LEARN SWING TRADING IN 3 MINUTES – BLOCKCHAIN 101

Guide:

Swing trading is a commonly used trading strategy, especially suitable for beginners. Given its manageable time scope, it provides a relatively convenient way to express a viewpoint on the market. Swing traders are active in most financial markets, such as forex, stocks, and cryptocurrencies.

This article will present essential knowledge about swing trading in cryptocurrencies, helping you decide if it’s the right choice for you.

What is Swing Trading?

Swing trading is a trading strategy that involves attempting to capture price movements over a medium to short timeframe. The core idea behind swing trading is to catch the market “swings” that occur within a few days to several weeks.

Swing trading strategies work best in trending markets. If a strong trend emerges over a longer timeframe, there may be numerous swing trading opportunities, allowing traders to capitalize on significant price movements. In contrast, swing trading can be challenging in a consolidating market. After all, if the market is sideways, it’s tough to capture substantial price changes.

What is Day Trading?

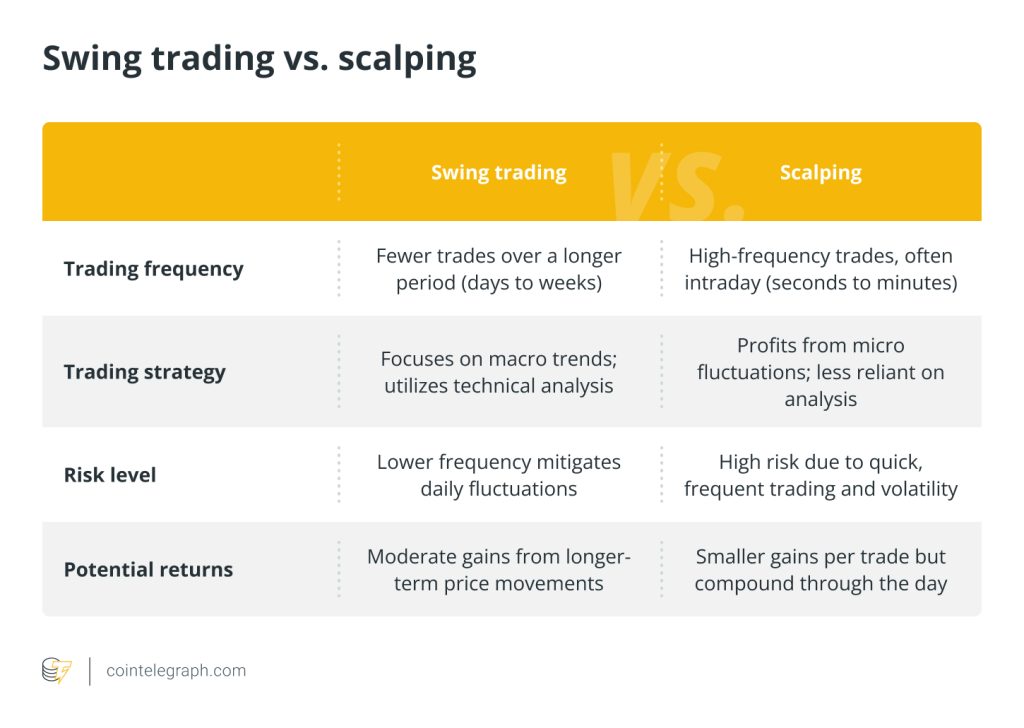

The central logic of day trading is almost identical to swing trading. The distinction is that day trading involves buying and selling assets within a 24-hour period, while swing trades typically last between 2 days to 2 weeks.

Day traders aim to hold for a while and then sell their assets for a decent profit. If an asset surges suddenly, a trader might wait for a reversal to occur on the same day. If an asset drops, the trader will try to apply the same strategy, exiting the market immediately once a bottom is found.

Day trading and swing trading each have their pros and cons. Day traders might be more inclined to pursue safer, smaller returns rather than taking risks waiting for a longer duration to achieve higher rewards.

Based on an asset’s volatility, swing traders can garner more substantial profits from their positions. Day traders will close out positions within a day, while swing traders will wait for assets to appreciate (or depreciate) before exiting the market.

This also elevates the risks for swing traders. The asset they are trading might undergo trend changes – something day traders are less exposed to.

Practical Application: The Consolidation Market is the Ideal Battleground for Swing Trading!

Every market plunge resulting from external shocks presents opportunities for investors in a consolidation market. In a market dominated by the play of existing funds, breakthroughs are challenging. Only by reaching a low point can opportunities arise.

A consolidation market is characterized by repetitive swings. There are plenty of opportunities to capitalize on both upward and downward movements. And the decline usually has a rhythm: if there’s a short-term dip, a rebound is imminent. However, investors must give the market some time. Don’t buy immediately after a sharp decline; wait for the exhaustion phase.

The consolidation market tests one’s trading discipline. It’s not just about avoiding panic during dips and greed during surges. It’s also about execution. Having a plan, setting stop-loss and take-profit levels, and not following through renders everything pointless.

Similarly, if you lack swing trading skills and cannot endure the market’s fluctuations, then all efforts are in vain. It’s easy to understand this, but hard to admit. Many tend to live in their imagined market scenarios, rather than adapting to actual market conditions.

Another crucial point is not to frequently change cryptocurrencies in a consolidation market. Often, switching cryptocurrencies is meaningless because it’s the overall market condition causing a downturn. What investors should do is control the rhythm through position management. Being familiar with a particular cryptocurrency is an advantage. Constantly changing to unfamiliar coins only increases the likelihood of making mistakes, leading to a disrupted trading rhythm.

Therefore, the essence of swing trading lies in an investor’s ability to uncover industry value points and familiarity with the characteristics of the project.

Practical Application: Case Study

Step 1: Choose a familiar cryptocurrency, like BTC.

Step 2: Identify support and resistance (pivot) levels. For this, please refer to the previous article on ” LEARN RESISTANCE LEVEL IN 3 MINUTES “.

Step 3: Determine if it’s a consolidation market. As mentioned earlier, the consolidation market is the best time for swing trading. Once you’ve chosen a cryptocurrency and identified its support and resistance levels, you need to determine if the market is in a consolidation phase.

Consolidation mainly comes in three types:

-

Uptrend: Higher highs and higher lows.

-

Downtrend: Lower highs and lower lows.

-

Range-bound trend: Horizontal movement.

The following diagram illustrates a typical uptrend:

In the figure above, each peak is higher than the previous one. In such a bullish trend, it’s a good opportunity to buy.

The next picture illustrates a typical downtrend:

In the figure above, each peak is lower than the last, signaling a good opportunity to sell.

The range-bound trend is the most common type of trend. Although no bullish or bearish trend appears in the figure, swing traders can still profit within this range, and it might even be easier than in the other two types of consolidation trends. How? By leveraging support and resistance levels.

As shown in the following diagram, note the two lines:

We can set take-profit and stop-loss levels at the positions of these two lines. When there’s no breakout, you can proceed to buy or sell.

Conclusion

Swing trading is a commonly used strategy in the trading market. Swing traders usually hold positions for a few days or weeks, depending on individual trading methods.

Should you choose swing trading or day trading? To find out, the simplest method is to try both and see which one best suits your trading style. Lastly, please remember that setting take-profit and stop-loss levels and adhering to them is crucial.

Responses