Bitcoin halving’s price influence ‘diminished,’ demand now key driver: CryptoQuant

The Open Interest in Bitcoin is now 30 times higher than it was 11 days before the 2020 Bitcoin halving.

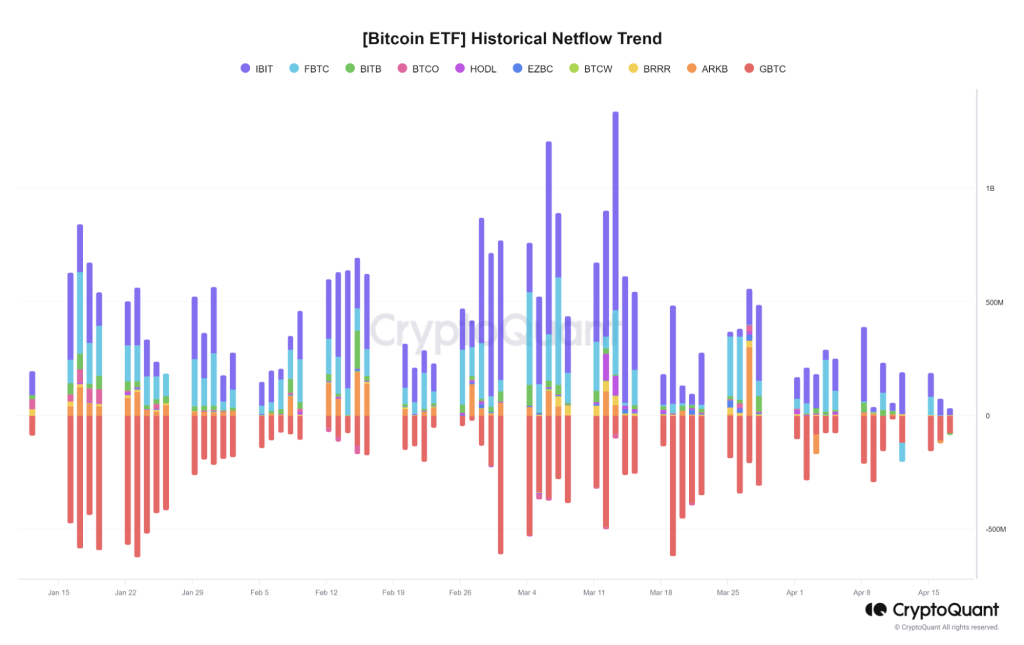

The supply shock of the Bitcoin halving won’t be as shocking to Bitcoin’s (BTC) price as many investors anticipate, says a new research report from crypto analytics firm CryptoQuant.

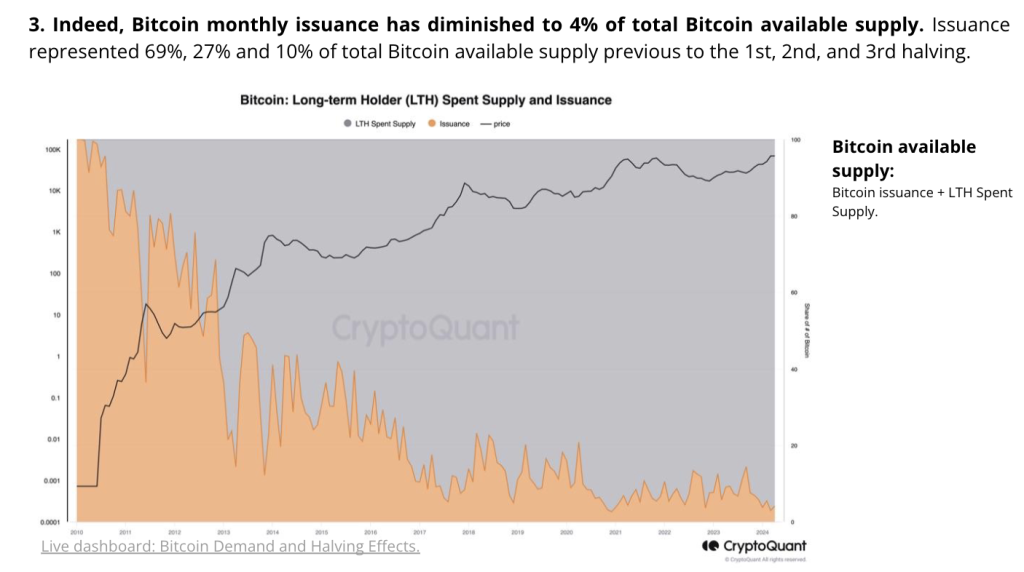

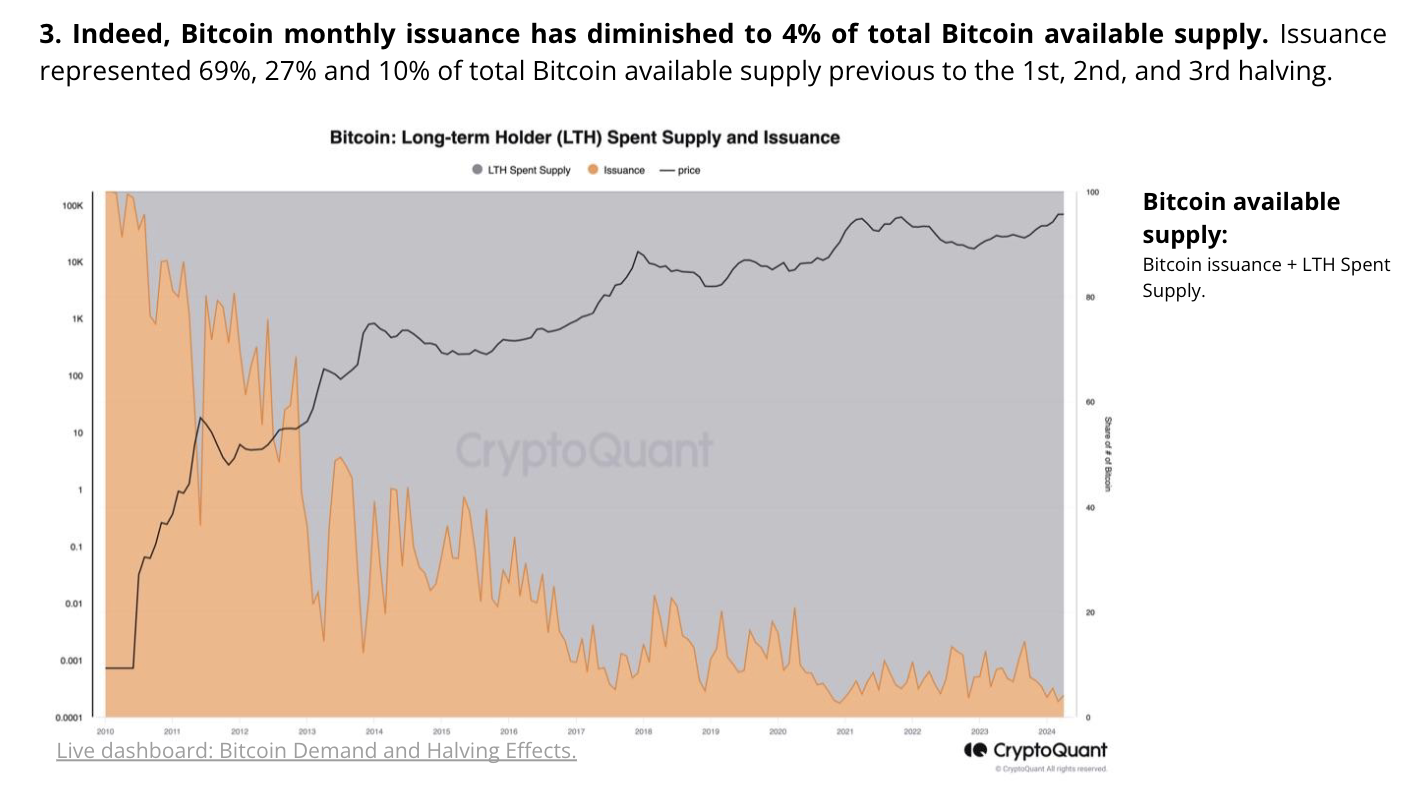

“We argue that the effect of the halving has been diminishing, as the new issuance of Bitcoin gets smaller relative to the amount of Bitcoin selling from long-term holders,” CryptoQuant wrote in an April 9 research report — viewed by Cointelegraph.

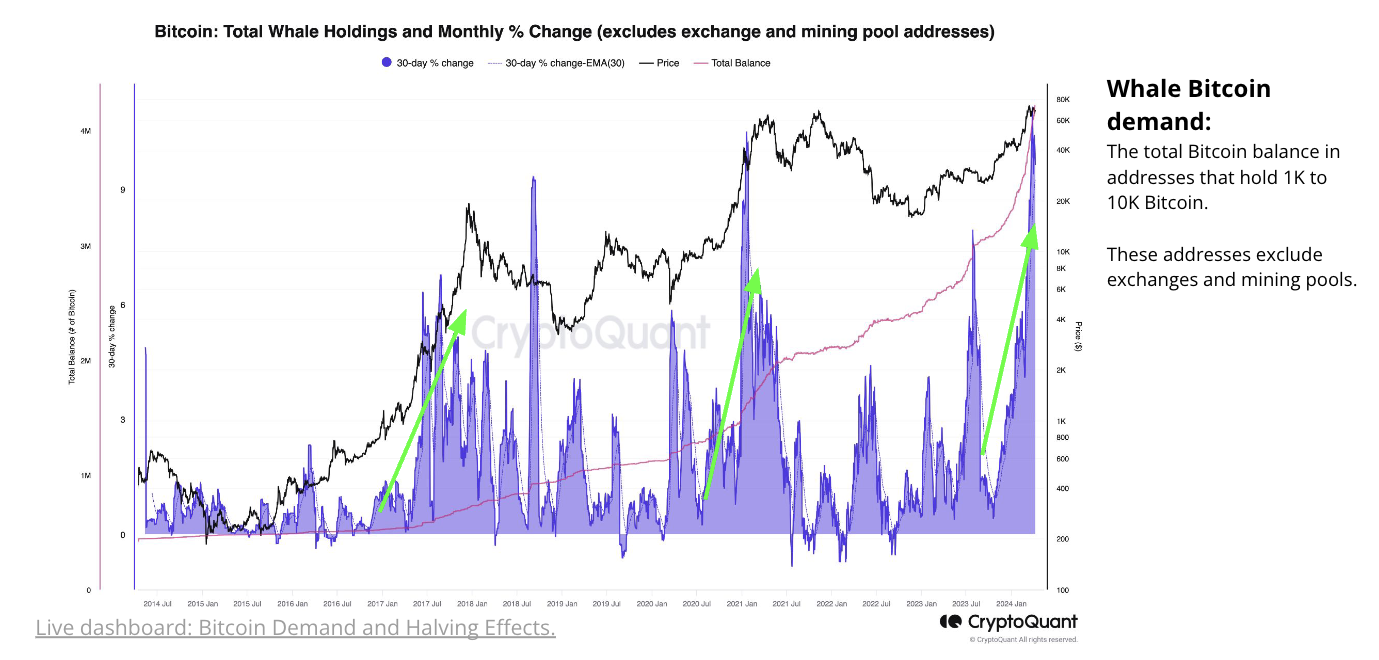

Instead, the “key driver” affecting Bitcoin’s price following the halving this time around will be the increase in demand from investors with sizeable holdings of Bitcoin.

Demand from whales holding between 1,000 and 10,000 Bitcoin has grown to “around its highest ever,” seeing 11% growth month-on-month, wrote CryptoQuant.

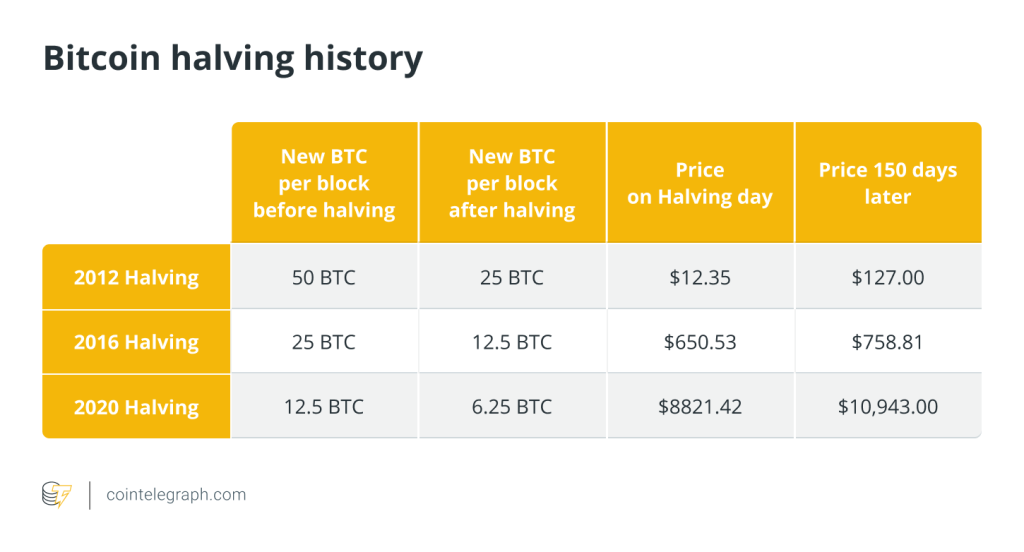

While the Bitcoin halving reduces supply — which typically puts upward pressure on Bitcoin’s price — there have been a few instances between 2021 and 2023 where the monthly demand from long-term holders has exceeded the supply within the same timeframe.

However, the current gap between them is much larger than it ever has been, suggesting that with an ongoing monthly supply deficit, the halving’s effect on Bitcoin price action might not be as powerful as it has been in the past.

Long-term holders are now accumulating about seven times more Bitcoin per month than the new Bitcoin entering circulation.

“Permanent holders are adding as much as 200K Bitcoin per month to their balances, much more than the ~28K Bitcoin issuance. Bitcoin monthly issuance will decrease to ~14K after the halving,” it stated.

Furthermore, the total issuance of Bitcoin plummeted to only 4% of the total available supply, a significantly smaller proportion compared to before previous Bitcoin halvings.

“Issuance represented 69%, 27%, and 10% of total Bitcoin available supply previous to the 1st, 2nd, and 3rd halving,” CryptoQuant wrote.

After the 2016 halving, the price of Bitcoin increased by about 4,200% to $19,800, and after the 2020 halving, the price of Bitcoin increased by almost 683% to $69,000.

The Bitcoin halving event is when Bitcoin miner’s rewards, along with its inflation rate, is cut in half. The upcoming halving will see the block rewards reduced from 6.25 Bitcoin to 3.125 Bitcoin.

At the time of publication, Bitcoin’s price is $68,764, representing a 7.12% increase over the past 5 days, as per CoinMarketCap data.

Related: Bitcoin’s halving won’t see a 600% return this year — so adjust your strategy

However, other indicators suggest that investors remain optimistic that the upcoming Bitcoin halving — currently slated for April 20 — will be a major catalyst for Bitcoin’s price to rise higher.

Open Interest (OI) in Bitcoin is currently at $78.36 billion, just 11 days away from the halving, as per CoinGlass data. This is roughly 30 times higher than the OI volume recorded 11 days before the previous halving in May 2020, which stood at $2.61 billion.

OI is a measure of the total value of all outstanding or unsettled Bitcoin futures contracts across exchanges, an uptick in value suggests heightened market activity and trader sentiment.

Pseudonymous Rekt Capital suggested to his 447,000 followers on X that any price dip in Bitcoin between now and the halving is likely to bounce back quickly.

“Do you realize whatever downside Bitcoin experiences before the halving, if any, will be the very last bargain-buying opportunity in the 2024 pre-halving period ever?” Rekt declared in an April 9 post on X.

Responses