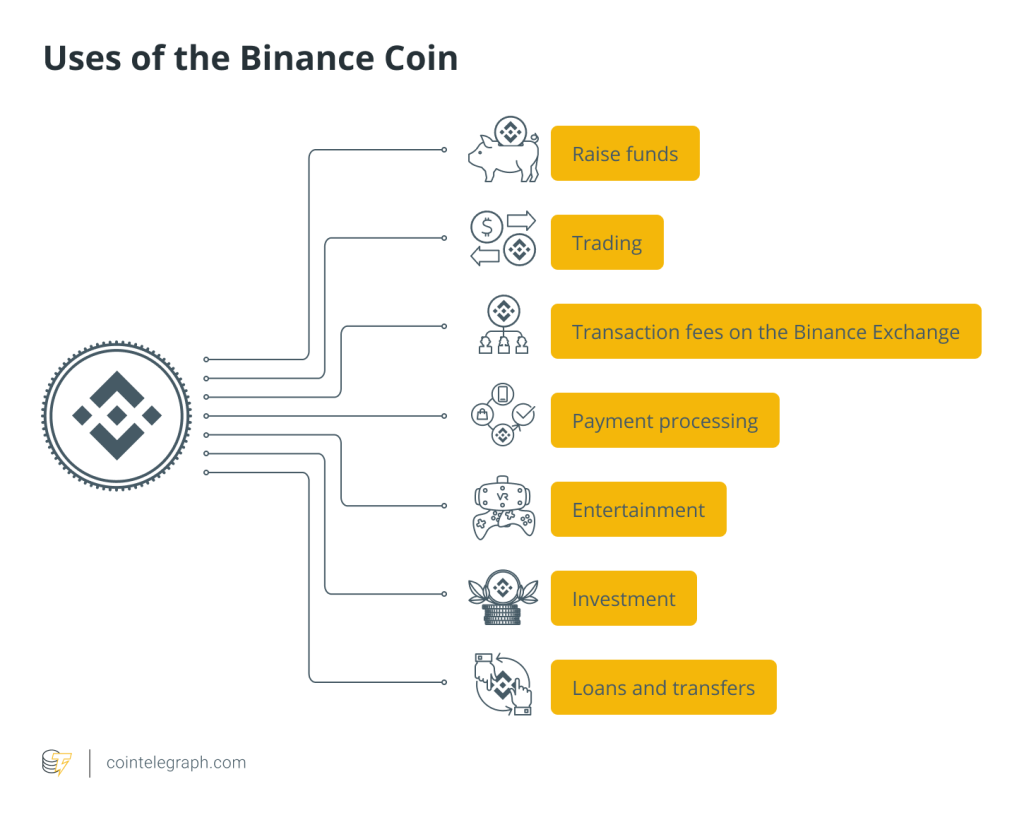

Since the money was being transferred using digital assets, the law enforcement agencies managed to trace it and subsequently freeze and seize it.

Although critics often try to point toward the use of cryptocurrency for money laundering, the nature of the blockchain makes it very difficult to launder the funds once identified. In numerous instances, crypto exchanges have traced and frozen funds linked to criminal activities.

The most prominent example of transparency and why it is difficult to launder funds using digital assets dates back to the 2016 Bitfinex hack.

Hackers managed to steal 119,756 Bitcoin (BTC) from the crypto exchange. However, the perpetrators behind the exploit were eventually caught and arrested in 2022 while trying to launder the funds.

Cointelegraph reached out to Binance and ZebPay for comments but had not received a response by the time of publication.

Responses