dYdX Chain halts production following scheduled network upgrade

The dYdX team said they are investigating and will reconvene with validators at 15:00 UTC today.

Decentralized finance (DeFi) protocol dYdX announced it is investigating a recent halt in block production as the chain underwent a scheduled upgrade.

On April 8 at 05:30 UTC, dYdX published a status report highlighting the chain was proceeding with a scheduled protocol upgrade and that functionalities of the dYdX Chain may be disrupted.

However, the chain did not resume block production after the scheduled maintenance.

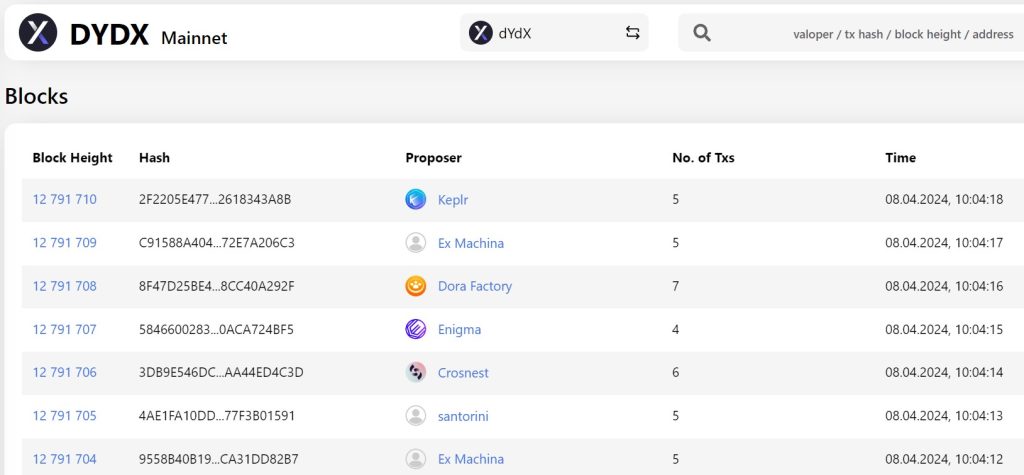

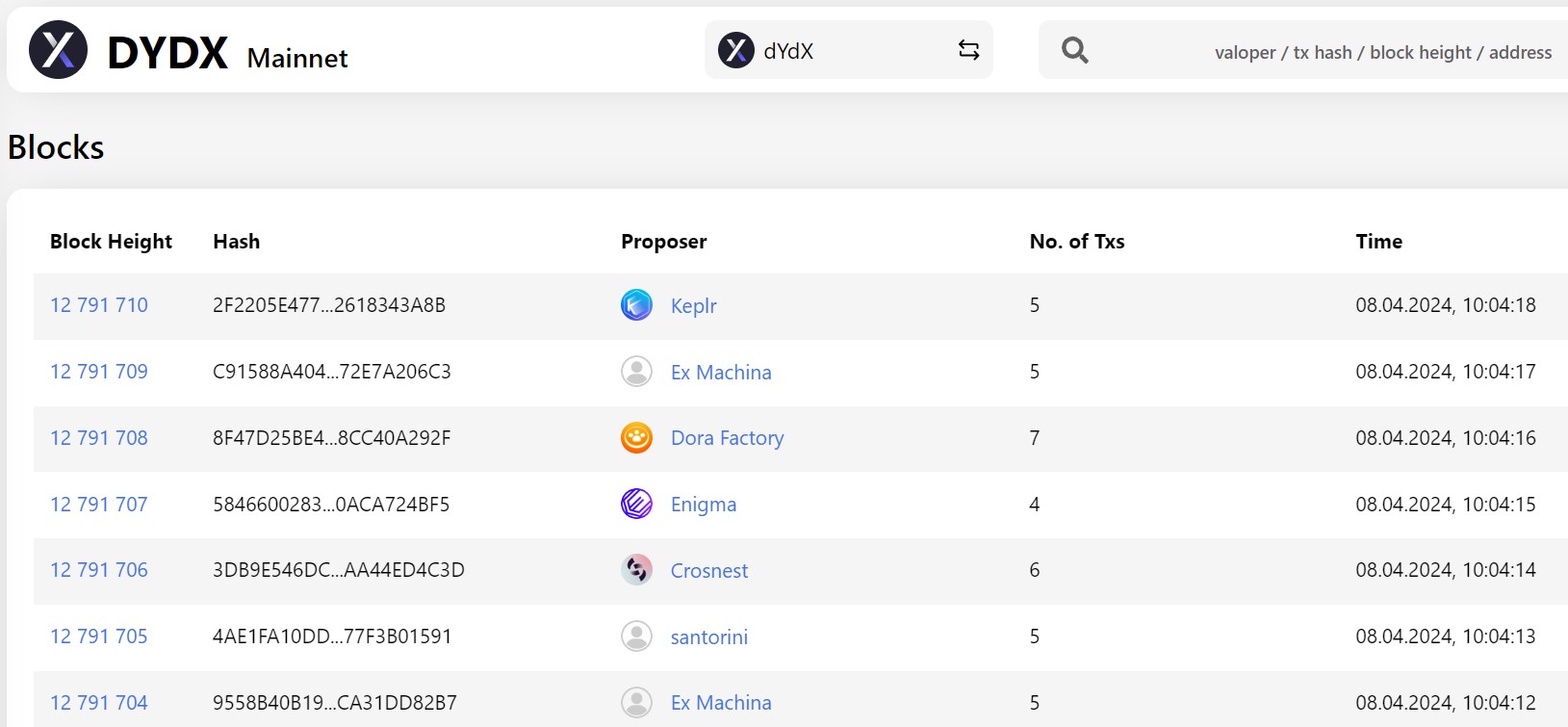

At the time of writing, the blockchain explorer platform Nodes Guru shows that the latest blocks produced by the dYdX mainnet were from the time of the scheduled upgrade, which was five hours prior.

dYdX also confirmed that the chain encountered an issue and said at 6:50 UTC that their team was already debugging it. However, the team said the issue is still being investigated and might not be resolved until later. They wrote:

“The issue continues to be investigated. It’s been agreed to reconvene with the validators around 15:00 UTC. This means that the devs won’t suggest a workaround or a fix until then so that the validators won’t get jailed for not being online when the chain restarts.”

The protocol upgrade was proposed on Feb. 21 and included advancements like order book features, risk and safety improvements and Cosmos-related enhancements.

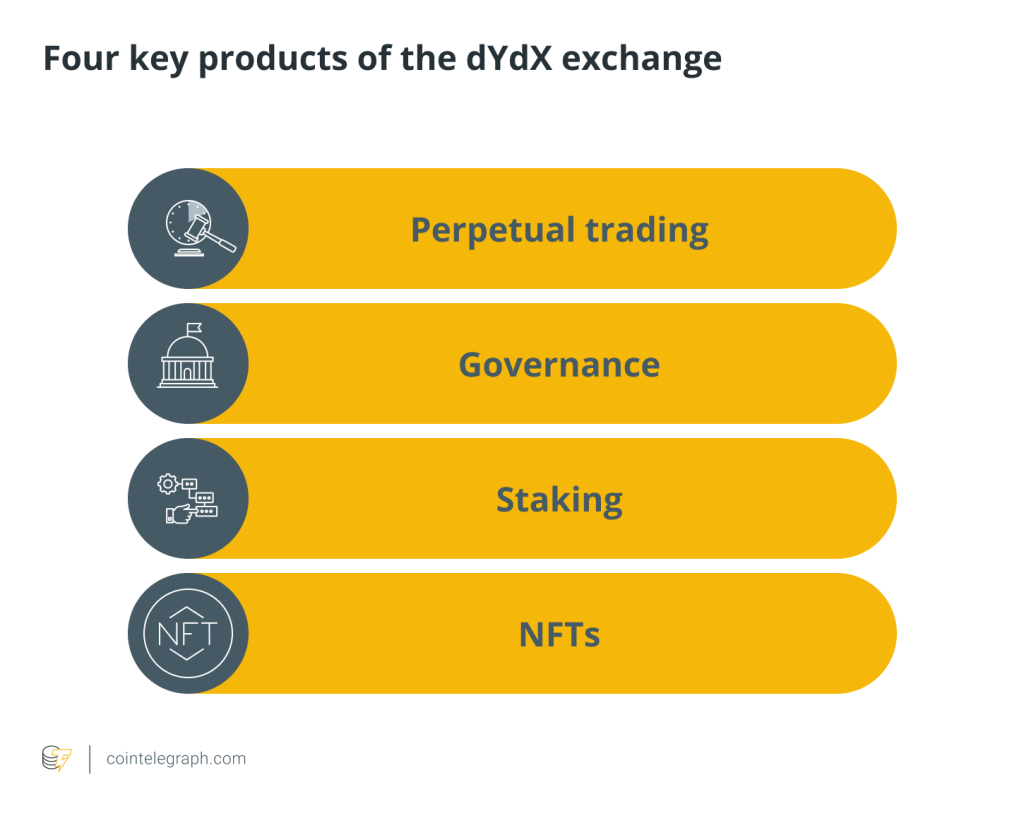

The outage comes after a recent development in dYdX when the community approved the staking of 20 million tokens.

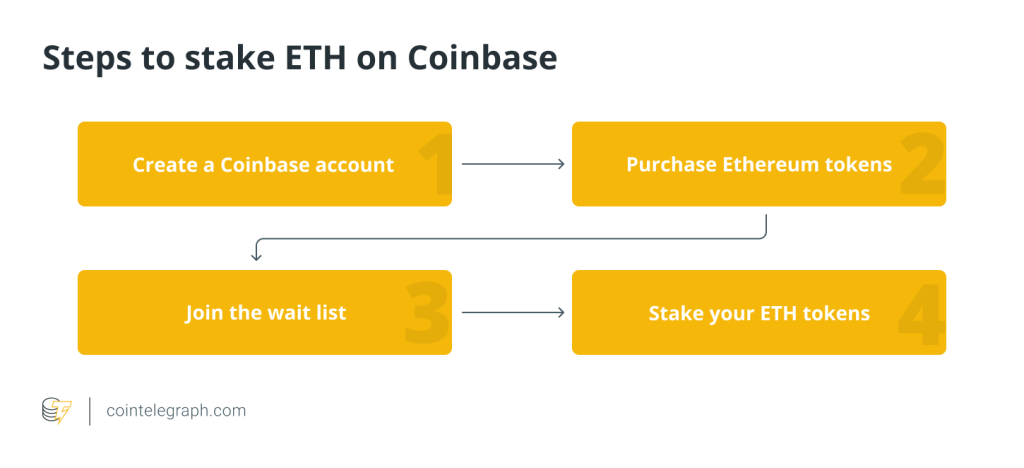

On April 6, the dYdX community voted to allow $61 million in treasury tokens to be staked on the liquid staking protocol called Stride.

dYdX highlighted that the move follows the growth in trading activity within the protocol. “The rate of DYDX being staked to validators has plateaued and deposits to the exchange are growing at a tremendous pace,” they wrote.

Related: dYdX founder blames v3 central components for ‘targeted attack,’ involves FBI

The dYdX chain also suffered a targeted attack which led to $9 million in losses in November 2023.

On Jan. 3, the protocol said it had already identified the attacker and was considering legal action. It also said it had improved its trading platform to enhance monitoring and alerts.

Responses