BONK, POPCAT and Solana memecoins stay green even as Bitcoin price drops

Memecoins in the Solana ecosystem defy the recent bearish downtrend in the crypto market by managing to generate double-digit gains.

Nearly every corner of the crypto market has corrected at some point in April, but, memecoins in the Solana ecosystem seem to be charting a different path.

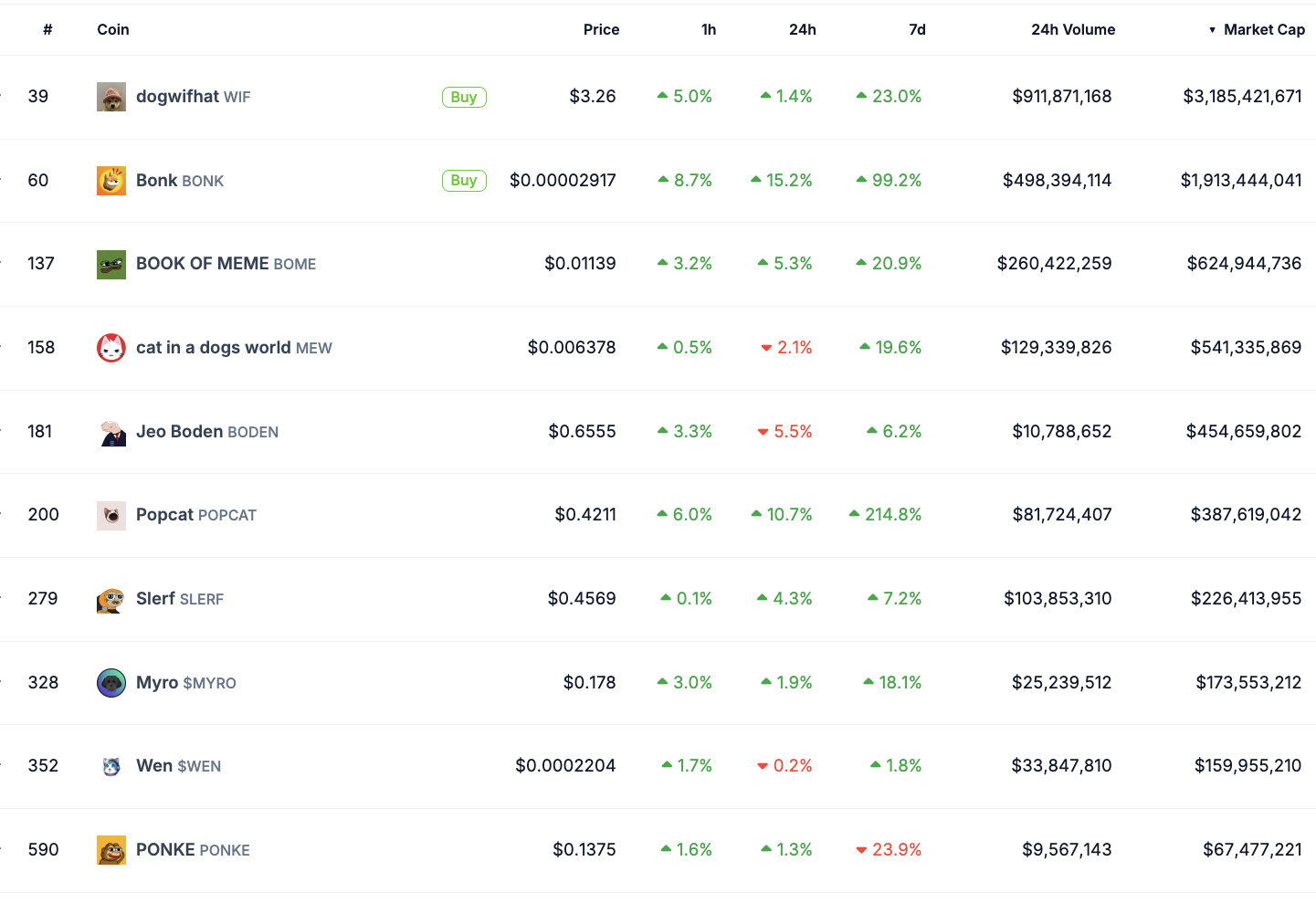

According to CoinGecko data, the total market capitalization of memecoins on Solana has significantly risen in the last 24 hours, climbing 4.2% to $8.261 billion.

Bonk (BONK) gained the most, rising 15.2% over the last 24 hours and 8.7% in the last hour. Popcat (POPCAT) followd with double-digit gains of 10.7% over the last 24 hours and 214% over the last seven days.

The leading Solana-based meme token by market value — Dogwifhat (WIF) — saw a 1.4% price ascent on the day and a 5% increase in an hour, bringing its market cap to $3.185 billion. Notably, WIF still accounts for nearly half of Solana’s total memecoin market share.

Many crypto analysts believe that it’s common for memecoins to pump on launch and plummet sharply when the price of BTC crashes.

Mert Mumtaz, the co-founder and CEO of Helius Labs pointed out the importance of memecoins for the industry and the networks hosting them, saying memecoins are good for “getting crypto into the hands of more people” and for stress testing the network.

Mumtaz added,

“Memecoins have improved Solana 10x long-term, just as NFTs had done in 2021.”

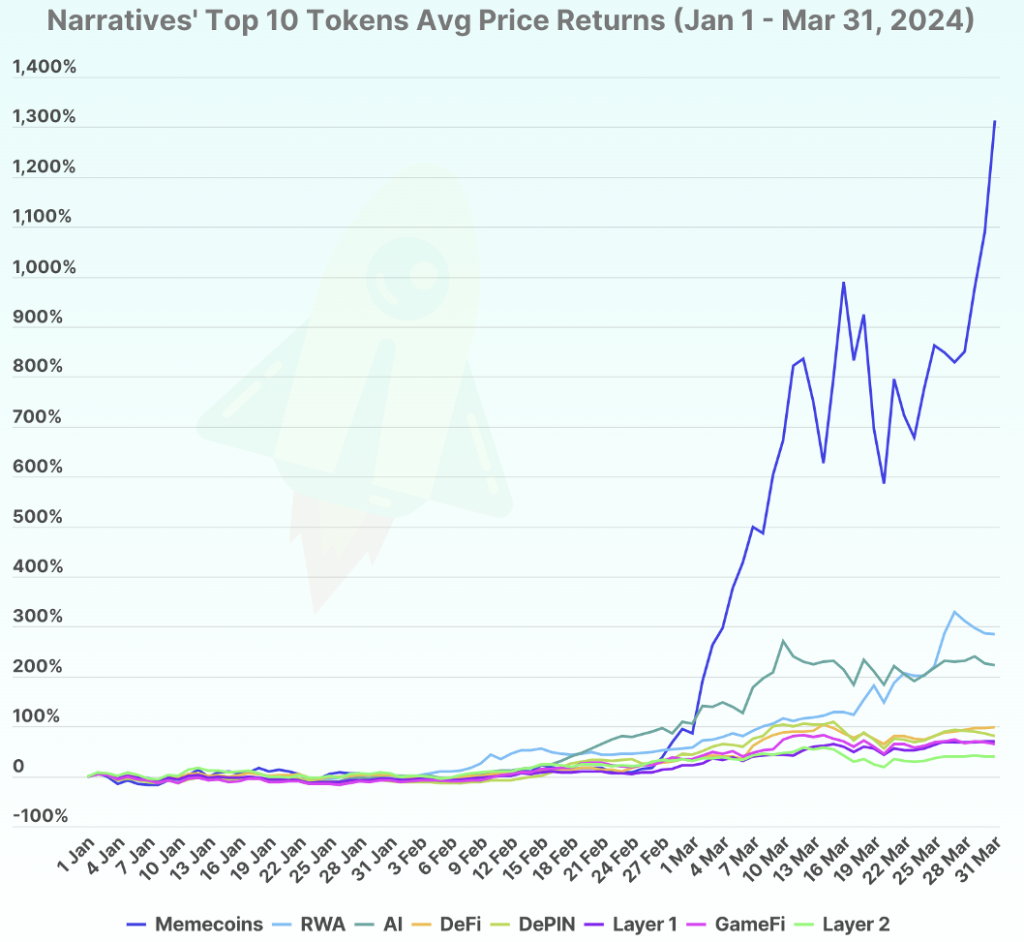

According to a recent report by CoinGecko, the memecoin sector has emerged as the most profitable narrative year-to-date..

The bullishness displayed by Solana memecoins reflects a broader trend of capital moving back into the riskier assets as the market readies for a sustained recovery after the April 20 Bitcoin halving event.

Solana network activity spikes

The rally in Solana memecoins amid a pullback in the broader market is evidence of the increased relevance of Solana as a layer 1 ecosystem. This means investors’ sentiment toward the blockchain is not speculative. Instead, it is rooted in genuine user engagement and high development activity.

Its potential has been reinforced by high transaction volumes and growth in DeFi applications (DApps).

Related: Why is Solana (SOL) price down today?

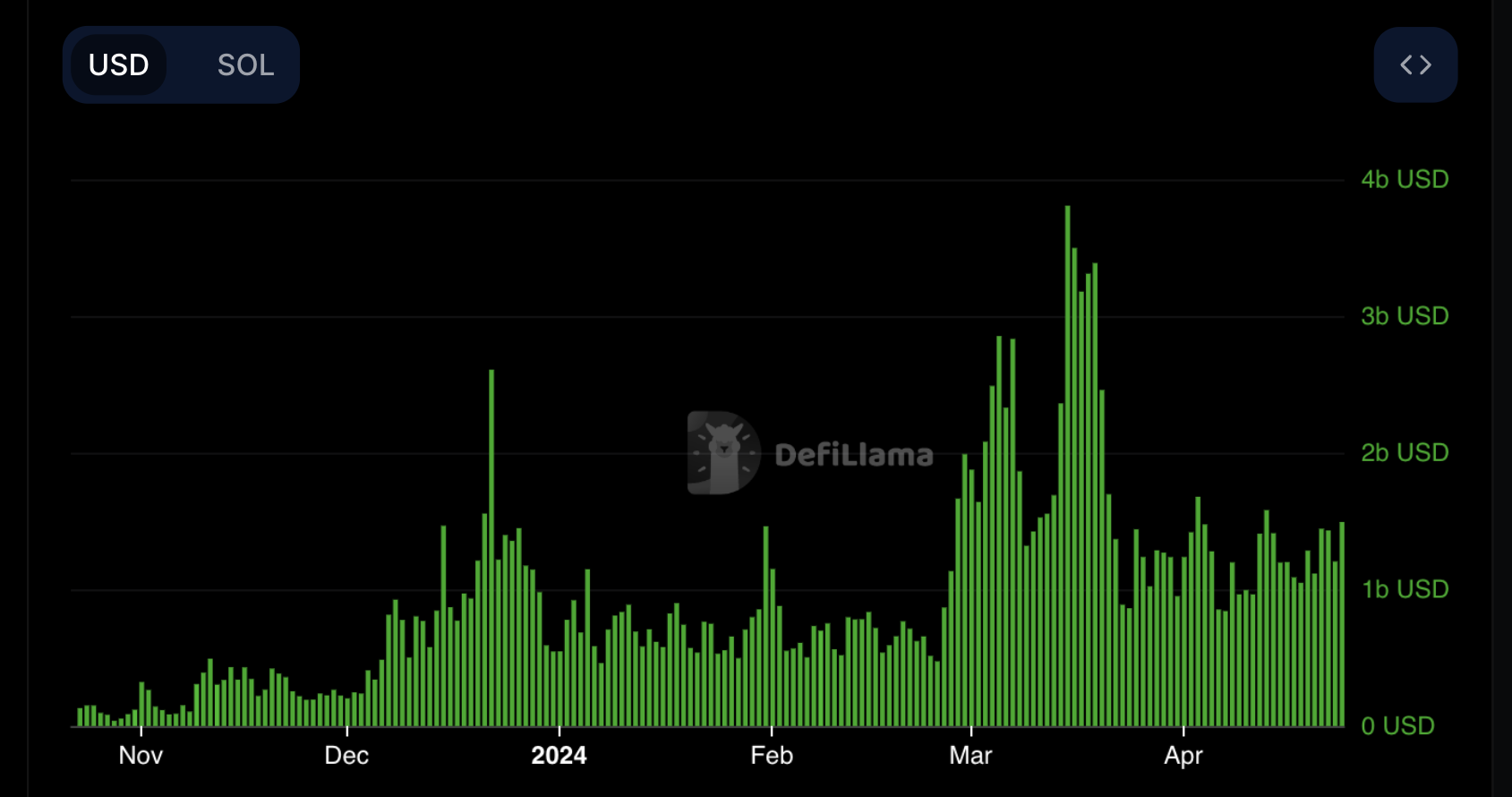

Data from DefiLlama reveals that volume on Solana climbed to $1.5 billion on April 25, up from $840 million on April 7. The blockchain’s all-time high volume is $3.8 billion — a figure set on March 15.

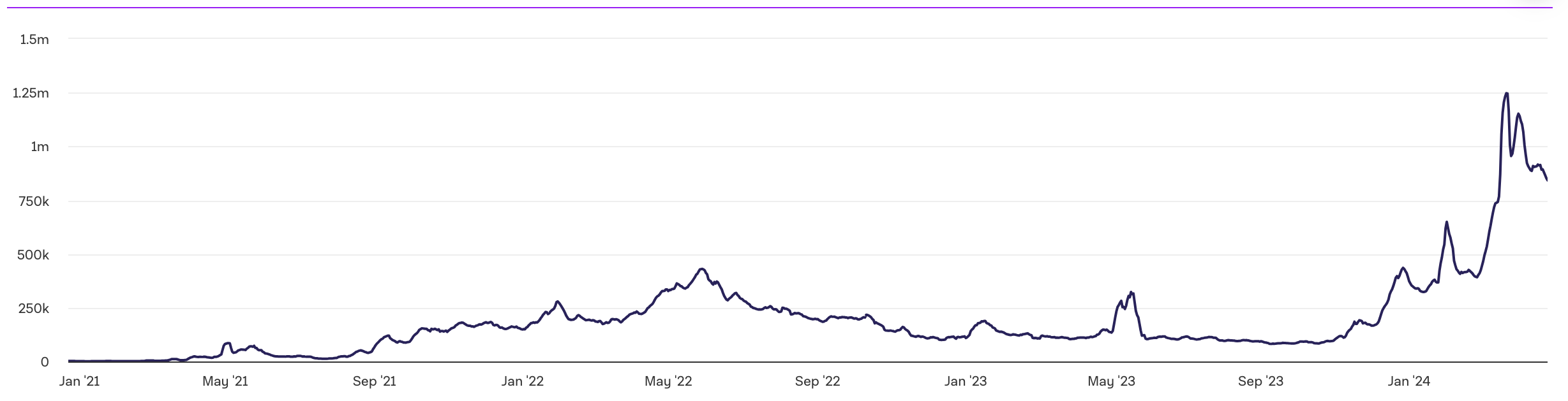

Looking at other metrics, data from The Block shows that the number of active addresses on the Solana network continues to rise. According to the chart below, more than 842,000 active addresses were clocked yesterday—higher figures than those recorded in 2022 and 2023.

Solana price in slight retracement

Compared to memecoin gains, the price of Solana (SOL) has experienced a pullback after its rally that began on April 17.

Data from Cointelegraph Markets Pro and Tradingview shows that SOL’s price decreased by 1.15% in the past 24 hours to $147.

Trading volume across all major centralized cryptocurrency exchanges has dropped by 56% from a six-week high of $8.9 billion on April 13 to $3.9 billion, according to data from CoinMarketCap.

Responses