$102M shorts liquidated as Bitcoin price surpassed $72K

Bitcoin price is now eyeing the $73,000 level, right under its all-time high, where new short positions are beginning to stack up.

Over $102 million worth of leveraged short positions were liquidated in the past 24 hours as Bitcoin (BTC) was trading above $70,400. Is the breakout from BTC’s weekly price range confirmed?

Over $33 million worth of Bitcoin shorts liquidated

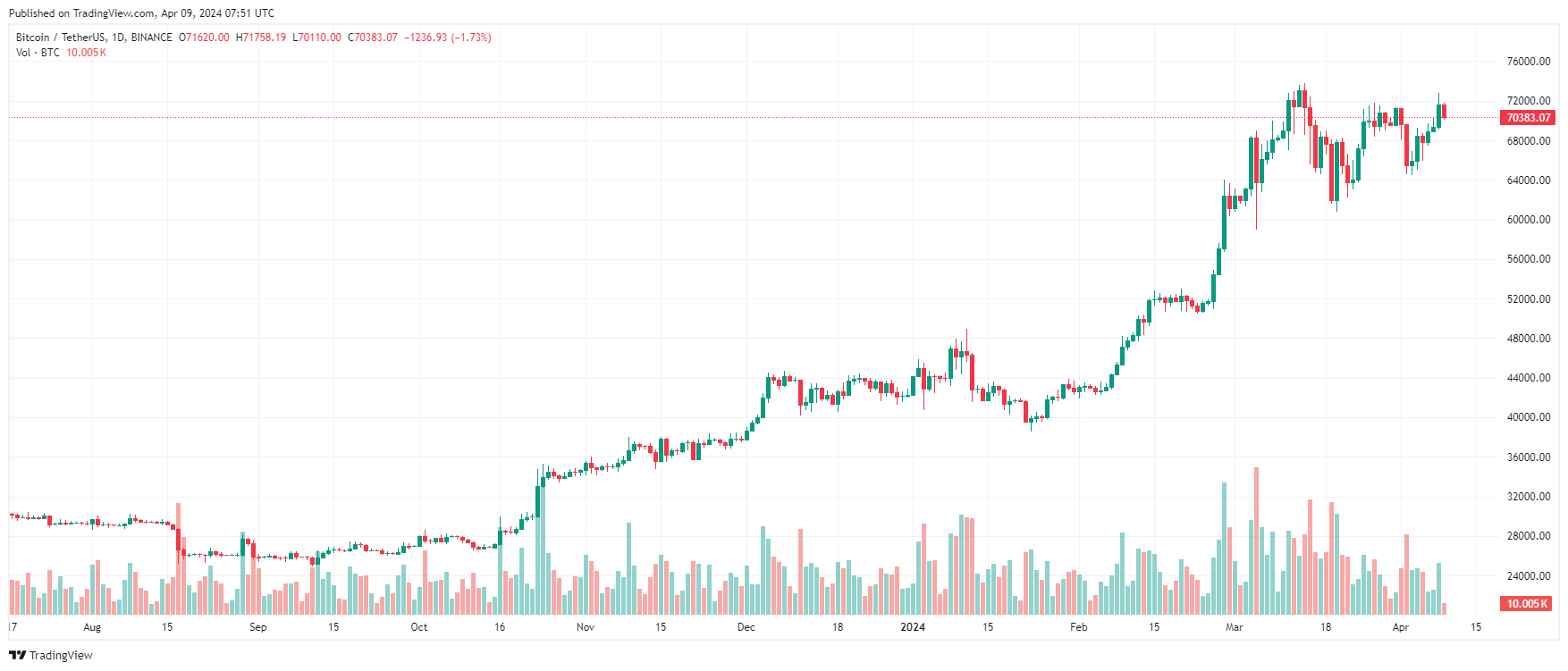

Following April 8’s weekly high of $72,668, Bitcoin price retraced to trade above the $70,413 mark, falling 0.55% in the 24 hours leading up to 9:45 am UTC, according to CoinMarketCap data.

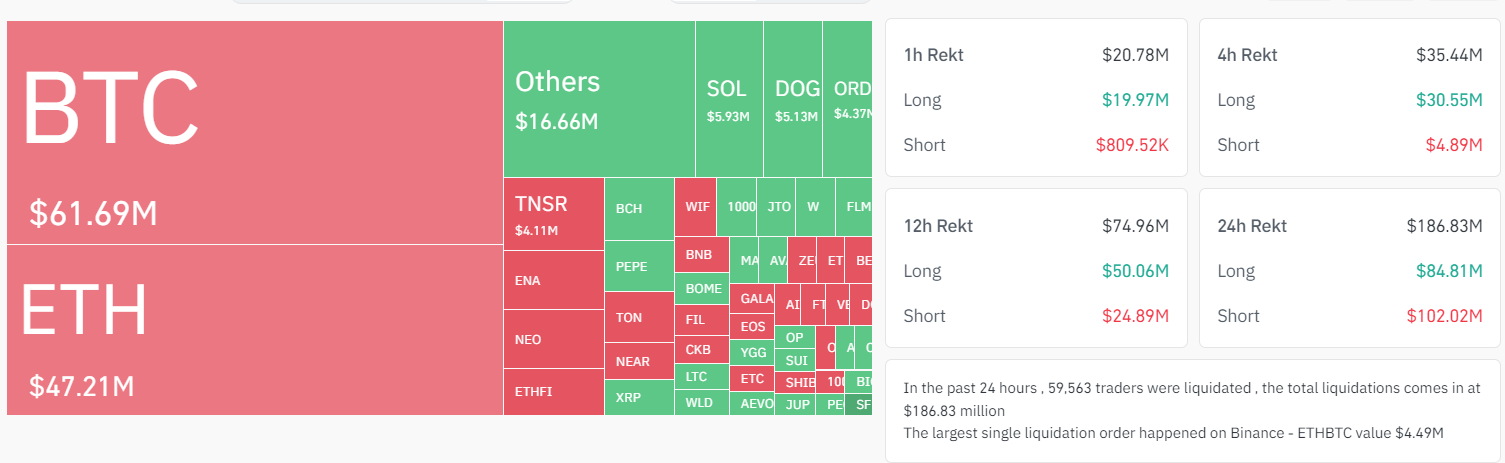

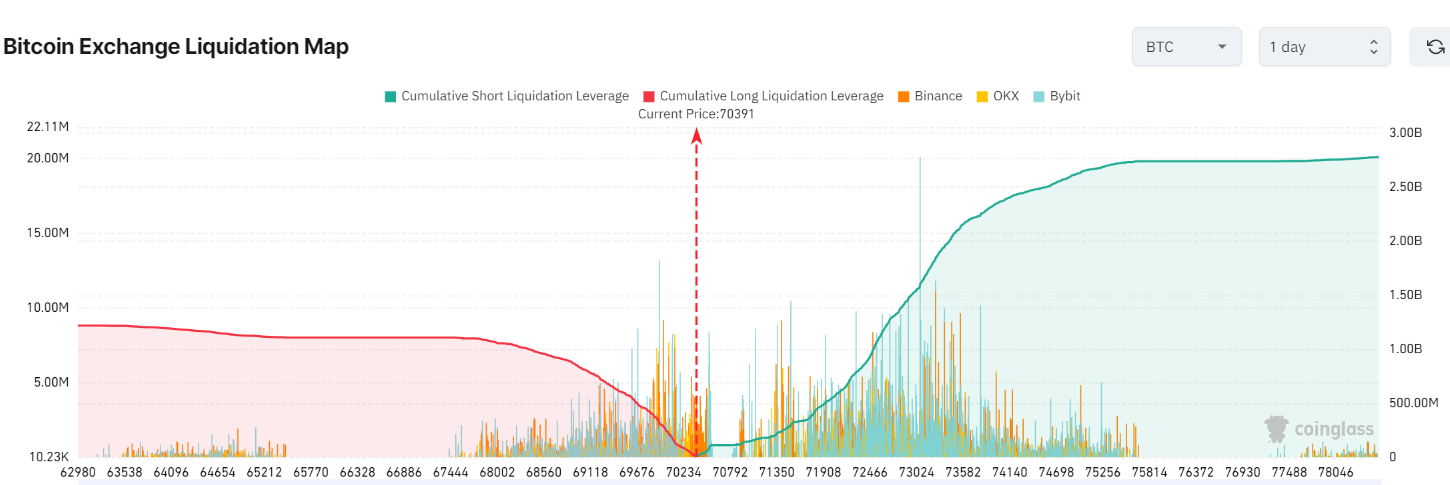

Following BTC’s rise to its weekly high, over $102 million worth of leveraged short positions were liquidated in the cryptocurrency market during the past 24 hours, with a total of $186.8 million worth of total liquidations, according to Coinglass data.

BTC liquidations totaled $61.6 million, with over $33.9 million in short positions and $27.7 million leveraged longs. The largest single liquidation order amounted to $4.49 million worth of Bitcoin on Binance, the world’s largest exchange.

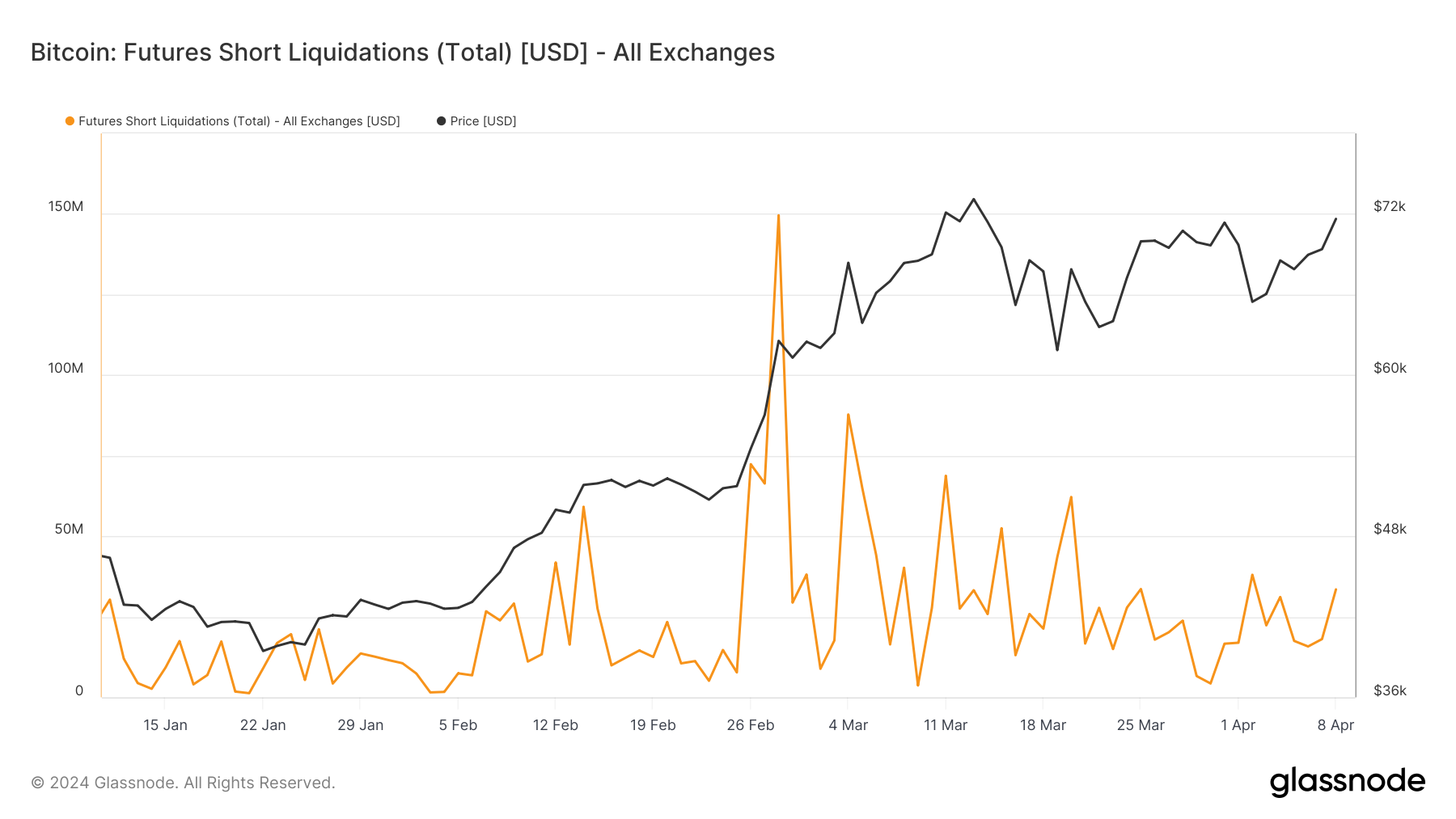

However, the $33 million worth of short Bitcoin liquidations is lower than the $38 million short liquidations on April 2. Moreover, BTC’s sudden 5% drawdown on April 2 liquidated $165 million of leverage in less than two hours.

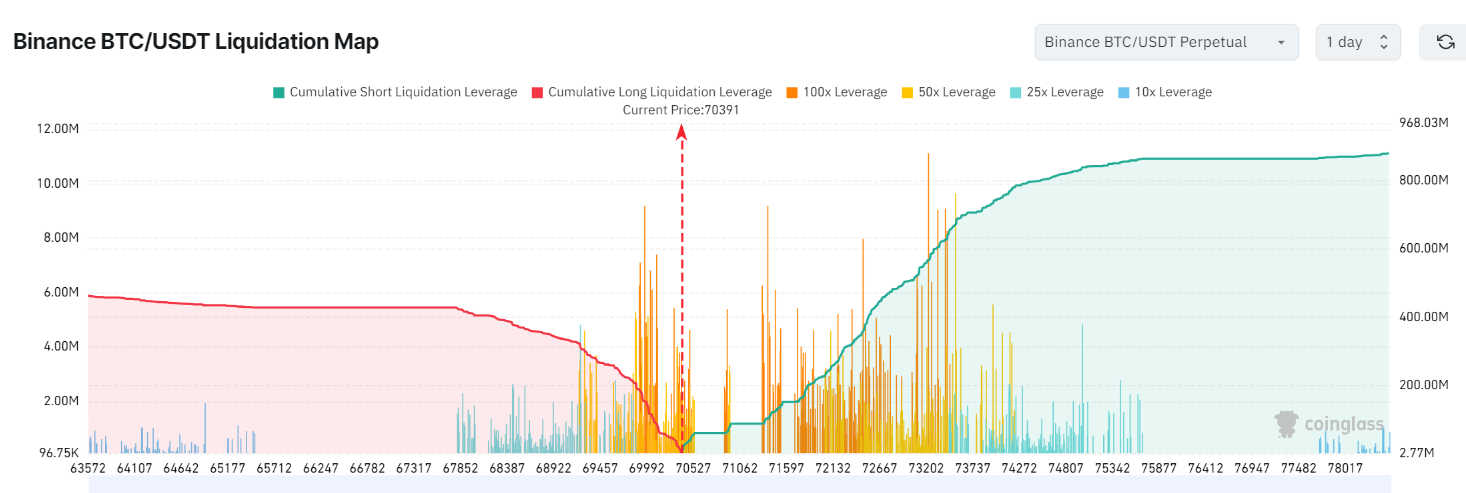

Now, if BTC’s price rallies back to $73,000, over $507 million worth of cumulative short leverage would be liquidated on Binance. Cumulative short liquidations on Binance would reach $666 million at $73,500.

Traders should also watch the $73,000 level — around the current all-time high — which now acts as significant resistance and a potential short-liquidation zone for the BTC price.

Related: Bitcoin mining profitability won’t necessarily fall after halving

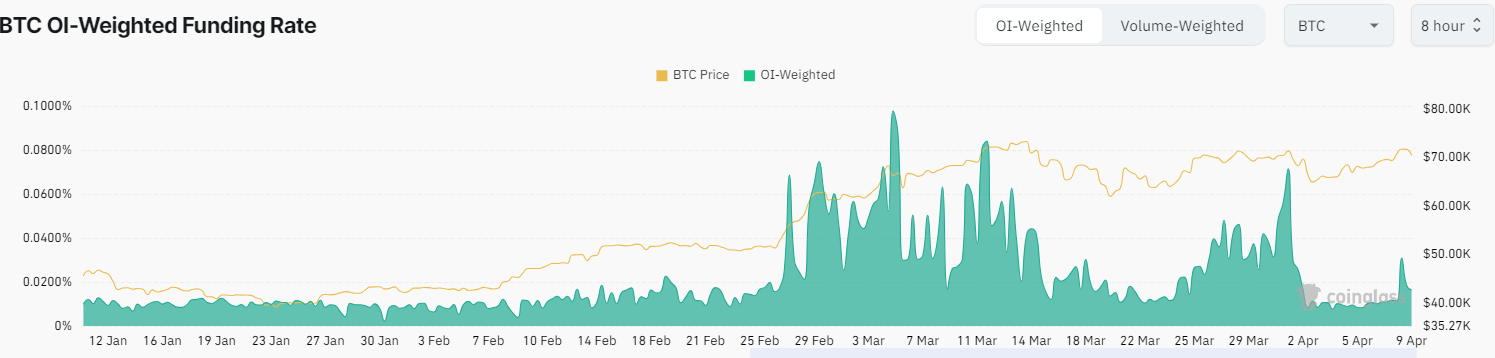

Following the liquidations, the Bitcoin futures funding rate saw a healthy reset, falling to 0.0163% on April 9, almost three times lower than the previous day. However, this is still significantly lower than the three-week high of 0.0714% on April 1.

Bitcoin price breakout confirmed

Now, Bitcoin price has successfully retested the old all-time high of $69,000, breaking out of the weekly range, which was needed to confirm future bullish momentum, according to an April 7 X post by popular crypto analyst Rekt Capital.

In a subsequent post, the analyst wrote:

“Bitcoin Daily Closed above the ~$69,000 level yesterday. And today Bitcoin is enjoying good upside.”

Bitcoin’s latest price rally can mainly be attributed to the inflows from spot Bitcoin exchange-traded funds and the anticipation surrounding the upcoming Bitcoin halving, according to Matteo Greco, research analyst at digital asset firm Fineqia.

Greco expects a sustained Bitcoin rally following the halving, which could last well into the second quarter of 2025. He told Cointelegraph:

“Historically, BTC halving events have marked significant points followed by 9–18 months of uptrend, culminating in cycle peaks. […] If historical patterns repeat, we may witness an uptrend for the remaining nine months of 2024, leading to a cycle peak expected between Q4 2024 and Q2 2025.”

Related: Bitcoin’s 2028 halving price target is $435K, historical data suggests

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Responses