Does wine age better on the blockchain?

GrtWines is taking the $441 billion fine wine market and putting it on-chain through Web3 tokenization, with the aim of opening new doors for investors of all generations.

In an effort to redefine the world of fine wine investment a new Web3 marketplace aims to uncork the next era of market accessibility.

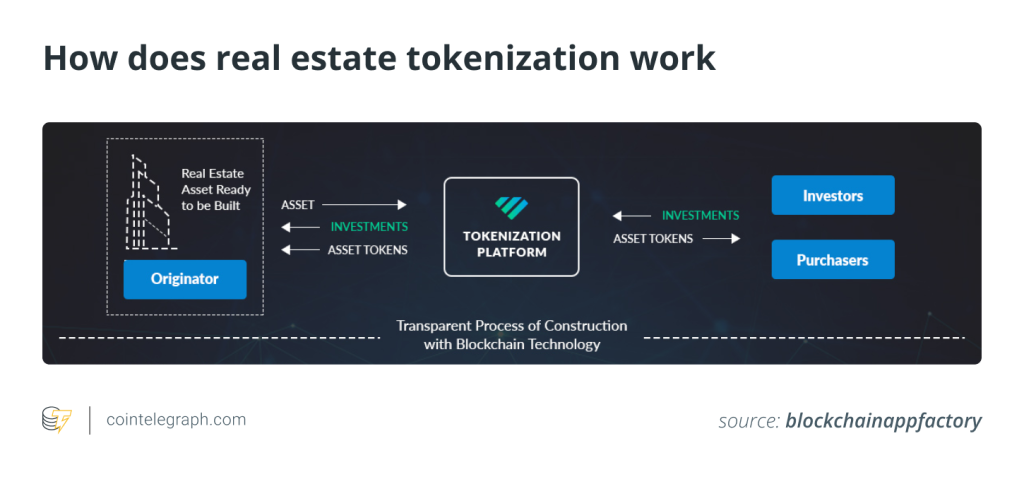

GrtWines, co-founded by former CLSA Chairman Jonathan Slone and acclaimed wine critic James Suckling, is a digital platform that allows collectors and investors of vintage and fine wines access to the market via digital asset tokenization.

Each digital certificate issued is tied to a real, investment-grade bottle of wine sourced directly from prestigious wineries. They are sourced directly from renowned wineries and stored in optimal condition until ready to be redeemed and delivered.

According to data from Statista, the wine industry is a multi-billion dollar market with a combined revenue from supermarkets, convenience stores, bars and restaurants to amount to $60 billion in 2024, in the United States alone.

Victor Yin, the CTO and co-founder at GrtWines called the creation of the platform a “significant milestone” in the maturation of the digital asset industry and blockchain technology and a new way to “democratize” the wine industry. He said:

“With the use of smart contracts, we double down on proof of ownership and provenance, effectively enhancing the overall transparency and security in the persistent counterfeit market.”

Related: Data NFT platform enhances security and user participation with XP system

The platform is launching alongside its first collection, “The Jefferson Collection,” which serves as a tribute to one of history’s most famous wine enthusiasts, Thomas Jefferson.

Jonathan Slone, the CEO and co-founder at GrtWines, said as a wine connoisseur, he feels passionate about the platform for preserving the rich heritage of wines while building a “transparent and connected community” driven by the consumers. He said:

“Traditional alternative assets such as well-aged wines, fine art and luxury watches have gained significant traction among younger buyers, serving as both portfolio diversification and elevated lifestyle.”

Luxury items as a whole have gained significant traction as tokenized assets on the blockchain over the last few years.

Examples can be seen with luxury brand blockchain platform Arianee, which recently launched a Polygon CDK-powered layer-2 to issue and manage digital product passports for various luxury brands and companies.

Additionally, in the fashion industry, fine artists, luxury brands and watchmakers have been utilizing on-chain assets like nonfungible tokens (NFTs) to verify ownership, track history of products and foster community.

Responses