Memecoins are like a ‘risky casino’ — Andreessen Horowitz exec

The chief technology officer of VC firm Andreessen Horowitz said that memecoins are like risky casinos that deter real builders from the crypto ecosystem.

The chief technology officer of the United States-based venture capital firm Andreessen Horowitz (a16z) has compared the ongoing memecoin frenzy to a “risky casino.”

A16z’s Eddy Lazzarin said in an X post that memecoins hamper the long-term vision of crypto that has kept so many of the original builders in the space.

He added that these memecoins aren’t technically exciting or attractive to builders and alter how the public, regulators and entrepreneurs see crypto:

“At best, it looks like a risky casino. Or a series of false promises masking a casino. This deeply affects adoption, regulation/laws, and builder behavior. I see the damage every day.”

He also addressed whether memecoins can find a place in mainstream investments like other crypto assets such as Bitcoin (BTC). The raging debate on the memecoin frenzy comes amid a recent report that suggests hedge funds are being lured into memecoin investment, looking for hefty returns.

The a16z executive received a lot of flak from the memecoin community, who were quick to point out the venture capitalist also funds investments in nonfungible tokens, which have seen prices tumble.

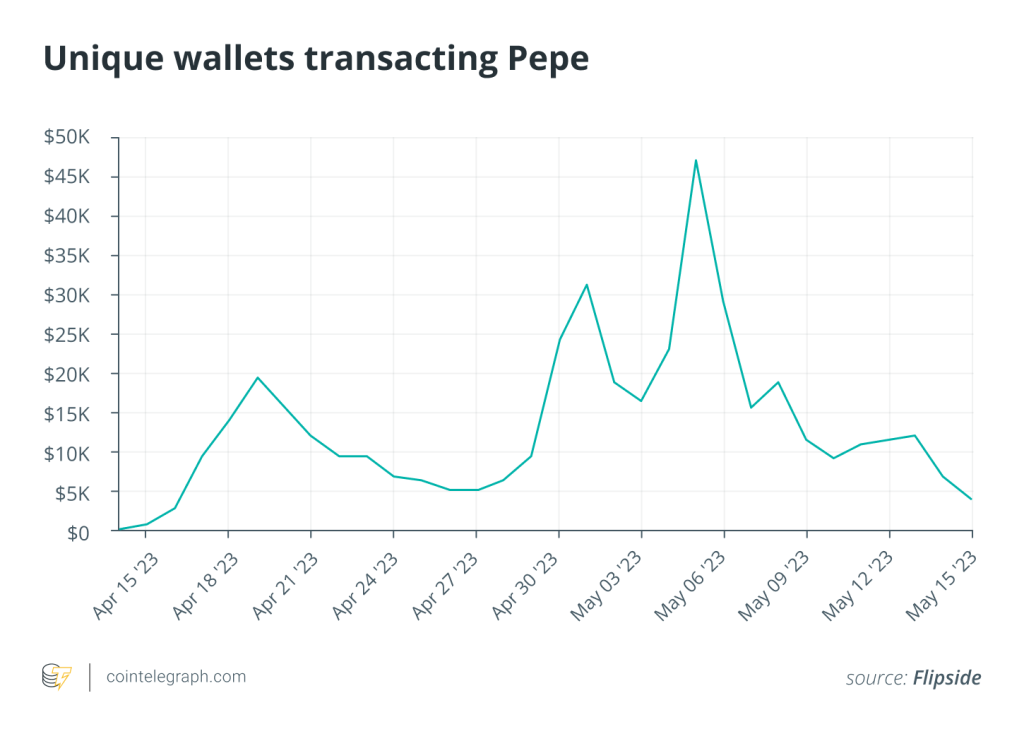

The memecoin frenzy in this bull market has seen explosive growth and hefty returns for tokens that are barely a couple of days old.

For example, the Book of Memes (BOME) token surged over 30,000% within a week of its launch and garnered a billion-dollar market cap before being listed on centralized exchanges.

Related: SEC lawyers resign after ‘gross abuse’ of power in crypto case — Report

Similarly, another popular memecoin, Dogwifhat (WIF), which launched in November 2023, has risen to over $3 billion in market capitalization, placing it in the top three memecoins.

Half a dozen memecoins have grown to gain mainstream media attention this cycle. However, that is only half the picture, as thousands of other memecoin projects have either orchestrated rug pulls or were dumped on the market straight after launching.

The stories of traders turning a few hundred dollars into millions often lure hundreds of new inexperienced traders to the crypto market.

However, most traders lose money chasing that one memecoin that could turn their fortunes around. Thus, just like gambling, these memecoins are a way for newcomers to try their luck.

Pro-crypto enthusiasts have voiced their opinions against memecoins, saying they don’t have any use case or real-world value.

Responses