$510M longs at risk if Ether repeats last weekend’s volatility

Even a small 2.25% decline this weekend could trigger the liquidation of over $500 million in Ether long positions.

More than half a billion dollars worth of Ether (ETH) long positions could face liquidation if Ether experiences the same price volatility as last weekend.

This comes amid mounting concerns that the United States Securities and Exchange Commission (SEC) might reject spot Ether exchange-traded fund (ETF) applications in May.

At the time of publication, Ether is currently trading at $3,134, according to CoinMarketCap data.

Over the past few weekends, Ether has experienced short bursts of volatility in its price, followed by quickly recovering to key support levels.

On April 20, the price briefly dipped by 2.25% to $3,036. The previous Saturday, April 13, it fell nearly 9% to $2,950 before recovering to $3,075.

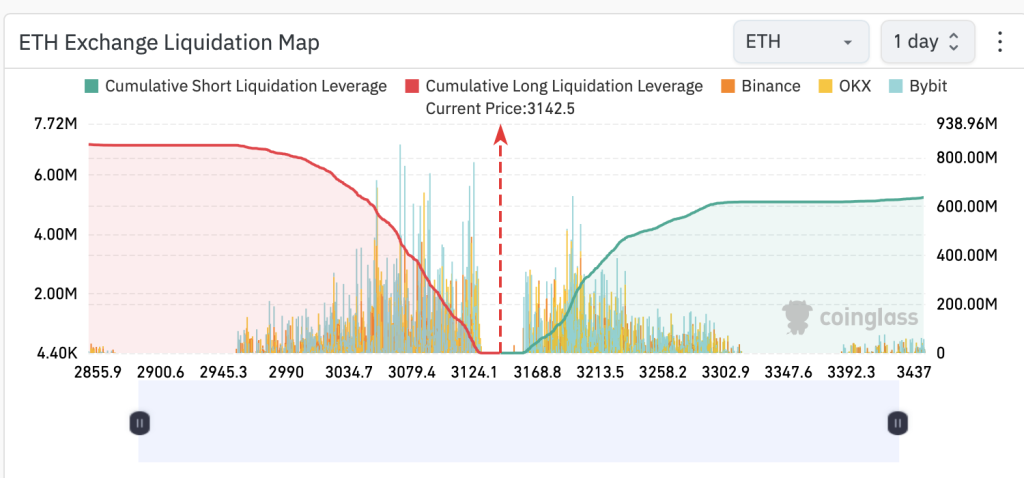

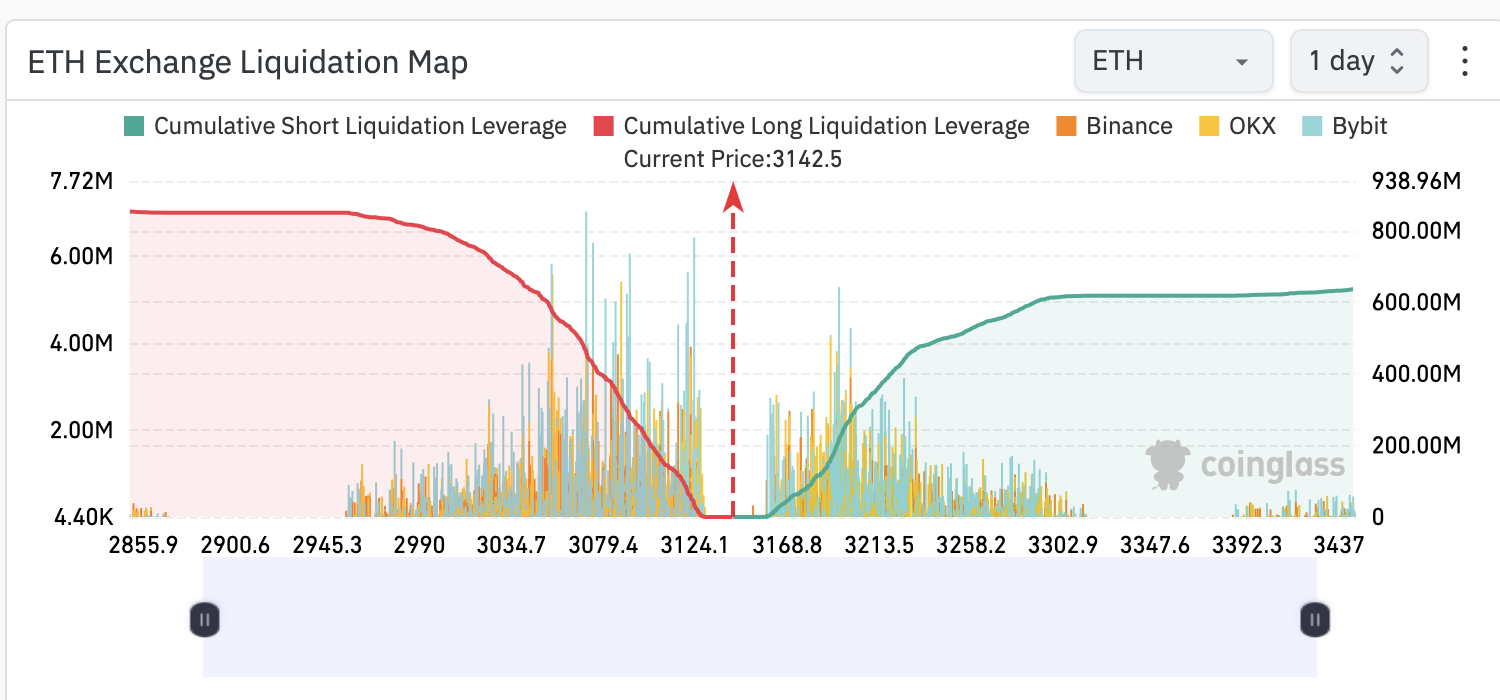

If it happens again this weekend, a significant amount of liquidations will be at risk. A similar drop of just 2.25% at its current price will lead to $510 million in long liquidations, according to CoinGlass data.

Meanwhile, a sharper decline similar to the 9% drop seen the previous weekend would result in $853 million being wiped in long liquidations.

The high volume of potential liquidations comes as Ethereum is experiencing broader uncertainties regarding the status of spot ETF applications, along with other legal challenges.

Related: Ethereum price data points to strong resistance at $3.5K

On April 24, Cointelegraph reported that U.S. issuers and other firms expect the SEC to reject spot Ether ETF applications in May following meetings with the regulator in recent weeks, citing four people who participated in the meetings.

The four persons claimed that recent meetings between issuers and the SEC have been one-sided, and agency staff have not discussed substantive details about the proposed products.

Meanwhile, on April 25, software development company Consensys filed a lawsuit against the SEC and its five commissioners over claims it plans “to regulate ETH as a security.”

Responses