Ethereum liquid staking protocol Puffer Finance raises $18M Series A

The project’s TVL surpassed $1 billion within one month of its testnet launch.

Puffer Finance, a liquid staking project built on Ethereum restaking protocol Eigenlayer, has secured $18 million in a Series A funding round to launch its mainnet.

According to the April 16 announcement, the round was led by Brevan Howard Digital and Electric Capital, with key investments from Coinbase Ventures, Kraken Ventures, Lemniscap, Franklin Templeton, Fidelity, Mechanism, Lightspeed Faction, Consensys, Animoca, GSR, and other angel investors.

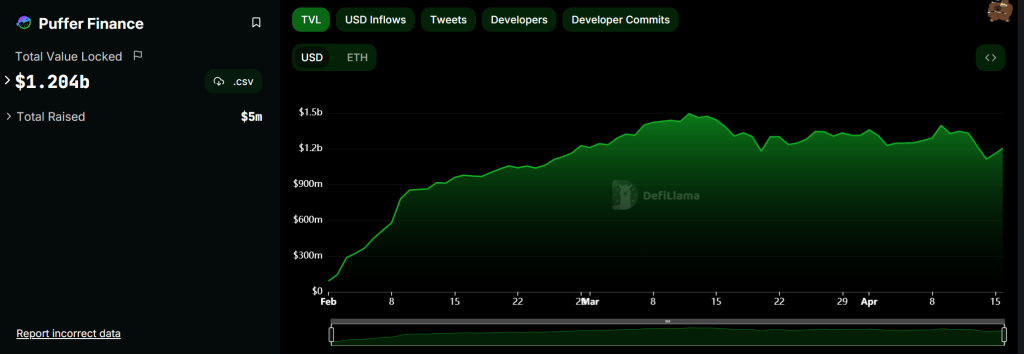

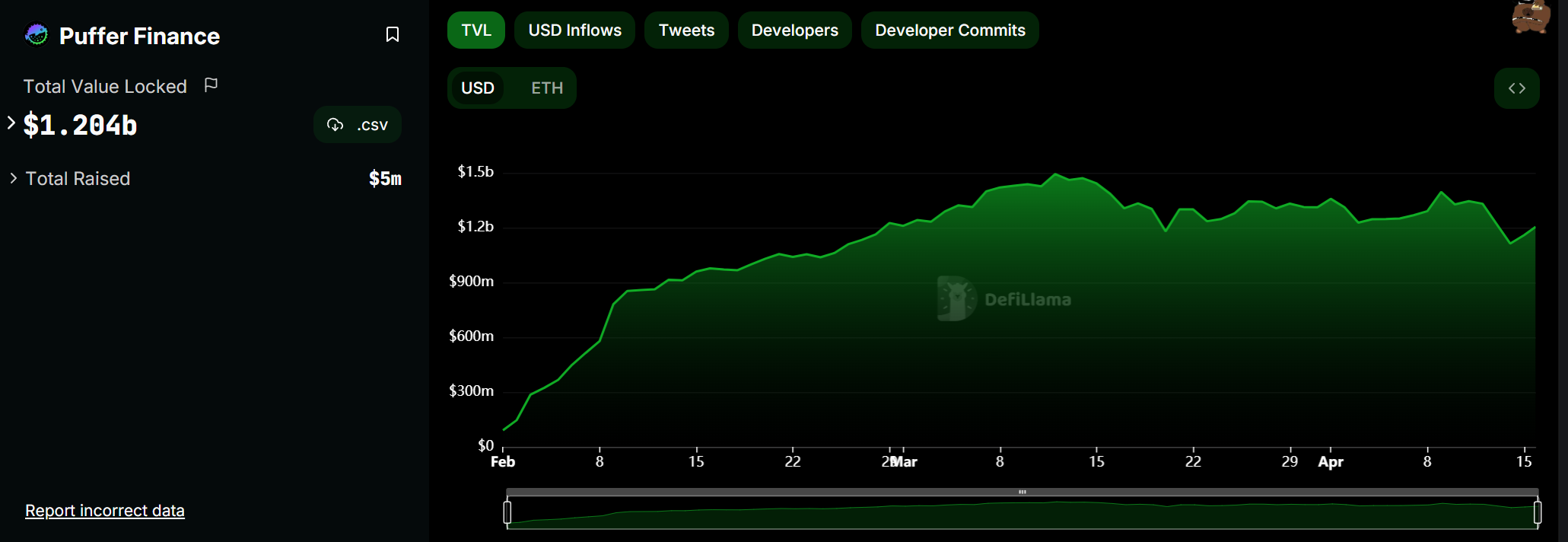

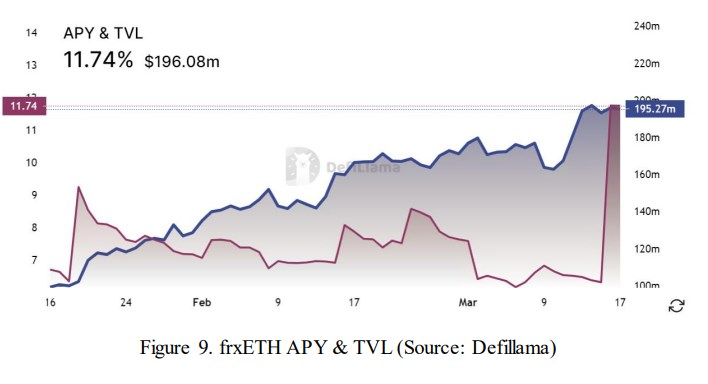

According to data from DeFiLlama, shortly after its early test phase in February, Puffer Finance surpassed a total value locked of $1.2 billion. To date, the protocol has raised a total of $23.5 million in venture capital funding.

“Following this round, Puffer secured a strategic investment from Binance Labs, enhancing its position within the Liquid Restaking ecosystem,” Puffer Finance said in its announcement while alluding to “technological advancements” in tandem with its mainnet launch.

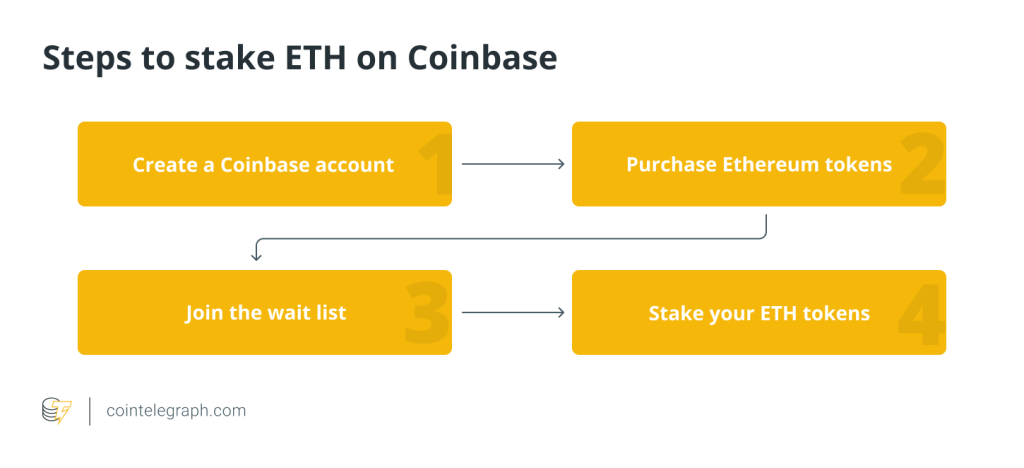

Puffer Finance’s technology allows Ethereum validators to reduce their capital to just 1 Ether (ETH), down from the 32 ETH required for individual stakers. In addition, users who stake Ether via Puffer receive Puffer liquid restaking tokens (nLRTs), which can then be used to farm yields in other decentralized finance protocols simultaneously with their Ethereum staking rewards.

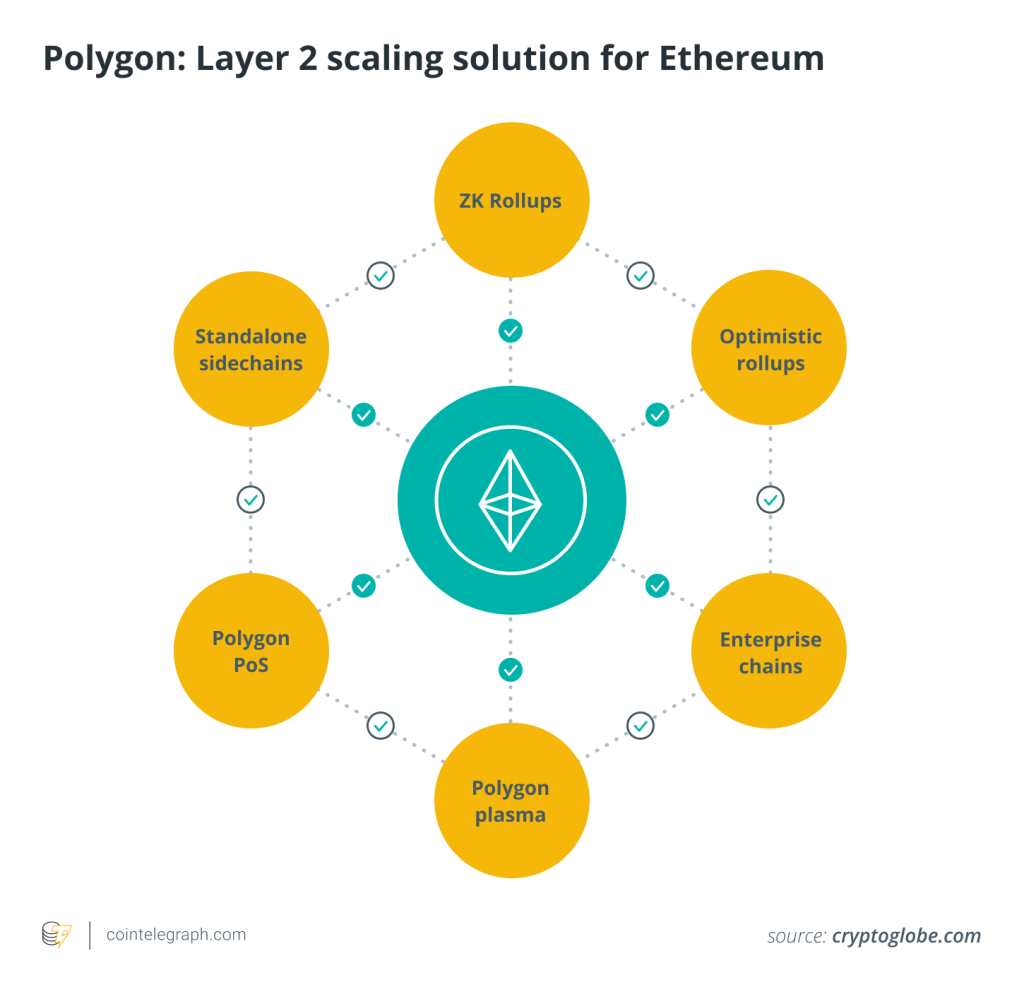

The process, known as liquid staking, has been long practiced by other blockchains, such as Cosmos, and has only recently moved to Ethereum after the Merge upgrade that shifted the network to proof-of-stake. “We aim to significantly reduce the barriers for home validators to participate, while delivering the most advanced liquid restaking protocol,” Amir Forouzani, core contributor at Puffer Labs, said in a press statement.

On March 6, Cointelegraph reported that EigenLayer shot past DeFi lending protocol Aave in its total value locked (TVL), with $10.4 billion worth of crypto committed to the protocol after temporarily removing a cap on how much users could stake.

Dune Analytics data shows EigenLayer has over 107,900 unique depositors with DefiLlama stats showing 74% of staked tokens are Wrapped Ether (wETH) and stETH. Liquid staking protocols are currently the largest DeFi protocol category with nearly $55 billion in locked value across about 160 protocols — buoyed mainly by Lido, the largest protocol by locked value at $35 billion.

Related: Restaking protocol EigenLayer partially launches on Ethereum mainnet

Responses