History of Crypto: Crippling inflation, rising debt, and the evolving crypto landscape

The 2022-2023 period saw several bad actors wiped from the cryptocurrency industry, none bigger than FTX’s Sam Bankman-Fried.

The cryptocurrency market took a beating in 2022, falling more than 70% over a time when the industry made headlines around the world for all the wrong reasons — from FTX’s bankruptcy and Sam Bankman-Fried being thrown in prison to the $50 billion collapse of the Terra Luna ecosystem.

The United States saw inflation hit a 40-year high as the country’s national debt figure continued to rise.

However, it wasn’t all doom and gloom — Ethereum made a major transition to proof-of-stake, while Bitcoin’s hashrate increased threefold. The market also rebounded strongly in 2023.

Here are some of the major industry events between 2022-2023.

EXPLORE THE HISTORY OF CRYPTO

US inflation rates have topped out, for now

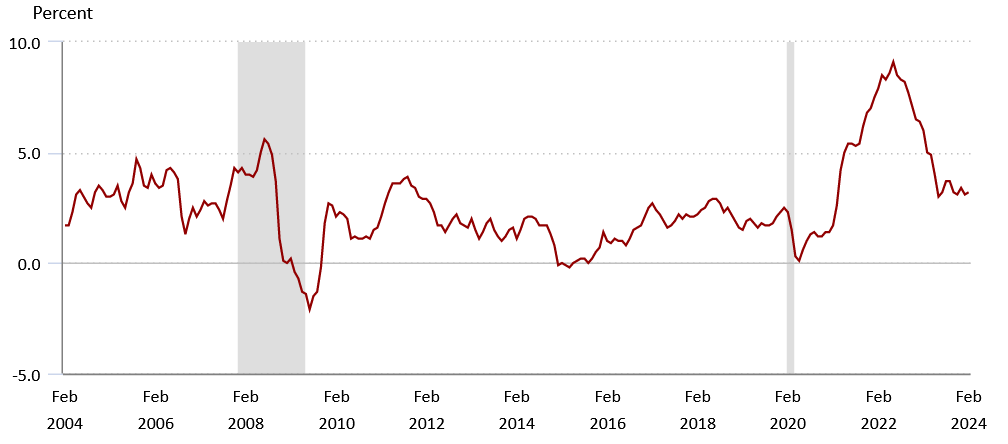

Crippling inflation was one of several macroeconomic factors that contributed to Bitcoin’s 77.2% fall from its previous all-time high of $68,990 to a cycle low of $15,740 in November 2022.

In fact, the United States Consumer Price Index (CPI) inflation rate topped out at 9.1% in June 2022, which marked its highest level since 1982, according to the U.S. Bureau of Labor Statistics.

Fortunately, CPI inflation started trending downward after June 2022, bottoming out at around 3% in June 2023. Since then, monthly figures have hovered around the 3% range.

Since June 2023 Bitcoin has soared over 135% from $30,480 to $73,737 at the time of publication, setting a new all-time high in the process.

However, the CPI inflation rate has risen 11.65% since November 2021, meaning Bitcoin still hasn’t hit its inflation-adjusted all-time high. That will happen when Bitcoin notches $77,026.

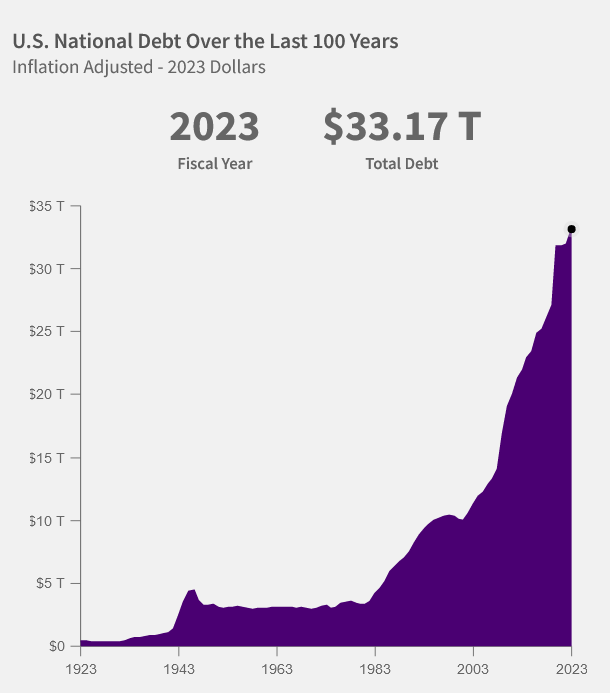

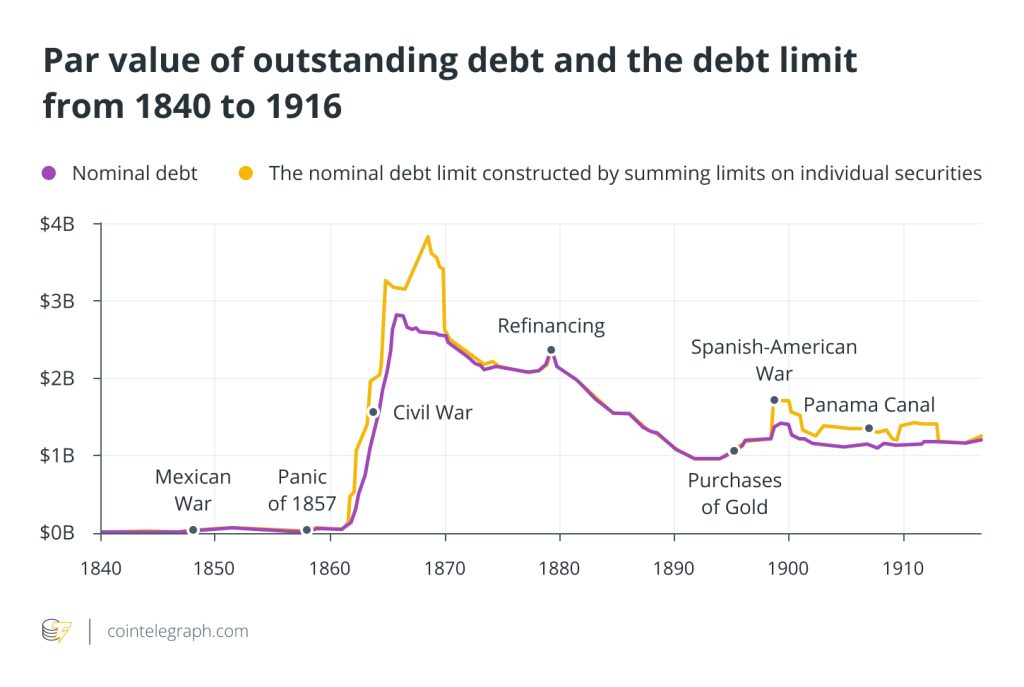

US national debt continues to soar

The United States national debt continued its exponential rise in 2022 and 2023, increasing 4.35% to $33.2 trillion over those two fiscal years, according to data from the U.S. Treasury.

The debt, which has since risen to $34.5 trillion, has put the U.S. on an “unsustainable fiscal path,” according to U.S. Federal Reserve Chair Jerome Powell.

Fortunately, the U.S. debt to gross domestic product ratio has decreased from about 3.2% to approximately 123%.

Researchers from the University of Pennsylvania say financial markets can only withstand another 20 years of accumulated deficits projected under current U.S. fiscal policy. After that, the debt dynamics would begin to “unravel.”

EXPLORE THE HISTORY OF CRYPTO

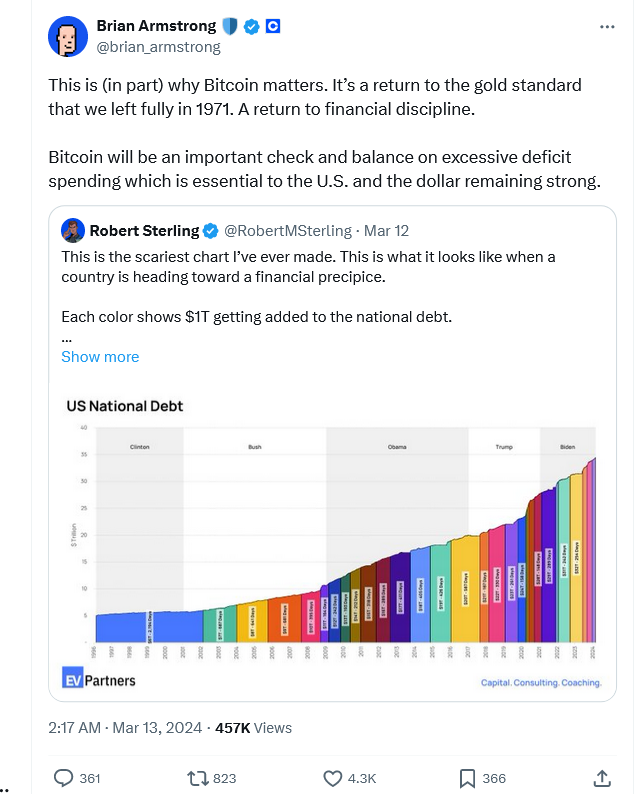

Coinbase CEO Brian Armstrong recently voiced that increased Bitcoin (BTC) adoption in the U.S. could serve as a “check and balance on excessive deficit spending,” which he believes is essential for the U.S. dollar to remain strong.

Bitcoin’s inclusion would mark a “return to financial discipline,” he added.

El Salvador is a textbook example of this, according to venture capitalist Tim Draper, who believes the country’s Bitcoin investment could help pay off the $215 million in debt it owes to the International Monetary Fund.

“[If] Bitcoin hits $100,000, they’ll be able to pay off the IMF [and] never have to talk to them again.”

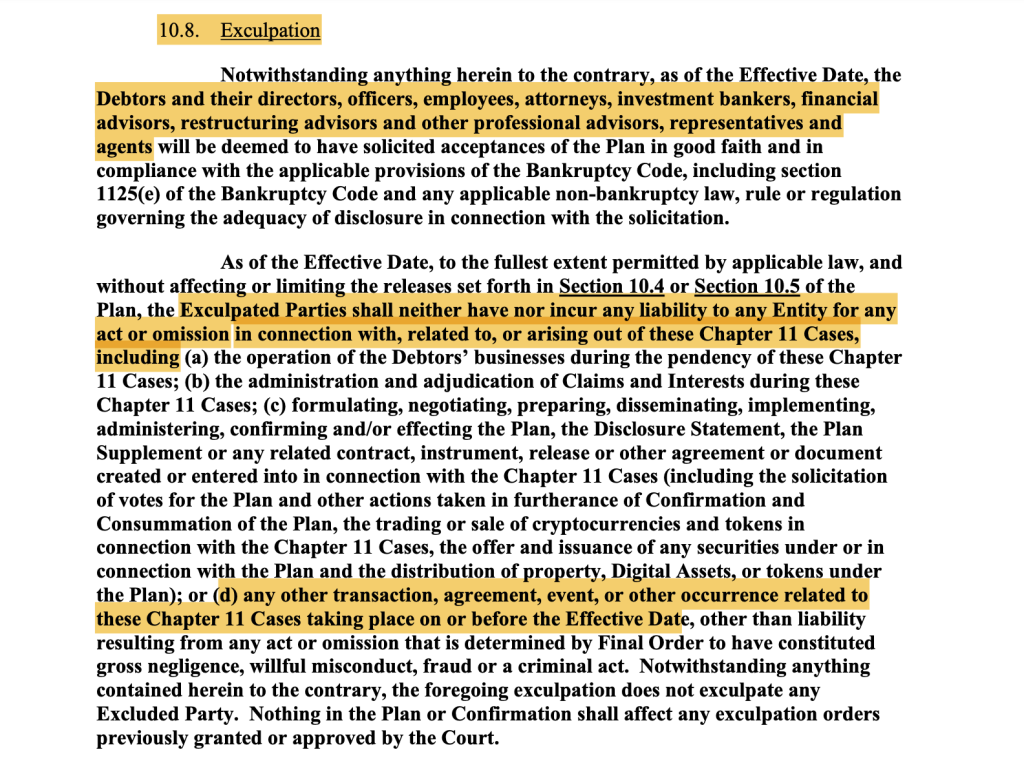

FTX’s collapse shocks the world as SEC plays cop on crypto industry

Tumbling macroeconomic conditions between 2023 and 2023 arguably impacted every cryptocurrency firm, which led to an array of bankruptcies, liquidations and even prison time for some of the industry’s most controversial figures.

The events triggered a wave of regulation by enforcement action by the Gary Gensler-led Securities and Exchange Commission (SEC), which declared itself the “cop on the beat” for the cryptocurrency industry.

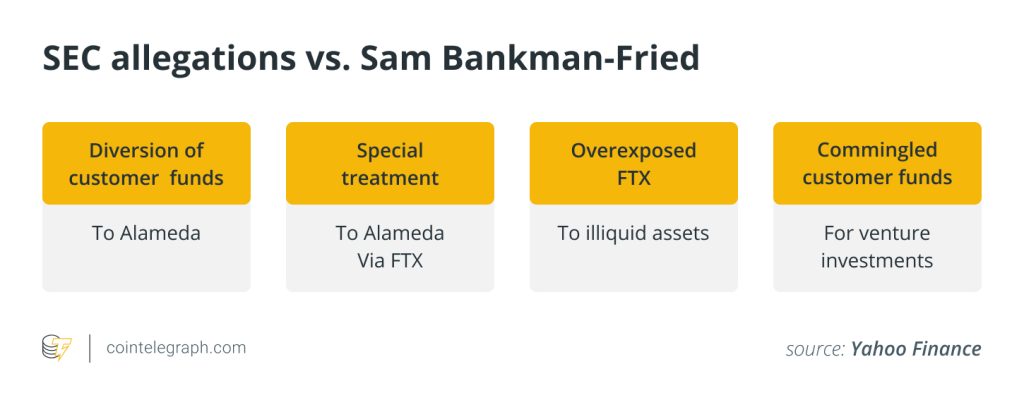

No collapse was bigger than FTX, which saw more than $8 billion in misappropriated customer funds wiped from a crashing market. BlockFi also went bankrupt — citing loans it lost from FTX — while Three Arrows Capital filed for Chapter 15 bankruptcy after its excessive leverage on long positions was wiped out.

Celsius and Voyager were other notable firms that filed for bankruptcy.

Former FTX CEO Sam Bankman-Fried was convicted of fraud last November for his role in orchestrating what some described as the largest fraud in U.S. history.

The $50 billion collapse of Terra Luna Classic (LUNC) and algorithmic stablecoin TerraClassicUSD (USTC) also caused carnage in May 2022.

The man largely responsible behind that collapse was Do Kwon, the former CEO of Terraform Labs, who spent more than five months on the run in several countries before being detained at immigration control in Montenegro for using a fake Costa Rican passport.

He faces fraud charges in his home country of South Korea and the U.S. for the role he played in the collapse of the Terra Luna ecosystem.

The SEC became determined to catch the remaining “hucksters,” “fraudsters,” and “scam artists” in the cryptocurrency industry after Bankman-Fried. Most notably, it sued the world’s largest cryptocurrency exchange, Binance, and its former CEO, Changpeng Zhao, who pleaded guilty to money laundering violations in November 2023.

The securities regulator also sued Coinbase in June 2023, claiming the trading platform unlawfully listed cryptocurrencies which it considered to be securities.

Related: Bitcoin’s banking crisis surge will ‘attract more institutions’: ARK’s Cathie Wood

March 2023 also saw a local banking crisis, with three cryptocurrency-friendly banks — Signature Bank, Silvergate Bank and Silicon Valley Bank (SVB) — collapsing, leading to fears that the U.S. banking system may not be as resilient as initially thought.

Even Jerome Powell, Chairman of the U.S. Federal Reserve, was left scratching his head over the collapse of SVB.

EXPLORE THE HISTORY OF CRYPTO

Despite several industry setbacks, builders kept building.

Most notably, Ethereum transitioned to a proof-of-stake consensus mechanism in September 2022, and, in doing so decreased its energy consumption by over 99%.

The Bitcoin network became more secure between 2022 and 2023, with its hash rate increasing 200% to 515 terrahashes per second during that time frame, according to Blockchain.com data.

Magazine: Unstablecoins: Depegging, bank runs and other risks loom

Responses