Bitcoin price rallies on halving day, but what do futures markets show?

Bitcoin’s price whipsaws align with global conflict and macroeconomic concerns, but data shows investors’ halving expectations positively impacting BTC price.

Bitcoin (BTC) witnessed a sharp 6% drop on April 19, falling to a low of $59,640 in the early hours, before quickly recovering to secure support above $64,500.

This rebound was driven by the optimism surrounding the upcoming Bitcoin halving, scheduled for April 20, which typically attracts significant interest from both traditional media and spot Bitcoin exchange-traded fund (ETF) providers. This event appears to have helped with offsetting the negative impacts of broader socio-economic challenges.

During the current tumult, the geopolitical landscape adds to the market’s volatility. As tensions escalate in the Middle East, Bitcoin’s price movement seems to correlate with global events. However, a recovery was aided by reassurances from Iranian officials, who stated there were no plans for retaliation, thus soothing markets’ nerves.

Low liquidations during extreme volatility strengthen the $60,000 support

Despite the dramatic $5,850 swing in Bitcoin’s price on April 19, liquidations in BTC futures remained relatively minimal, totaling around $45 million, as per data from Coinglass. This suggests that market participants were not heavily leveraged, a bullish signal considering that the $60,000 level has become a significant psychological support.

Cryptocurrency analysts at Amina Bank suggested that geopolitical tensions are not the sole drivers of market sentiment. As noted in their research, “Trading volumes, ETF flows, and news coming out of US inflation data are also pivotal.” These analysts also pointed out that miners are selling off their Bitcoin in anticipation of the halving, trying to secure profits before the reward reduction.

From an economic perspective, the resilience in U.S. inflation data and strength in the labor market, supporting a 0.7% year-over-year growth in retail sales, has led to reduced odds that the U.S. Federal Reserve will reduce interest rates in the next couple of months. This skepticism is reflected in the 5% decline of the S&P 500 index since it retested its all-time high of 5,265 on March 28.

Bitcoin halving proximity caused no relevant changes in BTC futures metrics

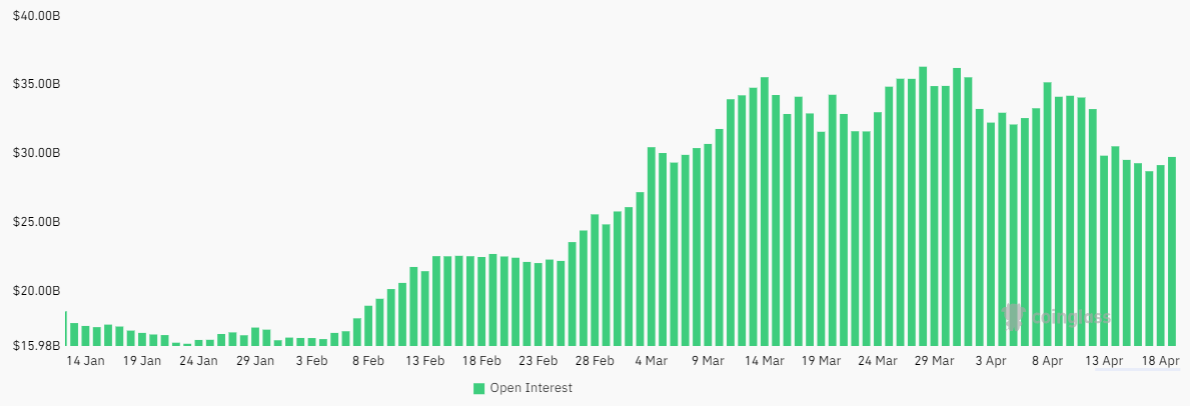

A bird’s eye view from BTC derivatives markets is a good starting point to analyze if the Bitcoin halving has driven considerable bets. According to BTC futures data, the current open interest stands at $29.8 billion, only slightly up from $28.6 billion two days prior. This slight increase suggests that the Bitcoin halving event has not sparked a significant surge in demand for leverage.

When viewed over a larger time frame, the demand for BTC futures appears subdued compared to the previous week’s $35.5 billion. Thus, there is no indication of excessive demand solely caused by the Bitcoin halving expectation.

Related: Is Bitcoin’s negative futures funding rate a sign of an upcoming BTC price crash?

To understand professional traders’ positions after the substantial price swing, one should analyze BTC futures premium. Such metric typically trades at a 5%–10% annualized premium compared with spot markets, indicating that sellers demand additional money to postpone settlement.

The premium for 3-month BTC futures is currently at 11%, which is moderately bullish but represents a decrease from last week’s 16%. Notably, even during the swift retest of the $60,000 level on April 19, the premium managed to maintain a robust 9%. The data indicates that while the market is cautiously optimistic, there is no rush of short-term speculative betting in anticipation of the halving event.

Responses