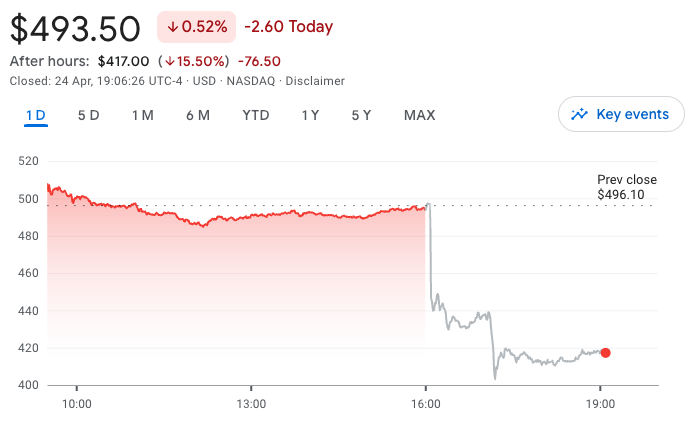

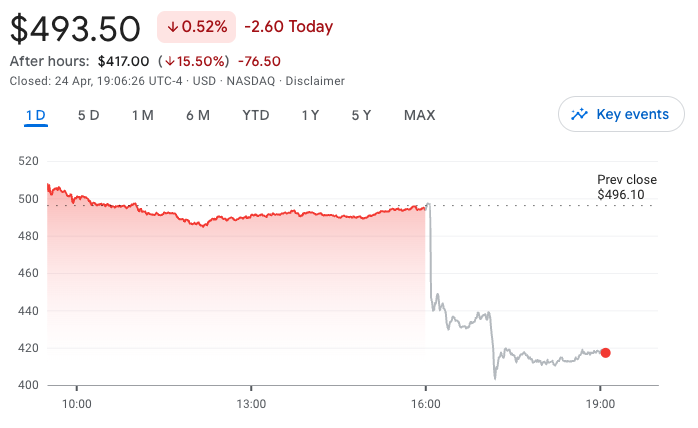

Meta drops 15% on weak outlook and high AI and metaverse spending

Meta shares dipped after a disappointing Q2 revenue outlook and plans to spend nearly $100 billion this year as it aims to “invest aggressively” in its AI products.

Meta (META) shares dropped 15% in after-hours trading after the firm said it will “aggressively” ramp up spending in artificial intelligence spending while its metaverse division will continue to run at a loss — amid a weak revenue outlook.

The giant said in its April 24 first quarter 2024 results it expected expenses to rise to a range between $96 billion to $99 billion — up from $94 billion to $99 billion due to “higher infrastructure and legal costs.”

It also bumped full-year 2024 capital expenditures to a top end of $40 billion from its prior $37 billion as it would “invest aggressively to support our ambitious AI research and product development.”

Its metaverse building Reality Labs lost $3.85 billion in Q1 — down from nearly $4 billion it lost in Q1 2023 — but Meta said expected these losses to increase year-on-year to bankroll the division’s product development.

Related: Mark Zuckerberg says Meta wearables that read brain signals are coming soon

Meta shares slid 15.4% after-hours on April 24 to $417.22 following it closing the day down 0.5% at $493.50, according to Google Finance.

Meta is, however, still up 42.5% year-to-date after hitting an all-time high of $527.34 earlier this month on April 5.

AI Eye: How to get better crypto predictions from ChatGPT, Humane AI pin slammed

This is a developing story, and further information will be added as it becomes available.

Responses