Bitcoin analysts agree that BTC has ‘a lot further to run’

Key on-chain metrics suggest a higher baseline for Bitcoin price now that the halving is complete.

Analyst and founder of the Capriole Investments fund Charles Edwards said multiple on-chain metrics suggest that Bitcoin and other cryptocurrencies have “a lot further to run” in this bull market.

In his latest newsletter, Edwards explained that transaction fees from the recent Runes launch and other long-term metrics after the Bitcoin halving suggest “higher baseline Bitcoin (BTC) prices.

“Bitcoin now harder than gold”

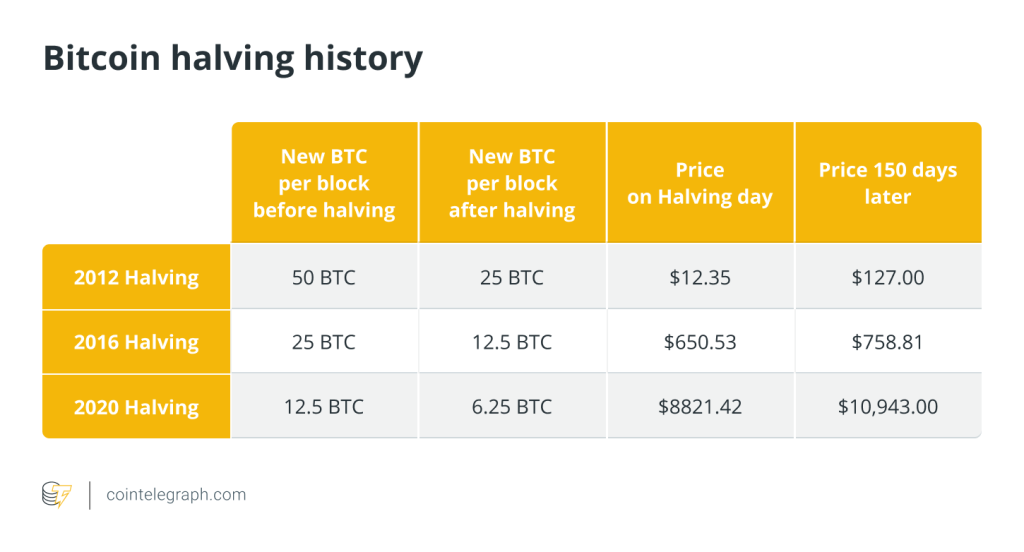

Bitcoin’s fourth halving resulted in a 50% drop in the digital asset’s supply growth rate, surpassing gold in terms of inflation rate.

Edwards said long periods of continuous currency debasement and high inflation rates place Bitcoin at the forefront of “global fungible assets” for long-term wealth preservation.

“Gold’s inflation rate went up +50% in 2023 to 3% p.a. That makes Bitcoin’s inflation rate less than one-quarter of gold’s. Bitcoin is now the hardest store of value.”

Market intelligence firm Glassnode reached a similar conclusion, saying that the halving resulted in Bitcoin decisively surpassing gold in terms of issuance scarcity.

Glassnode analysts said:

“The fourth halving also marks a significant milestone in the comparison of Bitcoin to Gold as for the first time in history, Bitcoin’s steady-state issuance rate (0.83%) becomes lower than gold (~2.3%), marking a historic handover in the title of scarcest asset.”

Meanwhile, American entrepreneur and former CEO of cryptocurrency exchange BitMEX Arthur Hayes said governments of the world will continue printing money to offset their debts, and their currencies will lose out against Bitcoin.

This makes Bitcoin the “hardest money ever created.”

Related: Price analysis 4/24: BTC, ETH, BNB, SOL, XRP, DOGE, TON, ADA, AVAX, SHIB

History rhymes but it may not repeat itself

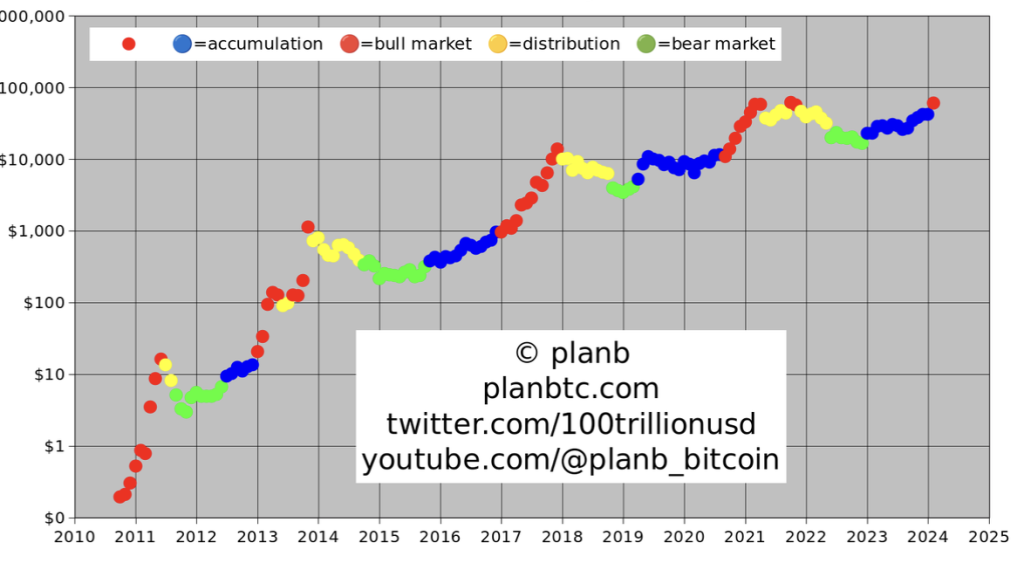

Many analysts have voiced their opinions on the implications of the Bitcoin halving on BTC price. Edwards now believes three things are likely to happen to the BTC post-halving.

The first scenario assumes that the BTC price will skyrocket. The second assumes that approximately 15% of Bitcoin miners will shut off their gear and quit the business. The third assumes that transaction fees will stay at a much higher level than average.

Edwards says he expects “a bit of all three” to happen.

“Bitcoin’s days under $100K are numbered.”

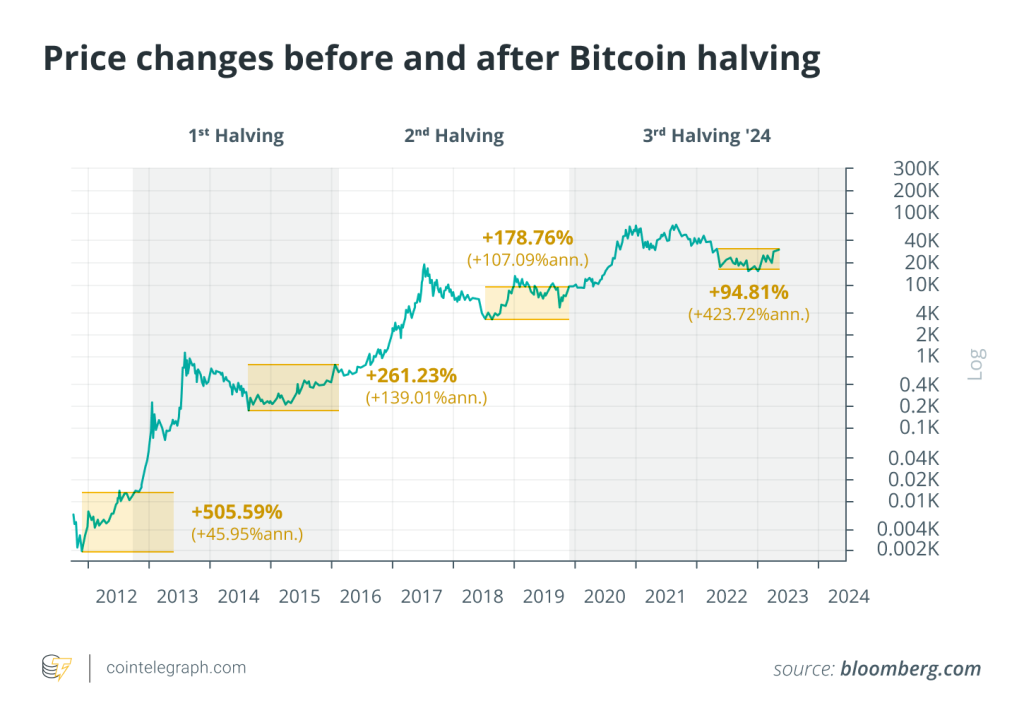

However, Glassnode cautioned its readers to manage their expectations against historical precedents, arguing that the performance of Bitcoin across various halving epochs is “very widespread” and “too different” to be used as a guide today.

“We do see both diminishing returns and a shallower total drawdown effect over time, which is a natural result of the growing market size and the scale of capital flows required to move it.”

Glassnode assessed BTC price performance between the cycle low and the halving and found that while there was a stark similarity between 2015, 2018 and the current cycle with between 200% and 300% price increases, the 2024 one was different as it broke the previous all-time high before the halving event.

“The ATH we saw in March comes off the back of both a historically tight supply and the remarkable demand interest brought online via the new spot ETFs.”

Glassnode also noted that while halving epoch 2 saw a larger price performance in the 365 days following, the current market dynamics and landscape are significantly different relative to the previous halving events.

While Glassnode did not rule out the possibility of an exponential growth in BTC price, they suggested that things might not play out exactly as they did in the past.

Hayes, on the other hand, said that BTC’s path from the current levels to $1 million may not be as difficult as its history of rising from zero, buoyed by the bursting of the sovereign debt bubble.

Responses