LEARN RANGE TRADING IN 3 MINUTES – BLOCKCHAIN 101

Abstract

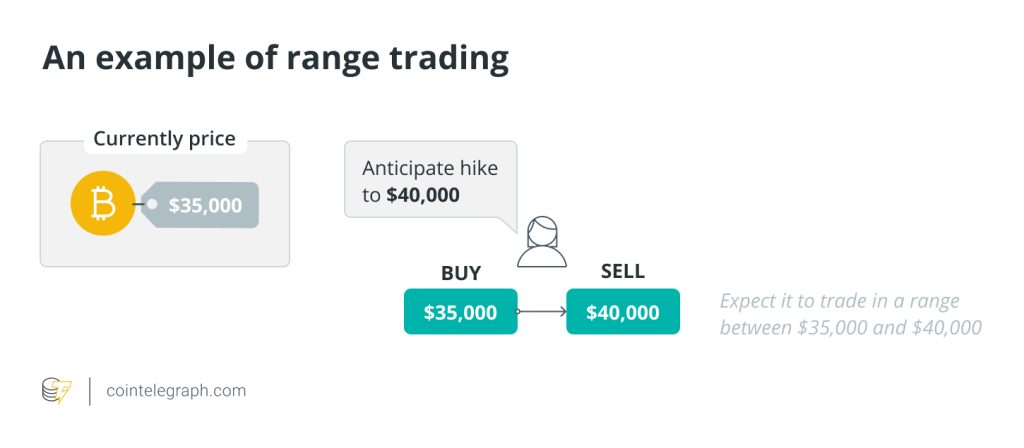

Interval strategy refers to the method by which traders make use of the market with small horizontal fluctuations (also known as sideways market) to make profits. For example, users who trade sideways will repeatedly buy assets at the support level (that is, the lowest price in the range) and then sell them at the resistance level (that is, the highest price in the range).

Guide reading

When each peak and each valley are at a relatively close price level, a trading area will appear.

Between (also known as consolidation trend), as shown in the figure below.

At this time, there are many peaks at a specific price, and the valleys are all gathered at a certain distance below the peaks. When a megatrend is in a state of temporary stagnation, such a pattern will appear. Trading range is also called consolidation or congestionarea or rectangle formation.

Charles dow called the latter small rectangular band line formation, and detailed the specific rules that the average index must follow in this form in the Dow Jones Industrial Average. Later, Hamilton, editor of The Wall Street Journal, thought that line formation was the only price form with predictive ability.

How does the consolidation market work?

To understand the interval trading strategy, traders must first understand how the consolidation market (also known as the interval market) works.

As the name implies, in the consolidation market, the price behavior fluctuates in the horizontal channel between high price and low price. In particular, the horizontal trend can create relatively predictable highs and lows for asset trading. You can use some technical indicators, such as the Average Amplitude Index (ATR), to identify the market with range fluctuation. 、

It is worth noting that the trading market has broken through the resistance level or support level, so it still has certain risks.

Advantages of interval trading

Interval operation method refers to the method of short-term trading by using key support resistance levels in the market, which has the following characteristics.

- the cost is relatively small.

Because we sell at the top of the range or buy at the bottom of the range, there are two possibilities for the price after we enter the market. The first is to continue the previous interval oscillation idea, so that we will succeed. The second is to break the upper edge of the interval or the lower edge of the interval. In this case, our operation of interval trading will fail. But if it fails, because we are selling or buying at the upper edge or the lower edge, the stop loss can only be driven above or below the upper edge. From the perspective of risk-return ratio, the cost of interval trading is small, but the profit is relatively large.

- Simple operation

Compared with other trading methods, the interval trading order simply finds the upper edge and lower edge of the interval and trades according to the stability of the interval. The operation is very simple and easy to master.

- high reliability

Interval volatility accounts for most of the trading time, and once an oscillation interval is completed and confirmed to be successful, it will last for some time.

Summary

Technical analysis tells us that the trend will always continue, and the oscillation trend will maintain inertia before the new direction comes, so the reliability is relatively high. Especially after several times of confirmation of building the top or bottom, a stable interval will last for a period of time.

Responses