Hashing It Out: Are RWAs the future of crypto?

In episode 54 of Hashing It Out, Micah Yeackley, the co-founder of Kula DAO, discusses how tokenizing traditional illiquid assets opens up investment opportunities to a broader audience.

In this episode of Cointelegraph’s Hashing It Out podcast, host Elisha Owusu Akyaw interviews Micah Yeackley, co-founder of Kula DAO — a project tokenizing a diverse collection of real-world assets (RWA) on the blockchain — about the prospects of the sector in the Web3 space and what it means for developing markets.

The episode also touches on other significant topics, such as regulation and what RWAs on the blockchain mean for retail and institutional investors.

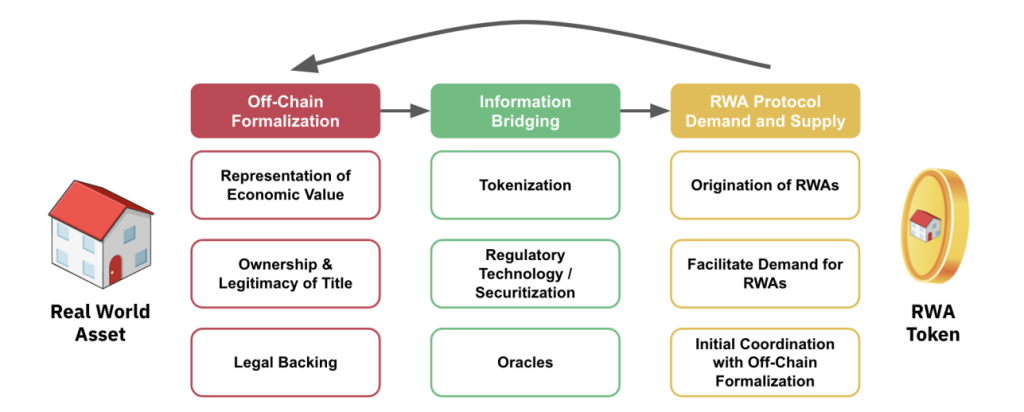

Yeackley explains that tokenizing real-world assets can span across multiple asset types beyond what most people expect. He highlights that even though Kula started out by focusing on natural resources, the project quickly realized that anything with real-world value could be tokenized, including water resources, agricultural projects and real estate developments.

Based on the wide variety of RWAs that can be tokenized, Yeackley suggests that projects are more likely to benefit from having a diverse pool of assets, which is Kula’s approach. He explains:

“Well, when you talk to any savvy investor, anybody that’s investing money for a long time, they’re experienced at it. They’re always going to say diversification is key.”

Yeackley breaks down the “DoubleDAO,” a component of the Kula DAO governance structure, which aims to collate the best of Web2 and Web3 governance, ensuring checks and balances during the decentralized autonomous organization’s (DAO) decision-making process. The Double-DAO provides asset-layered protection so that the voices and participation of key stakeholders are protected.

The Double-DAO includes a “RegionalDAO,” where local communities affected by the assets can actively participate in decision-making.

He also highlights how the project’s rollout in Zambia has led to changes at a partner mine in areas such as equal pay for women and the construction of social amenities through the voting process.

Moving to regulation, Yeackley says it’s difficult for projects in the sector to be regulated. Kula has received pre-approval from the Virtual Assets Regulatory Authority in Dubai and is set to become the first regulated RWA DAO to tokenize natural resources and commodities.

Yeackley believes that regulation should be the first step and not the last in a sector with extensive regulation in the traditional financial landscape.

Listen to the latest episode of Hashing It Out on Spotify, Apple Podcasts or TuneIn. You can also explore Cointelegraph’s complete catalog of informative podcasts on the Cointelegraph Podcasts page.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Responses